- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Central Banks

- Deutsche Bank Revives The Failure of Lehman Brothers

- Home

- News & Analysis

- Central Banks

- Deutsche Bank Revives The Failure of Lehman Brothers

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisDeutsche Bank Revives

The Failure of Lehman Brothers

Deutsche Bank’s woes dominated headlines this week. On Sunday, the multinational investment bank announced 18,000 job cuts around the globe by 2022 and shut down its global stock trading business as part of a sweeping overhaul.

It was reported that the cuts had been anticipated for weeks. We watched the staff of the German bank being laid off around the world including, Sydney, New York, and London offices this week.

It was difficult to witness the lay-offs of the troubled bank without reviving the moments of Lehman Brothers. Since the 2008 financial crisis, the bank started its downfall over a series of costly scandals, alleged wrongdoing, and years of mismanagement.

The massive restructuring did little to boost investor sentiment. The market is worried that the overhaul is not enough to deliver shareholders’ value in the future. In the face of its large workforce cuts, there are concerns on the revenue stream from the core European retail and corporate banking.

Additionally, in the era of low global interest rates and an-already struggling European banking sector, Deutsche Bank’s restructuring does not inspire a lot of confidence.

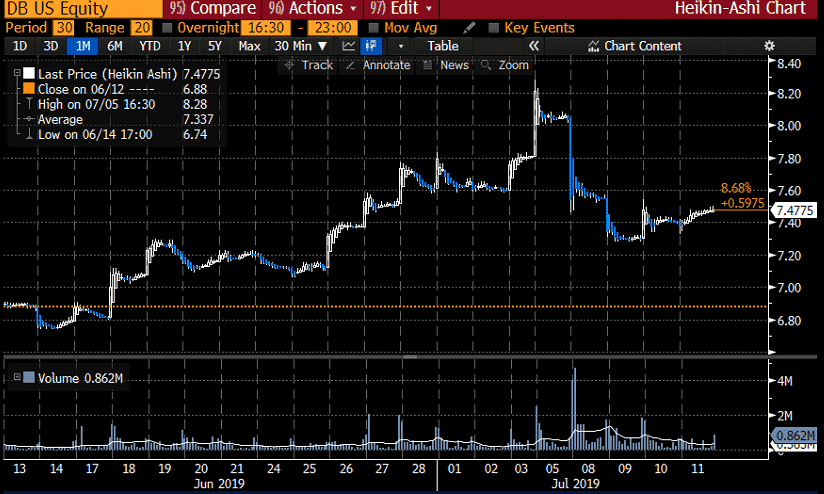

Just recently, the Chief Executive Officer, Christian Sewing was celebrating its first major win when Deutsche Bank passed the stress test after it repeatedly failed past exams. The bank’s share price has increased since the beginning of June. However, this week were the bearer of bad news.

The bank might not have anticipated the lack of optimism on the revamp plans. The market has doubts over the restructuring and the ability of the German lender to meet its 2022 profitability goal is highly questionable.

Its share price fell by more than 10% from a high of 8.22 last week to a low of 7.28 this week!

Source: Bloomberg Terminal (1 Month Chart)

The week got worse as Deutsche Bank is being dragged in a wider probe of a 1MDB scandal. The investigation adds to the list of other high-profile government probes.

The restructuring has not been met with optimism by global rating agencies as well.

Now is probably not the time to test the buy the dip strategy.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Interest #Rates #Fed #InterestRates #Banks #Banking #FinTechNext Article

Trading plan statements – Developing consistency in action and measurement

A written trading plan, usually comprising of several guiding action statements, serves the following two invaluable purposes: Facilitates consistency in trading action e.g. in the entry and exit of trades, allowing the trader AND Measures the strategy used specified within each statement to make an evidence-based judgement on how well thes...

July 16, 2019Read More >Previous Article

ASX Share CFDs: Timing Entry: “The professionals close the market”?

Traditionally, one of the long-lasting market clichés is that the “amateurs open the market the professionals close it”. Although this may be a ...

July 9, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading