US stocks mixed in choppy session amid an OPEC+ surprise and weak manufacturing data

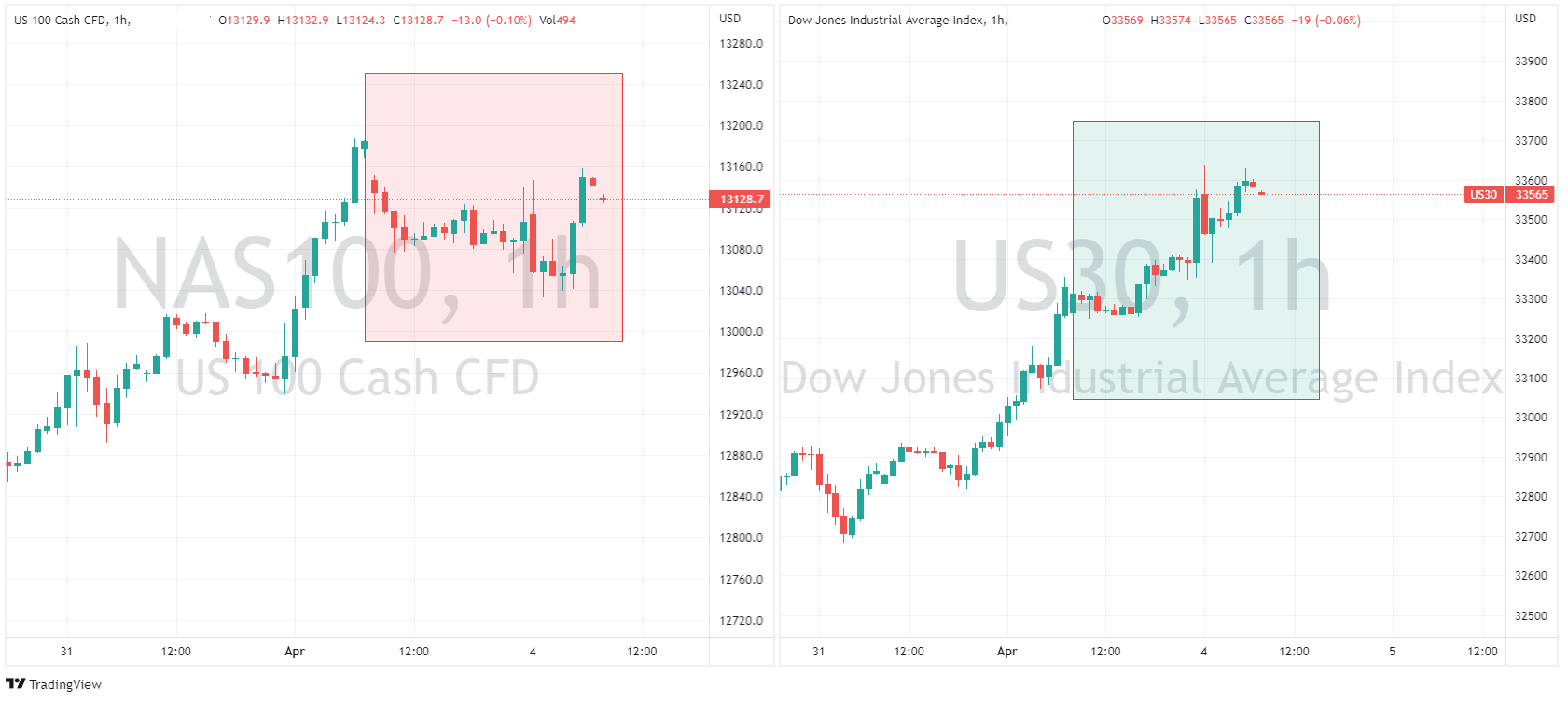

4 April 2023Markets on Monday opened to the news of a surprise OPEC+ Oil output cut seeing WTI oil gap open over 5% that along with weak manufacturing figures out of the US saw a whipsawing session in equities, the Dow did finish strongly though, up over 300 points, dramatically outperforming the Nasdaq by the most since October last year, the tech heavy index finishing in the red by about a quarter of a percent.

The DOW was helped along by outperformance of energy stocks, with Dow component Chevron rallying over 4% on the OPEC news, while market uncertainty saw investors rotate from the more risk sensitive growth stocks listed on the Nasdaq.

The big news of the day was the surprise oil output cut from OPEC+ after they announced on Sunday that they would be cutting daily production by more than 1 million barrels a day starting in May and running until the end of the year. This sent WTI crude surging past 80$ a barrel and hitting it’s highest point since January this year and back to the highs of it’s 2023 trading range.

This also makes the Feds job a bit harder, as the spectre of higher oil prices will likely end in higher energy costs which will in turn fuel inflation which could lead to a more hawkish Fed, rate hike odds for the May meeting increased to 56% from the 53% previously.

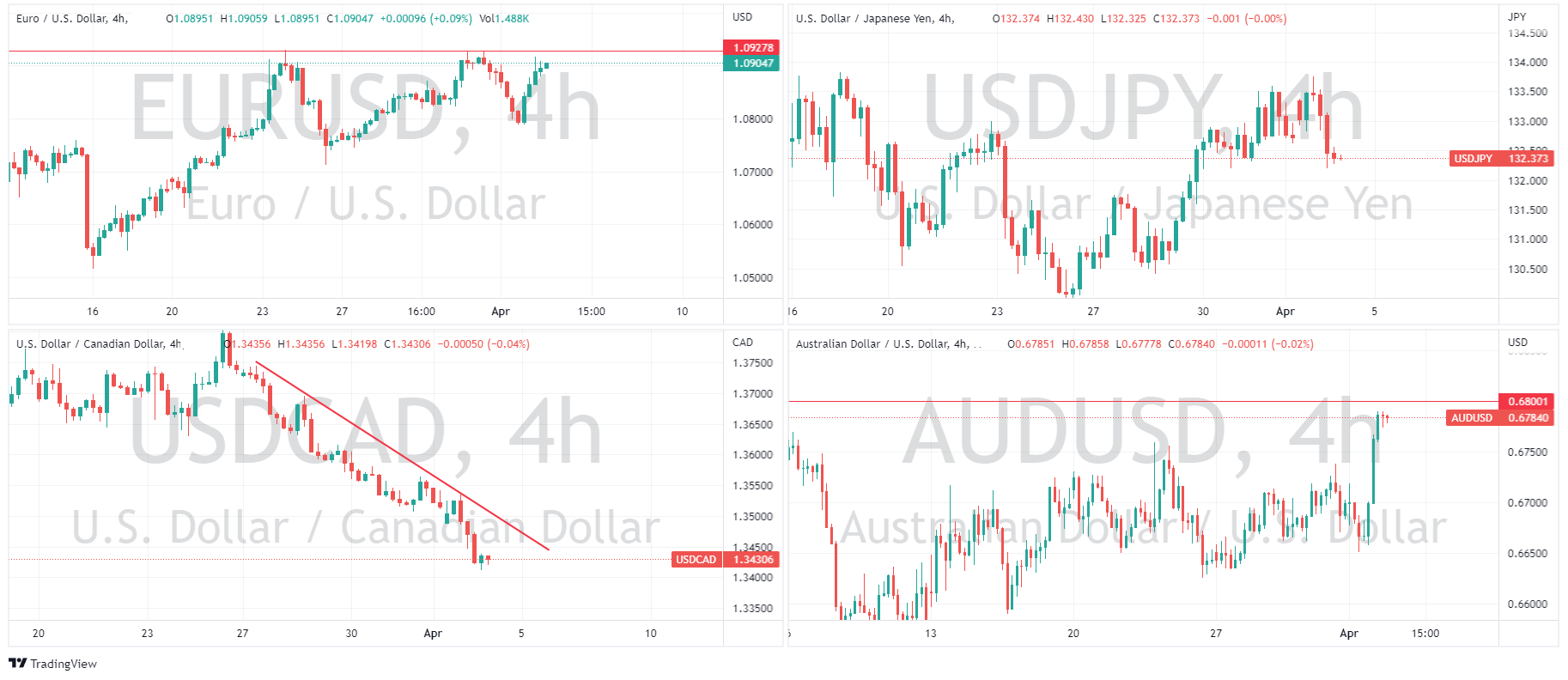

In FX the USD was weaker across the board.

Gold pushed higher on this weakness, along as being a safe haven as the markets were bit shaken by the OPEC news, it touched on 1990 USD an ounce before pulling back modestly.

EURUSD rallied again above 1.09 to test the resistance level round 1.0930 where it again found sellers to hold it there.

The Yen found some extra support in a move lower in US 10 year yields and rallied despite some weak manufacturing figures out of Japan.

CAD also performed strongly, the dramatic surge in oil prices helping the Loonie to outperform the USD.

AUD outperformed ahead of today’s RBA rate decision, hitting the highs just under .68 that were set back in March. The futures market is fully pricing in a pause later today from the RBA, but there are a few economists who are predicting another 25bp hike, so there could be an upside surprise come 2:30pm Sydney time.

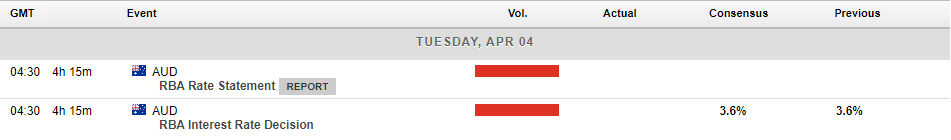

Todays calendar below:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Market Analysis 3-7 April 2023

XAUUSD Analysis 3 – 7 April 2023 The gold price trend can be viewed both positively and negatively in the short and medium term. As the closing of the Doji bar and last week's sell pressure bar indicate market hesitation. Although the previous week, gold has had strong buying momentum and has continued since the beginning of March. But ...

Previous Article

The Week Ahead – RBA and RBNZ rate decisions , US employment

US Stocks finished Q1 with a bang as Wall st wrapped up a volatile, and event filled quarter with Federal Reserve rate tightening, a banking sector pa...