Bank of England gives Funds three days to get books in order

12 October 2022The Bank of England has seemingly turned its back on protecting UK Retirement funds, after initially bailing out these funds who were facing serious liquidity issues in relation to their exposure to Fixed income assets.

History

As a part of new UK Prime Minister, Liz Truss’s mini budget she outlined big tax breaks for much of the country. This was to ease the pressure of increasing energy prices and cost of living. Whilst these tax breaks would have been good for the people, increasing flow of money into the economy would not help the Bank of England in its attempt to bring down record high levels of inflation.

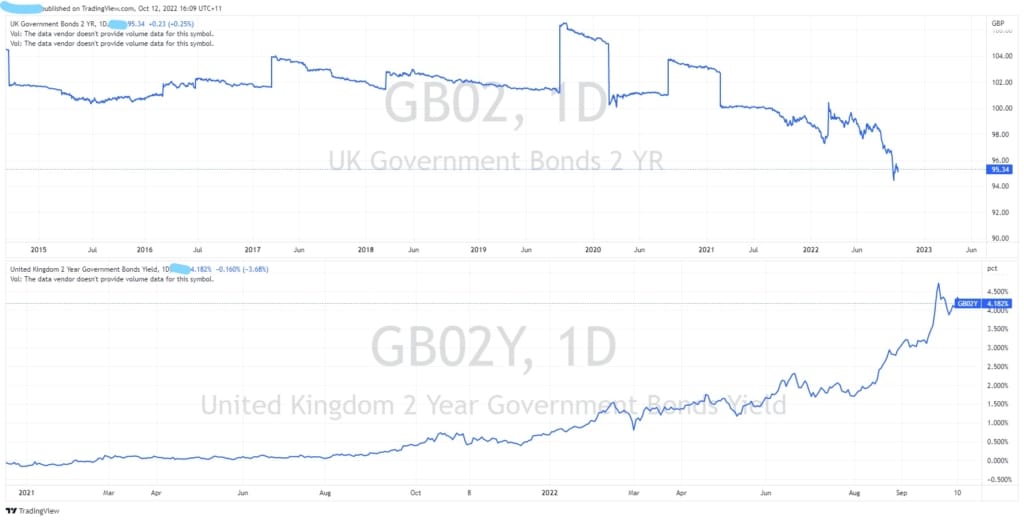

This led to a serious pricing issue for the UK government bonds. As the yields began to rise, the prices began to drop. This caused major issues for many of the country’s retirement funds who held almost 1 trillion pounds of exposure to these bonds and other derivatives.

This created a disastrous situation whereby these funds were having to post more and more collateral and sell off their existing bonds to meet their other obligations. It also caused a viscous cycle of selling and further pushed the prices down with some funds being margin called. With the system on the brink The Bank of England agreed to prop up the market and buy up to 5 billion pounds worth of Bonds per day. This saw an initial spike in bond prices, however it quickly subsided, and the prices have dropped back to prices that they were at before the intervention.

Recent Developments

According to reports, and statements from the Bank of England, the Bank is not as willing to bear the losses of these funds and prop up the market anymore.

Governor, Andrew Baily was not so enthusiastic about more buying stating that they will not bail out the Funds any longer and that they have “3 days” to sort out their books pointing to calmer conditions then the events of prior weeks.

This news may come as a bit of a downer to many who were hoping that intervention would continue to support the UK guilts and the GBP. It may also indicate that the Bank is still primarily focused on getting inflation under control over a potential recession.

The chart below shows the impact of the weakening economy and the currency on the bond market as prices continue to move lower. With volatility set to continue, the question remains, Will there be enough time for the funds to rebalance their books of will the refusal to continue to prop up the bond market come back to bite the United Kingdom’s financial system.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

US stocks end slightly lower in a choppy session after hot PPI data and mixed FOMC minutes.

US markets mostly tread water ahead of todays CPI figure, equities and the USD traded in a fairly tight range, a lack of expected chaos out of the UK and what were considered a mixed FOMC minutes saw markets in a holding pattern as traders await US inflation data. Though a modest drop as compared to recent times, it still marked the 6th down day...

Previous Article

Aussie Dollar breaks through two year price lows

The Aussie dollar has been dropping on the back of global volatility and a lower-than-expected interest rate hike. The AUD has dropped to its two-year...