Bank of England announces biggest single rate hike in 33 years

4 November 2022Another day, another hike. On Wednesday, the US Federal Reserve announced its latest policy decision to raise its interest rates from 3.25% to 4%, to its highest level since January 2008.

On Thursday, it was the Bank of England’s turn to announce its decision. As expected, the central bank raised its interest rates by 0.75% to 4%. It was the highest single increase since 1989.

Inflation

Bank of England highlighted that its biggest job is to bring inflation back to its 2% target. The bank expects inflation to rise in Q4 but start falling from early next year.

”Inflation is too high. It is well above our 2% target. High energy, food and other bills are hitting people hard,” the bank said in a statement.

”It’s our job to make sure that inflation returns to our 2% target. This month we have raised our interest rate to 3%. In total, since December 2021, we have increased our interest rate from 0.1% to 3%.”

”What will happen to interest rates will depend on what happens in the economy. At the moment, we expect inflation to fall sharply from the middle of next year.”

Economic outlook

As for the economy, the central bank did not have the most positive outlook for the near future.

It now expects the recession to last for a prolonged period.

”There has been a material tightening in financial conditions, including the elevated path of market interest rates. In addition, high energy prices continue to weigh on spending, despite an assumption of some fiscal support for household energy bills over the next two years. As a result, the UK economy is expected to remain in recession throughout 2023 and 2024 H1, and GDP is expected to recover only gradually thereafter.”

Market reaction

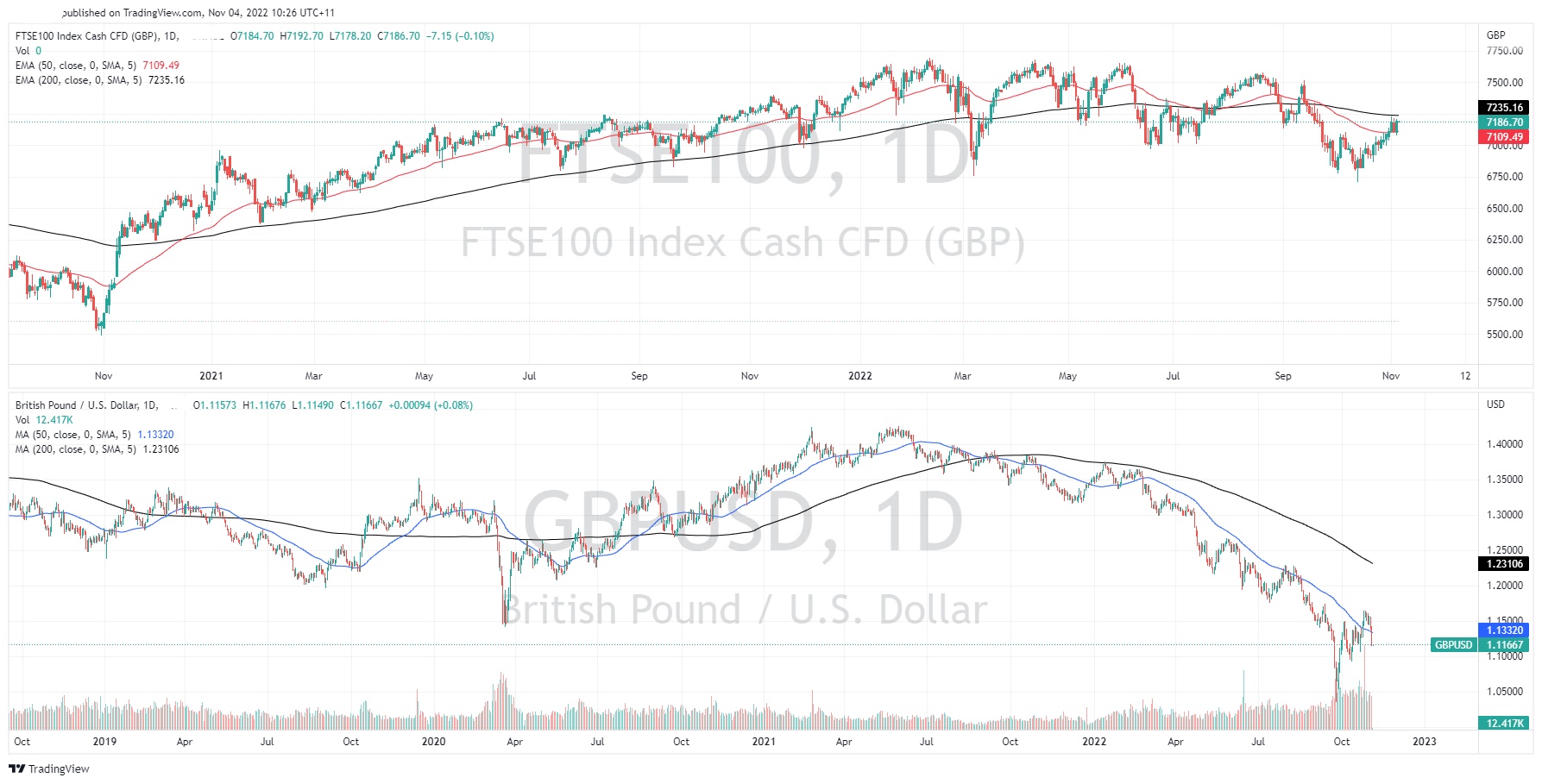

The Pound was weaker against all major currencies on Thursday, falling the most vs. the US Dollar.

Cable was down by around 1.93%, trading at 1.11771 level.

The next Bank of England rate decision will be on 15th December.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Is Bitcoin in a league of its own?

Bitcoin, the currency of tomorrow, a new age currency, has seen some severe ups and downs over the last few years. From reaching highs of nearly 70,000 dollars to dropping to lows of 17,000 the volatility and action around the cryptocurrency has been startling. Even compared to other traditional currencies the range and volatility of the price has ...

Previous Article

US stocks dump in choppy session after FOMC decision

US equites had a wild ride over night, A strong ADP jobs report was indexes track lower at the start of the session (Good news is bad news!) only to h...