The Causes of Today’s Flash Crash

3 January 2019

Today’s flash crash in the FX markets was surprising to many of us. The triggers behind the slump in the currency’s markets are vague, and everyone was left wondering about a reasonable explanation. First of all, we think it is important to note that we are in a low volume trading environment and any reaction/news can be exacerbated in such thin markets.

Manufacturing Activity

A series of PMI reports released on Monday and Wednesday highlighted the weakness throughout the global manufacturing sector which has increased fears about the outlook for global growth.

- Caixin Manufacturing PMI fell from 50.2 to 49.7

- German Markit Manufacturing PMI fell from 51.8 to 51.5

- EZ Markit Manufacturing PMI fell from 51.8 to 51.4

- Canadian Markit Manufacturing PMI fell from 54.9 to 53.6

- US Markit Manufacturing PMI fell from 55.3 to 53.8

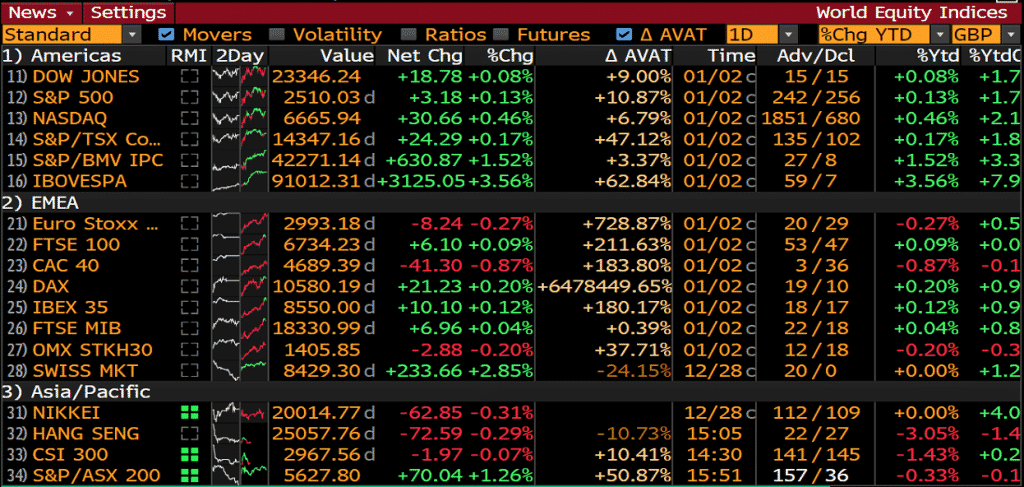

The heightened concerns brought additional turbulence in the stock markets when trading resumed on Wednesday, the first trading day of the year 2019.

Apple’s Revenue Forecasts

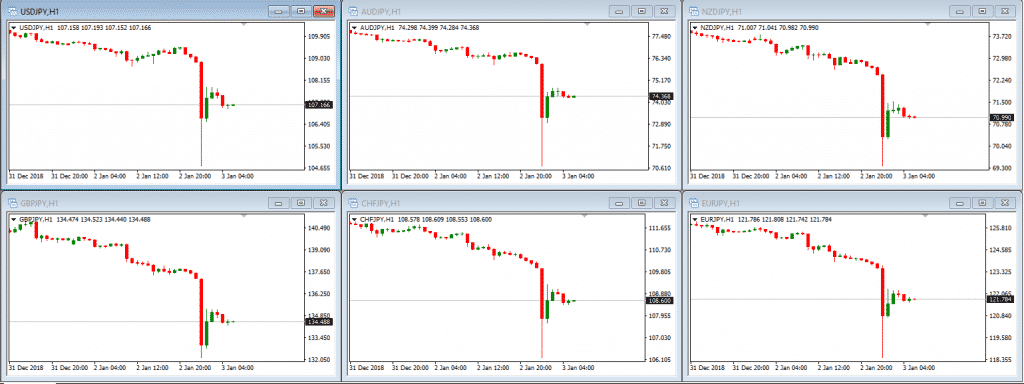

Apple’s move to downgrade sales on slowing iPhone sales in China fueled the fears about the global economy. Investors fled to safety and sought safe-haven assets like the Japanese Yen which surged through key support levels. Major currencies crashed against the Yen before paring some of the losses. The strong moves in the Yen pairs prompted speculators also to believe that Japanese traders were forced to exit their short yen positions.

USDJPY, AUDJPY, NZDJPY, GBPJPY, CHFJPY and EURPJY (Hourly Charts)

Source: GO MT4

In the stock markets, given that Apple is the bellwether for the technology sector, the surprise announcement weighed on the technology stocks in the Asian session. The performance in Asia/Pacific region was mixed, and investors struggled to find a direction.

Source: Bloomberg Terminal

We may see more downgrades in the months to come as slowing global growth and trade tensions will probably remain the key challenges in the financial markets.

For more information on trading Forex, check out our regular free Forex webinars.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Review of the Year 2018

The bears roared loud and clear in 2018! In 2018, the financial markets were hit by several headwinds across the year and investors were left struggling to find a direction towards the year-end. Economists and strategists were forced to reassess the economic forecasts for 2019. Trade and geopolitical issues had changed the dynamics of the f...

Previous Article

The Dow Jones Industrial Average

Source: Bloomberg Terminal For the traders returning from the Christmas break, the sudden surge in the Dow Jones Industrial Average is probably the ...