- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- Back-To-Back Interest Rate Cuts

- “Tentative Signs” that house prices in Melbourne and Sydney are now stabilizing.

- The growth in housing credit also steadied.

News & AnalysisSecond Rate Cut

The Reserve bank of Australia (RBA) cut interest rate by 25 basis points which marks the first back-to-back rate cut since 2012. The RBA also sets the interest rate to a record low at 1%:

“Today’s decision to lower the cash rate will help make further inroads into the spare capacity in the economy. It will assist with faster progress in reducing unemployment and achieve more assured progress towards the inflation target. The Board will continue to monitor developments in the labour market closely and adjust monetary policy if needed to support sustainable growth in the economy and the achievement of the inflation target over time.”

The RBA highlighted the persistent downside risks to the global economy, but the tweaks in the labour market stood out.

“There has, however, been little inroad into the spare capacity in the labour market recently, with the unemployment rate having risen slightly to 5.2 per cent.”

Housing Sector

The housing sector was a significant risk for the Australian economy, and cutting interest rate was a double-edged sword. However, the statement brings some optimism on the housing sector despite conditions in most housing sector remain soft:

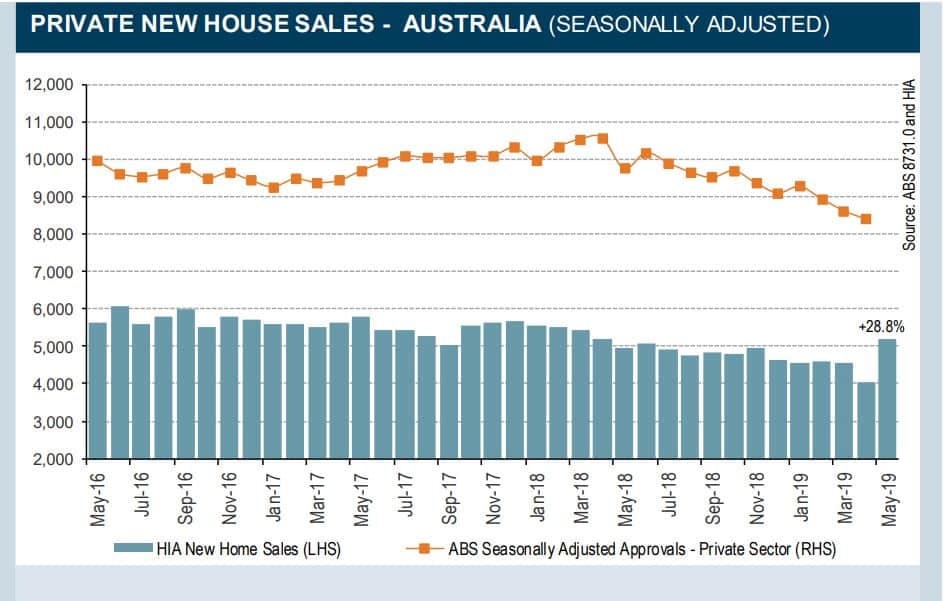

On the economic front, the HIA New Home Sales for the month of May was released today. New Home Sales climbed from -11.8% to 28.8%.

It is a significant rebound, and the bounce back is before the rate cuts which indicated that it may be fueled by the optimism post the federal election.

Now, that the RBA has cut rate twice in two months, it will be worth monitoring the housing data in the coming months to assess its impact on the housing sector.

