Stocks and Oil hammered, Gold and Bonds rally on Credit Suisse woes

16 March 2023US indexes finished in the red today with the exception of the Nasdaq which eked out a small gain as banking fears spread to Europe.

Shares of Credit Suisse plunged to all time lows on fears of the banks financial position and after a top investor in the form of the Saudi National Bank ruled out any further financial help for the bank. US Stocks did mount somewhat of a comeback after the European close on the announcement by the Swiss National Bank that issued a statement of support saying they “Will Provide Liquidity If Necessary”.

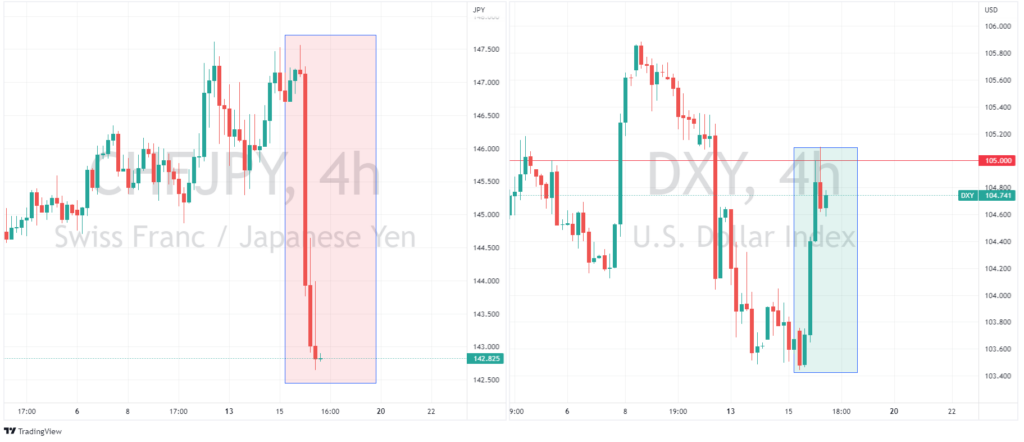

There were some big moves in the FX market , with safe haven currencies rallying strongly while cyclicals suffered. The USD rallied strongly, with the Dollar Index pushing strongly through the 104 level and testing the 105 resistance level before pulling back slightly. The main beneficiary though was the JPY which outperformed the USD on haven flows.

The Swiss Franc was the obvious outlier, normally seen as a safe haven it got poleaxed against all it’s major peers after the SNB announced its support of CS.

Commodities also has a wild ride, safe haven flows saw gold soar to just below the 1940 level, this despite a rampant US dollar. WTI oil was the yin to golds yang, slumping to it’s lowest level of 2023, smashing through all support levels to drop as low as $66 a barrel before retracing, recession fears and a strong USD being the major drivers.

Bitcoin again tested its major resistance at 25k, and again was rebuffed with investors preferring the safety of gold and bonds as safe haven alternative.

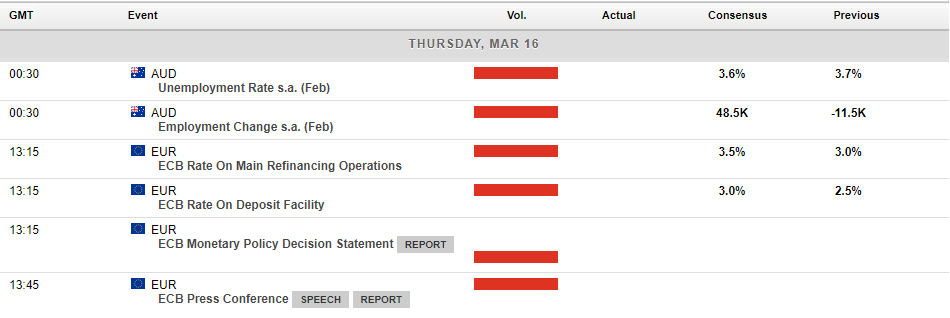

The next 7 days is a huge one for Central Bank action, starting later today with the ECB rate decision. Only a week ago futures markets were pricing in a 100% chance of a 50bp hike, these odds have moved dramatically lower over the last couple of days with the market now only barely pricing in a 25bp hike.

This meeting will be very closely watched as the Fed, SNB and BoE all have their rate decisions next week, what the ECB do today will likely sway traders predictions on the other major Central Bank actions coming up, be prepared for some serious volatility ahead!

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Will the ECB continue with a 50bps hike as planned?

In the lead-up to the European Central Bank (ECB) interest rate decision this week, the market has seen significant turmoil. Firstly from the Silicon Valley Bank (SVB) failure, followed by the news that Credit Suisse’s largest financial backer is unlikely to provide further financial support. This led to Credit Suisse stock plunging by more than ...

Previous Article

XAUUSD, GBPUSD, EURUSD Analysis 13-17 March 2023

XAUUSD Analysis 13-17 March 2023 The gold price outlook remains positive in the short and medium term. As the price of gold rested above the 18...