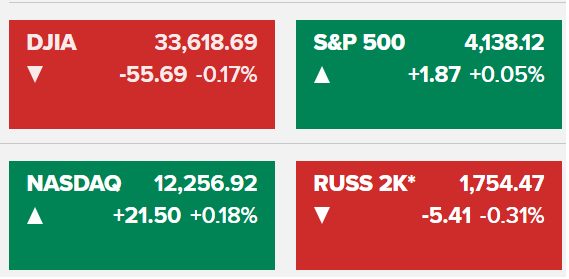

Asian markets looking to open flat after US stocks finish mixed in choppy, rangebound session

9 May 2023Major US indices finished mixed to flat on a slow news day and lighter than usual volumes not helped by the UK being on a holiday as traders seem to be waiting for pivotal inflation data released later this week.

The Nasdaq, lifted by lingering good feeling from recent Tech earnings outperformed, finishing up 21 points, while a paring back of a recent rally in regional bank stocks saw the Russell at the bottom end, down 5.41 points or 0.31%

There was a mixed market reaction to the eagerly awaited senior loan officer survey (SLOOS) report which showed a tightening of credit availability with further deterioration expected in the year ahead, although this was largely what Fed Chair Powell had alluded to last week so not a big surprise. The mixed market reaction was due to this tightening, less work would be needed to be done by the Fed, but it also signals a very probable recession is coming, hence the whipsawing in equity markets.

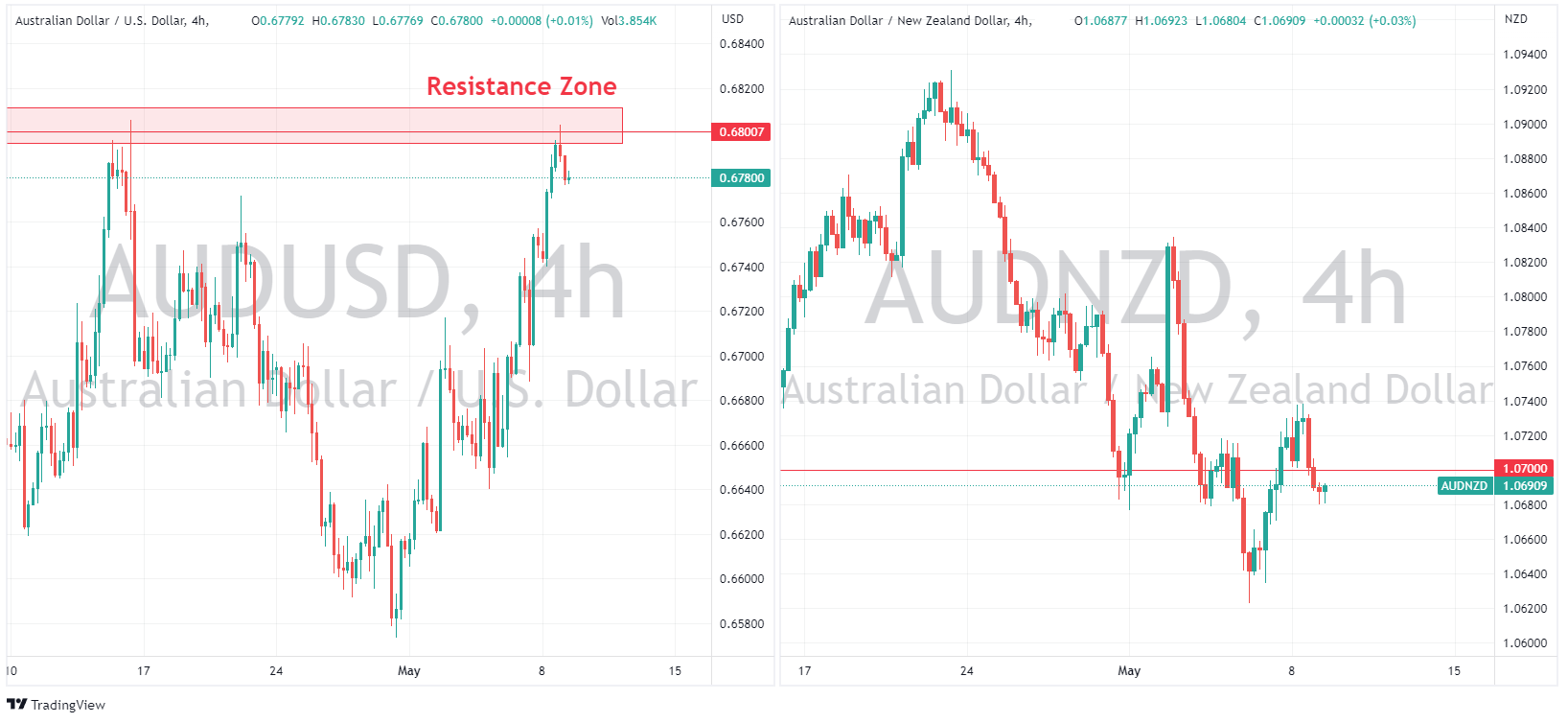

FX Markets

The USD was flat and traded within a very narrow range amid a quiet start to the week which lacked any tier 1 data on top of the UK being on a holiday for the Kings Coronation. The US Dollar Index traded down to it’s support zone around 101 before finding support and lifting in the 2nd half of the session as bond yields rallied after the SLOOS report.