Rate Cut Reactions

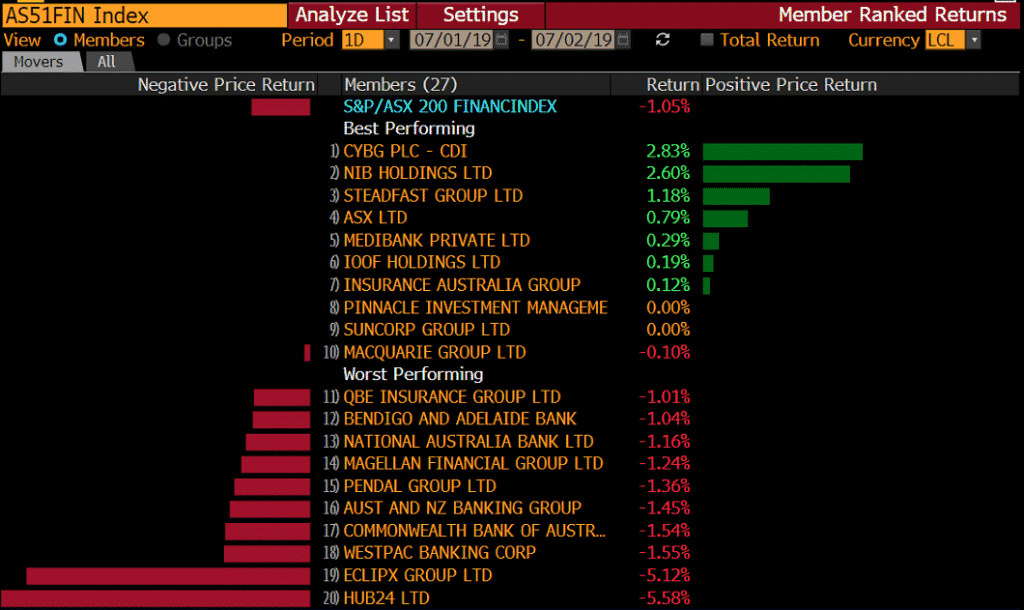

The Australian share market had a solid day ahead of the RBA cut to finish only slightly higher. The financial sector came under pressure and the big four bank shares sold-off in late trade. CBA, NAB, ANZ and Westpac finished the day lower by more than 1%.

Source: Bloomberg TerminalAs of writing, ANZ was the first bank to pass on the full RBA interest rate cut.

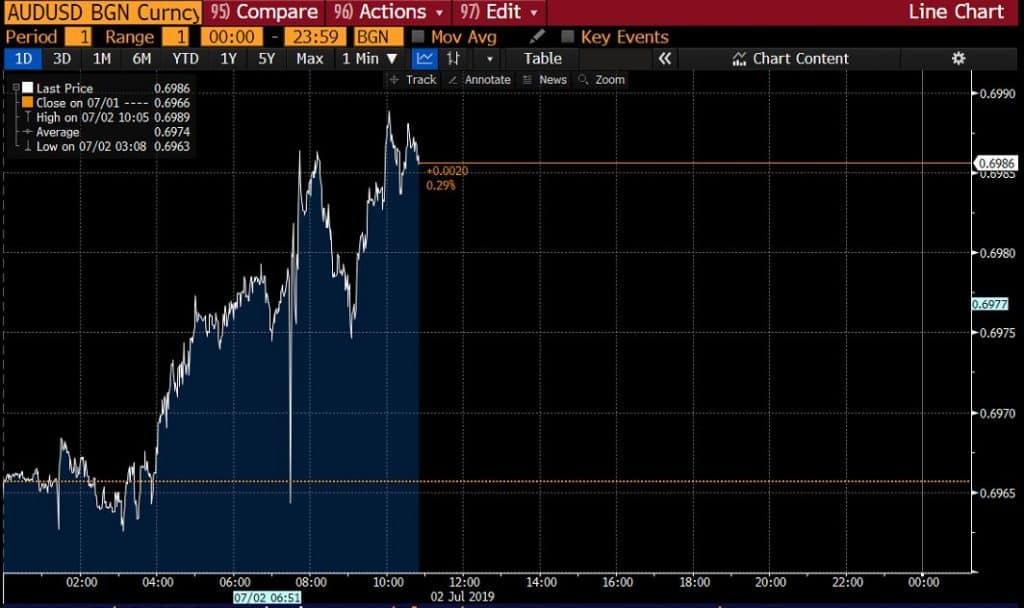

The Aussie dollar was actually firmer at 69.80 US cents as the rate cut was mostly priced-in. The housing data supported the local currency.

AUDUSD

Source: Bloomberg TerminalThe information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

5 influencing factors on the impact of economic data in your trading

There are few times when the market (irrespective of trading vehicle) is more likely to move in price quickly than on the release of some economic data. Judging potential market response can be complex as often many data points are released in quick succession but is an important component of overall risk management relating to your trading positio...

July 3, 2019Read More >Previous Article

Gold to Silver Ratio: Is it useful to commodity CFD traders?

When digging deeper into issues relating to trading precious metals you may come across the idea of using gold to silver ratios as part of decisio...

July 2, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading