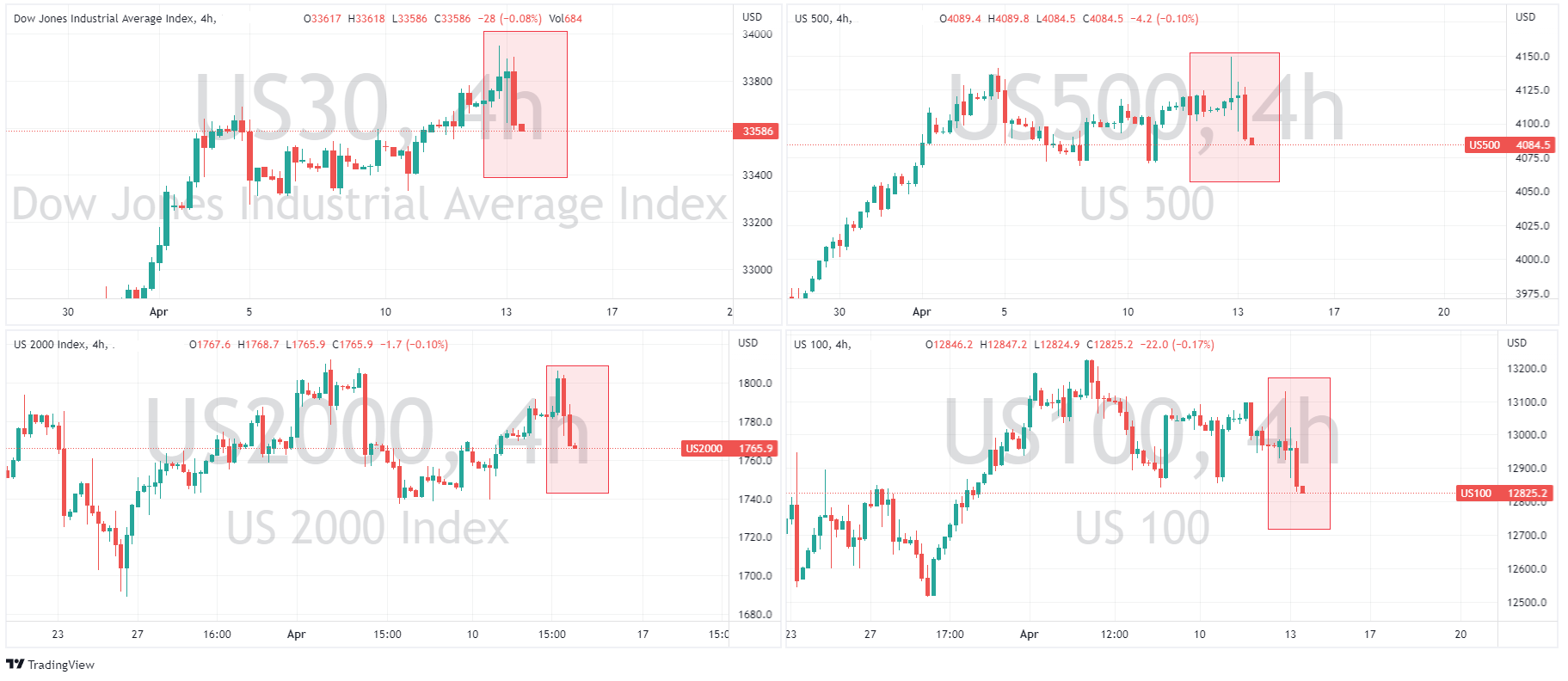

US Stocks give up gains on cool CPI as Fed minutes stoke recession fears

13 April 2023Major US stock indices slid in Wednesday’s session after a cooler than expected CPI figure gave them a boost only run out of steam and ultimately finish in the red after Fed minutes stoked recession fears. The Dow outperformed it’s peers, down around 38 points as investors continued to favour defensive stocks over more risk sensitive growth stocks after Fed minutes showed that some members expect a “mild” recession later this year due to the banking crisis.

There was a market-wide dovish reaction to the US CPI coming in softer than expected (5.0% Y/Y vs exp. 5.2%) , seeing stocks rally strongly, this move up was faded later in the session on hawkish remarks from various Fed members that re-iterated that despite a recent cooling the Fed “had some work to do” to bring US inflation back into the target range. Federal Reserve minutes released late in the session stoked recession fears and put more pressure on risk assets.

FX MARKETS

The USD tumbled after the CPI figure with the Dollar Index crashing through its short term support levels, hitting lows of 101.44 before finding some support at the April lows set earlier in the month.

The Yen was supported by a weaker dollar and CPI induced lower US bond yields with the USDJPY being held at its resistance level of 133.85, before tumbling briefly to a 132 handle before finding some support as the USD recovered slightly on hawkish Fed speak later in the session.

The Euro was also supported by the CPI induced USD sellof, but was further bolstered by comments from ECB member Villeroy, who was hawkish on inflation and Holzman who said the inflation outlook argues for another 50bps in May. This saw the EURUSD breakthrough it’s April highs, touching on 1.10 which is its highest level since February.

