City of London Feeling the Brexit Effect

15 January 2018City of London Feeling the Brexit Effect

Not a day goes by without Brexit being mentioned and we can expect more of this to continue for some time, even after Britain leaves the European Union next year. With the International Monetary Fund (IMF) cutting its economic growth forecast for Britain for the coming years, are we also starting to see the impact of it on the City of London – the biggest financial centre in the world?

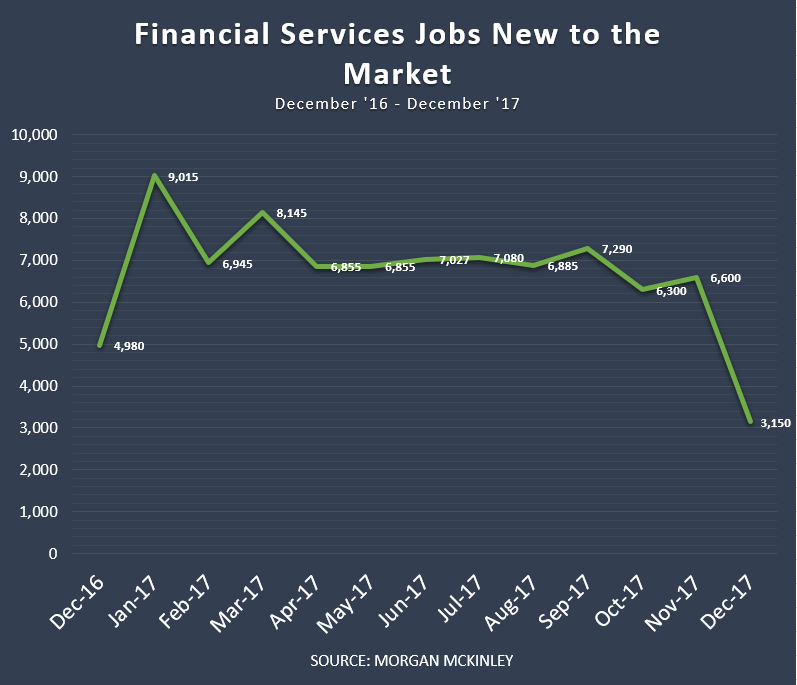

Morgan McKinley has shown that the number of jobs available in December 2017 fell by around 52% month-to-month, a much bigger decline compared to the 30% drop seen over the same periods in 2015 and 2016. “In December, the city is abuzz with holiday parties, not hiring, so a drop is to be expected, but for it to be such a seismic drop is alarming” said Hakan Enver, the operations director for financial services for Morgan McKinley.

Year-on-year we have seen 37% fall in vacancies which is a completely different picture to when we look at figures in 2015 and 2016 when we saw a 16% increase in job openings.

A recent survey by account firm Binder Dijker Otte (BDO) has shown that the United Kingdom has dropped out of the ranking for top six countries for potential migrants from the European Union. Paul Eagland, managing partner at BDO said the government must act to secure the UK’s access to talent: “UK businesses are already struggling with a skills shortage. The impact of the EU referendum and uncertainty around a new trade deal is likely to make this worse.”

“It’s absolutely imperative that the Government makes it clear to the world that the UK is still a great place to do business and that we continue to attract the world’s brightest and best to our country”.

UK’s former immigration minister, Brandon Lewis, said that the issue of skilled worker visas was up by 38% but that is unlikely to make up the difference.

Mr Enver said: “On the one hand, it’s great that the UK is still being considered an attractive destination from countries outside of the EU.”

“However, on the other hand, there are signs that European employees are becoming less captivated by the draw of working in this country.”

“2017 was the year we were told we’d have an exit strategy and a transition plan. We have neither.

“As new rounds of talks kick off, let’s hope 2018 brings the much-needed clarity and stability everyone’s waiting for.”

A challenging time for the financial sector in Britain.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

World’s Largest Economies

World's Largest Economies When it comes to the top national economies around the globe, the United States is well ahead of all countries - having the largest economy by Gross Domestic Product (GDP). The United States generates nearly a quarter of the world’s GDP at $18.6 trillion, that’s around $7 trillion more than China ($11.1 trillion)...

Previous Article

UK Trade vs The World

UK Trade vs The World With the UK leaving the European Union next year, its trading arrangements with the bloc will change. How they will change will...