US equities finish in the red after retail sales miss and ongoing debt ceiling concerns

17 May 2023US stocks finished mostly lower in what was a risk-off session amid mixed data releases from the US and ongoing debt ceiling concerns weighing on risk markets. A lackluster forecast from retail giant (and Dow component) Home Depot (HD) also didn’t help.

The Dow led losses, ending up down over 300 points while the Nasdaq was the least worst of the major US indices, just ticking red, down 22 points.

Debt ceiling concerns are starting to really come to the fore with a meeting between the White house and congressional leaders failing to make much progress on Tuesday, likely we will be hearing more and more about this impasse as both sides play chicken with each other and risk sentiment deteriorating as a result until a deal is made.

Just as a chart of interest, below is the current S&P 500 and VIX charts in Green, superimposed over charts from 2010-2011 which is the last time an acrimonious debt ceiling debate was occurring.

Source:Zerohedge.com

FX Markets

The USD was firmer on the session, on the back of rising bond yields and debt ceiling induced haven flows, retracing Monday’s losses to be mostly unchanged for the week so far.

EUR was flat against the USD but saw gains vs GBP on hawkish ECB commentary from known-hawk Holzmann. EURGBP retaking the 0.87 handle. With the ECB expected to have a more aggressive rate hiking path forward from here than the BoE, EURGBP will be one worth watching as these rate differentials should give it a tailwind.

AUD and NZD both declined vs the USD on the back of disappointing Chinese data indicating that the China reopening is not living up to expectations. The AUD was hit harder, seeing AUDNZD go sub 1.07 again, a level that recently has been a good buying opportunity in this pair.

Commodities

Gold tumbled in Tuesdays session, with XAUUSD blowing through the big 2000 level, for the first time since May 1st, to re-enter it’s range that is was stuck in during April. Rising bond yields and traders preferring the USD and Yen as safe havens seeing sellers take charge.

Crude oil was also lower on Tuesday as weak economic data out of China and a miss in US retail sales saw demand fears haunt oil, USOUSD being rejected at it’s upper trend line to settle the session with a 70 handle. Ongoing procrastination from the US administration on when and how to start buying to refill the SPR also weighing on prices.

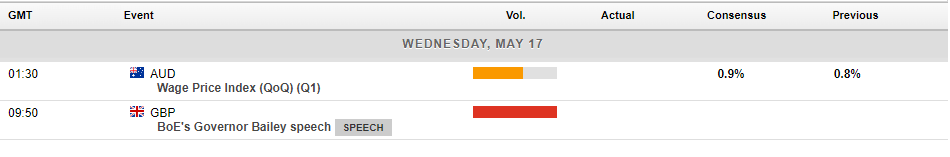

Today’s economic calendar is fairly light on major risk events, the Aussie Wage Price data at 11:300 AEST could get the AUD moving. Wage data has been cited by the RBA in its decision making quite heavily so will have the ability to cause some volatility in Aussie markets. A speech by the BoE Governor Bailey will also be one to watch.

Charts Source : Tradingview.com

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Target beats estimates – the stock is up

Target Corporation (NYSE: TGT) announced Q1 financial results before the market open in the US today. The company posted solid results beating revenue and earnings per share (EPS) estimates. Company overview Founded: June 24, 1902 Headquarters: Target Plaza Minneapolis, Minnesota, United States Number of employees: 440,000 (2023) ...

Previous Article

US stocks finish in the green on weak data and regional bank short squeeze

Major US indices finished broadly higher after weak Empire State manufacturing figures fed into the “bad news is good news” for equities narrative...