Central Bank Interest Rates

16 May 2018Central Bank Interest Rates

By Klavs Valters

A central bank’s interest rate is a rate at which it typically lends money to local banks. This interest rate is charged by nations’ central or federal banks on loan advances to control the money supply in the economy and the banking sector.

Each central bank has its own annual schedule when announcing its rates. In the trading world, it’s prudent to keep a tab on these announcements as it impacts market volatility if there is a sudden interest rate rise or fall.

These rates also have an impact on everyday life, as they often determine what you pay for borrowing money, as well as what the bank will pay you for saving money.

Recent Rate Hikes

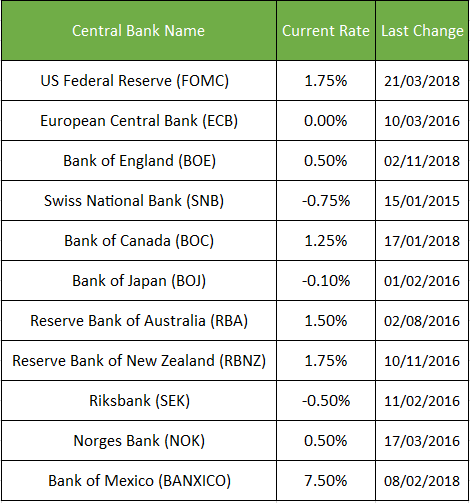

The most recent rate hike came from the US Federal Reserve back in March 2018, when it increased its rates from 1.5% to 1.75%. Additionally, the Federal Reserve also signalled its intention to further raise this rate in the future. This has been the sixth time the US Federal Reserve has raised its interest rates since the 2008 financial crisis.

Bank of Canada increased its key interest rates back in January by 0.25% to 1.25% while quoting a number of upbeat news stories, including an economy that is running flat-out, healthy job gains, and the lowest unemployment rate in over 40 years. This has been Bank of Canada’s third rate hike since the summer of 2017, and the first time the overnight rate has been above 1% since 2009.

Current Bank Interest Rates

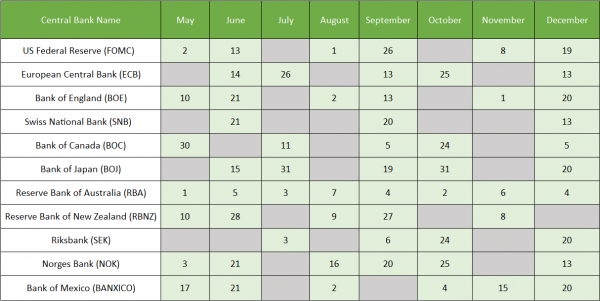

Central Bank Interest Rate Announcement Timetable for 2018

To keep up to date with other news announcements, visit our ‘Economic Calendar’ section on our website – https://www.int.gomarkets.com/economic-calendar/

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Premium MT4 Trading Tools

As a pioneer of providing MetaTrader 4 in Australia since 2006, our premium MT4 trading tools help provide you with real time trading alerts and a suite of MT4 add-ons to help improve your trading experience when trading the global markets. Whether you prefer to trade Forex, Indices or Commodities, our choice of premium MT4 trading tools will provi...

Previous Article

Federal Budget 2018: A Mixed Reaction

Federal Budget 2018: A Mixed Reaction By Deepta Bolaky Treasurer Scott Morrison handed down his third incorporating tax cuts, superannuation benefit...