The Antipodes, AUD and NZD, were the G10 outperformers and seeing strong gains against the USD with NZD outperforming AUD. A bounce back in commodity precious giving them both a tailwind. AUDUSD was held at it’s major resistance level of 0.68, coming withing a couple of pips of it’s April high. AUDNZD fell below the psychological 1.07 level from where is has found strong support recently.

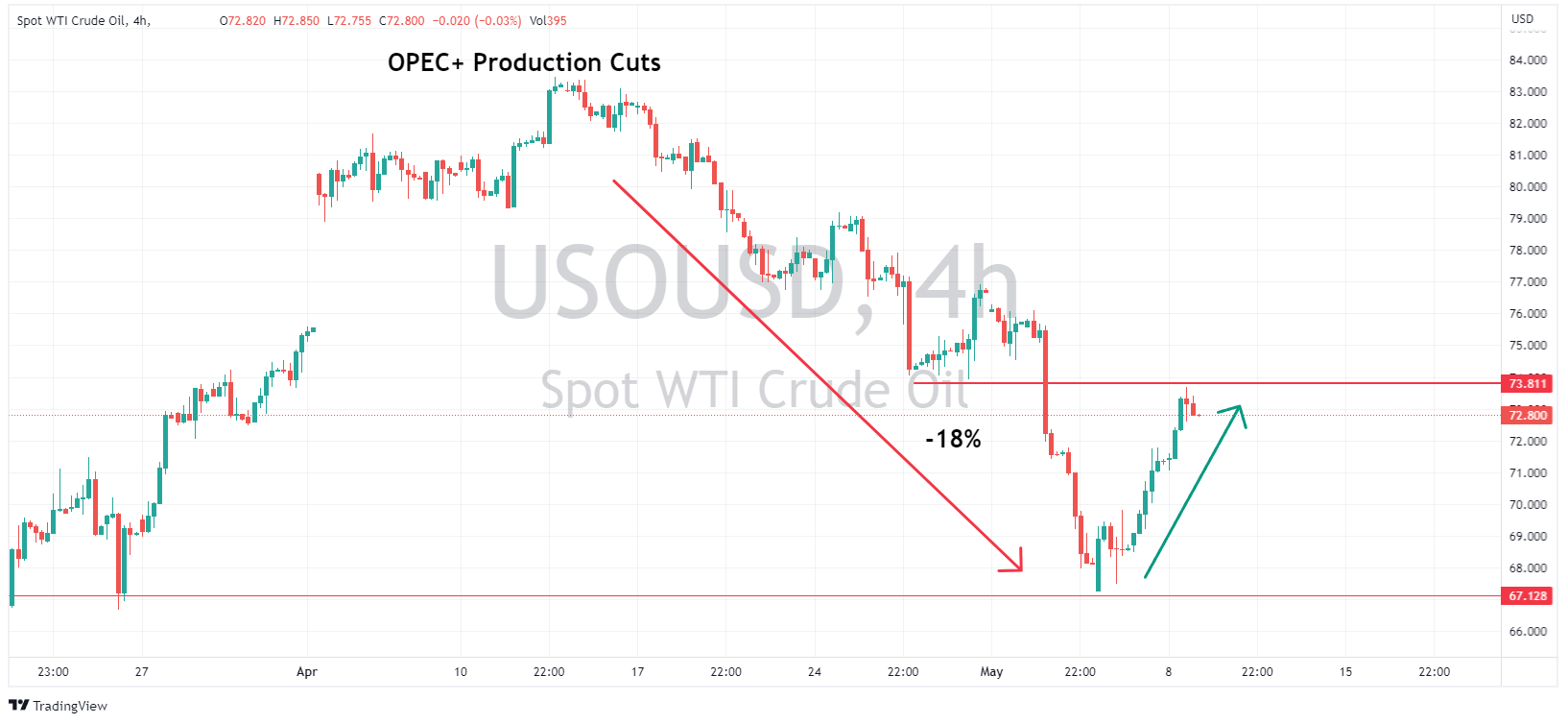

Commodities

XAUUSD held the 2010 support level and ground higher in a low volatility session, touching on 2030 before pulling back modestly. Inflation reports out of the US starting Wednesday should see whether this support level can hold and we possibly get another move higher.

Crude Oil continued to recoup some of its losses from the recent heavy sell-off. It seems that fears around US bank stress, China’s industrial weakness and global growth concerns that have been the drivers of this sharp down move seem to be a bit overdone in some traders minds, USOUSD rallying to 73.68 before finding resistance at the previous range lows.

Crypto

One big mover in an otherwise quiet market all-round was Bitcoin. BTCUSD tumbled back below $27,500 – back to the Mt Gox dump spike lows (caused by rumours of large selling from Mt Gox) after reports that Binance halted BTC withdrawals temporarily.

Another light day in economic releases today, with the real action starting on Wednesday as US inflation figures start to come in. Though AUD and ASX traders should be aware of the Federal budget being released in Australia later today, some volatility could be expected in these assets as the market reacts.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Market Analysis 8-12 May 2023

XAUUSD Analysis 8 – 12 May 2023 The gold price outlook is positive in the medium term. Although last week's closing of the buying pressure bar would indicate a loss of buying momentum due to the weekly selloff. But the price is still moving above the 2000 support, it is very likely that the price will continue to move above the 2000 level ...

Previous Article

Risk events in the week ahead – BoE set to hike, US CPI

US stocks rallied strongly on Friday on a stronger than expected Jobs report, improved banking sentiment and strong earnings from Apple (AAPL) which s...