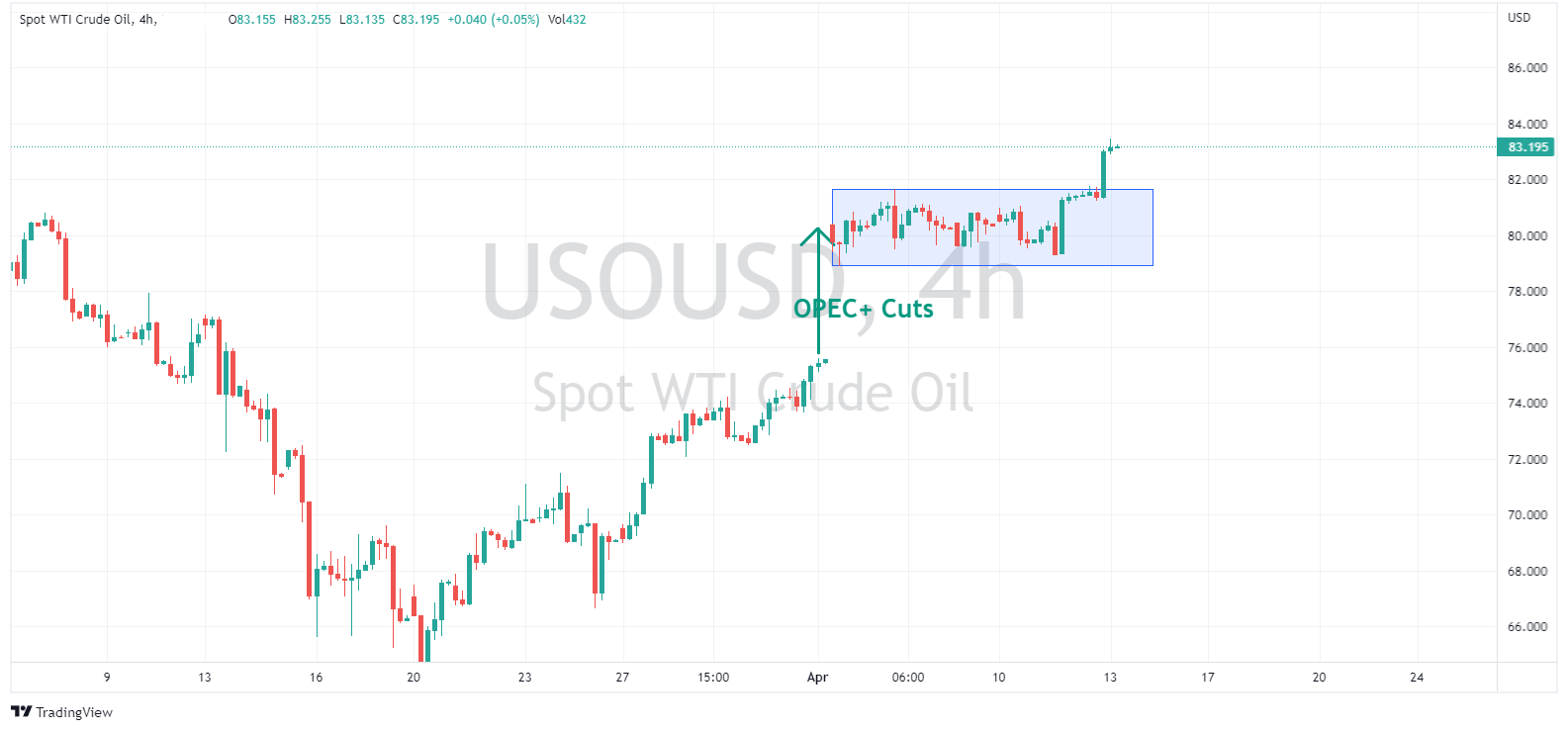

Commodities

Crude oil surged higher, with USOUSD breaking through the top of the range set since the surprise OPEC+ cuts a couple of weeks ago. Soft CPI data and a weaker USD being the main drivers.

Gold was also helped by a weaker USD and also lower bond yields, with XAUUSD looking to test the April highs before retracing somewhat, settling around 2015 USD an ounce.

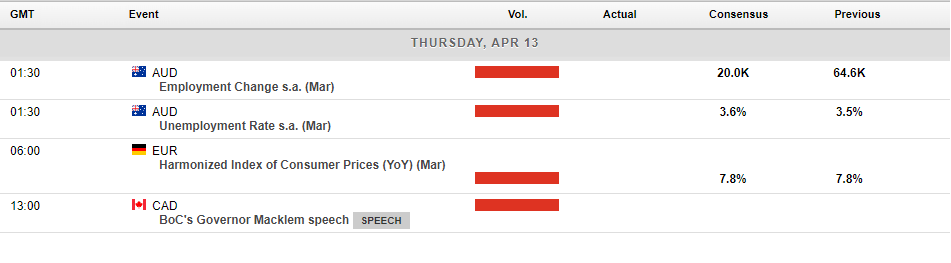

Todays economic releases see another busy session in the US with more inflation figures in the PPI reading, unemployment claims which will be interesting after Fridays beat on the NFP.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Indices Trading – What are Indices and how to use CFDs to trade them

Index trading is one of the most popular class of markets to trade for CFD traders, rivalling major FX pairs in trading volume, but what is indices trading and how does trading them with CFDs work? Most people will be familiar with the names of the major stock indices from financial reports in all forms of media, the most popular stock indices o...

Previous Article

USDCAD Analysis

On the 9th of March 2023, the Bank of Canada (BoC) released its monetary policy decision to keep rates at 4.50%. In the accompanying statement, the Bo...