RBA preview – likely 50bp hike incoming

2 August 2022Todays RBA policy meeting is expected by most analysts to result in a 50bp hike as the bank tries to play catch up and get on top of elevated inflation figures.

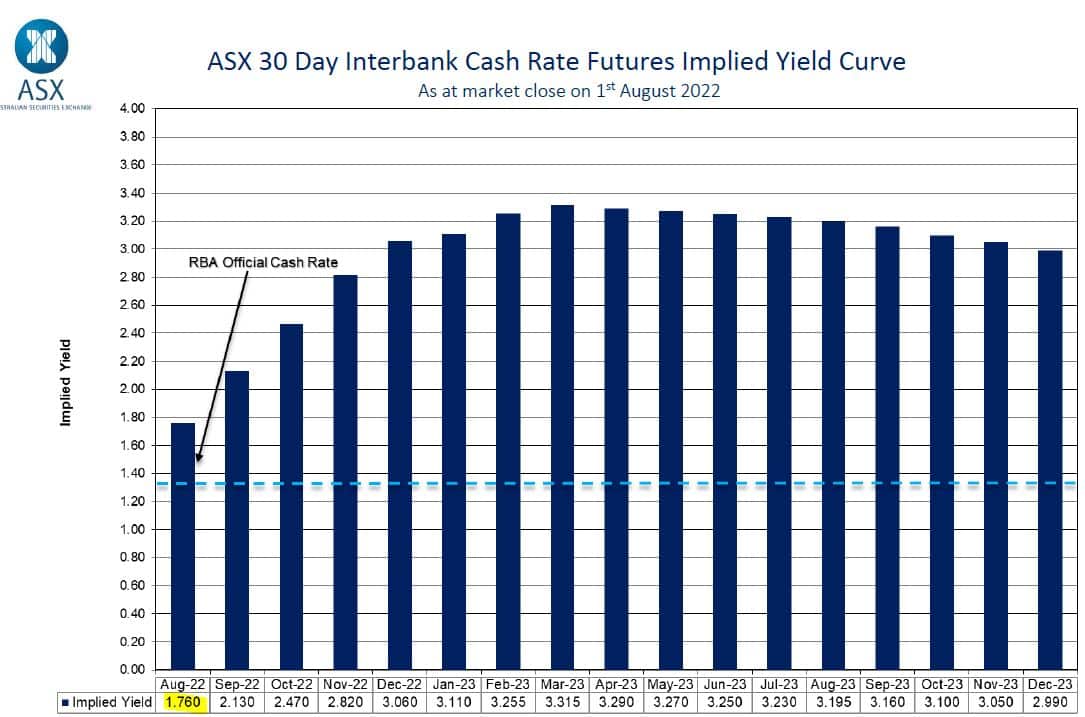

The slightly lower Q2 CPI figures released last week has seen futures markets price out what was earlier feared could be a 75bp supersized move, a 50bp hike would see the bank able to respond further in September should the Wage price index data due on 17 August show an alarming increase in wage costs. A 50bp hike today will bring the cash rate up to 1.85% which means we would be looking at least a further 65bp of hikes coming to bring the cash rate to the neutral level of 2.5% indicated by RBA governor Lowe at the last RBA policy meeting.

Currently August rate futures are trading at an implied yield of 1.76%, pricing in a rise of 41bp which indicates traders are giving around an 80% chance of a 50bp hike. Bond traders are rarely wrong when this much is priced in so I expect a 50bp move today with the accompanying statement giving clues to Septembers meeting where it’s looking so far as a toss up between 25 or 50bp.

Expected AUD reaction

If a 50bp hike is announced, the most likely course in the short term for the AUD will be an initial spike up due to the markets only pricing in 80%, then volatility as the algos read the statement, and more volatility as humans get through it. Followed by a sustained move in either direction depending on how markets re-price after digesting what the RBA has released.

Keep an eye on our Twitter page for instant reaction to the RBA announcement

Also please join us on our live webinar of the RBA meeting and market reaction, register at the link below

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

NIO latest delivery numbers announced – the stock is up

NIO Inc. (NIO) reported its latest delivery numbers for July on Monday. The Chinese electric vehicle company delivered 10,052 cars last month – an increase of 26.7% year-over-year. The deliveries in July consisted of: 7,579 premium smart electric SUV’s 2,473 premium smart electric sedans NIO has delivered a total of 227,949 ele...

Previous Article

The week ahead – Central banks, NFP star in a busy calendar, will bad news be good news?

Market sentiment continued to improve in the past week with equity markets rallying as traders pared back on bets on the extent of the Federal Reserve...