Hot CPI fails to hold AUDUSD above key level

31 May 2023Australian CPI released today surprised to the upside coming in at 6.8% y/y , well above the consensus of 6.4% which itself was an increase on March’s figure of 6.3%

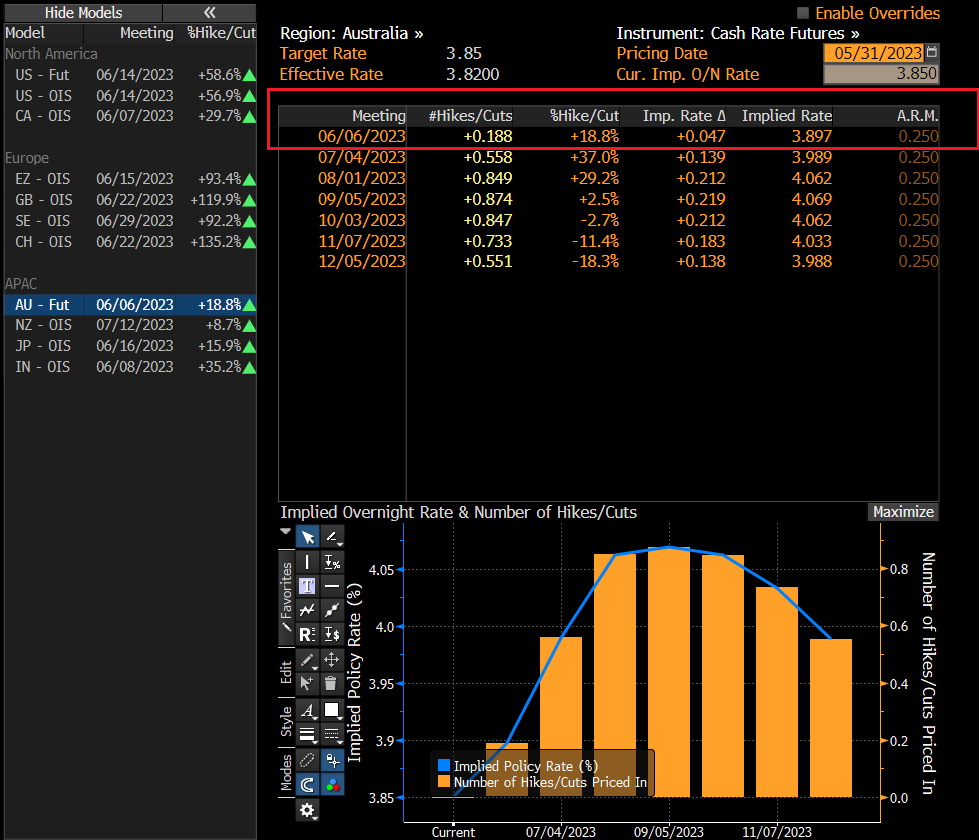

Coming into the figure futures markets had priced in a measly 2.5% chance of a hike next week by the RBA, that changed dramatically with odds jumping to 18.8% for a 25bp hike according to cash rate futures traders.

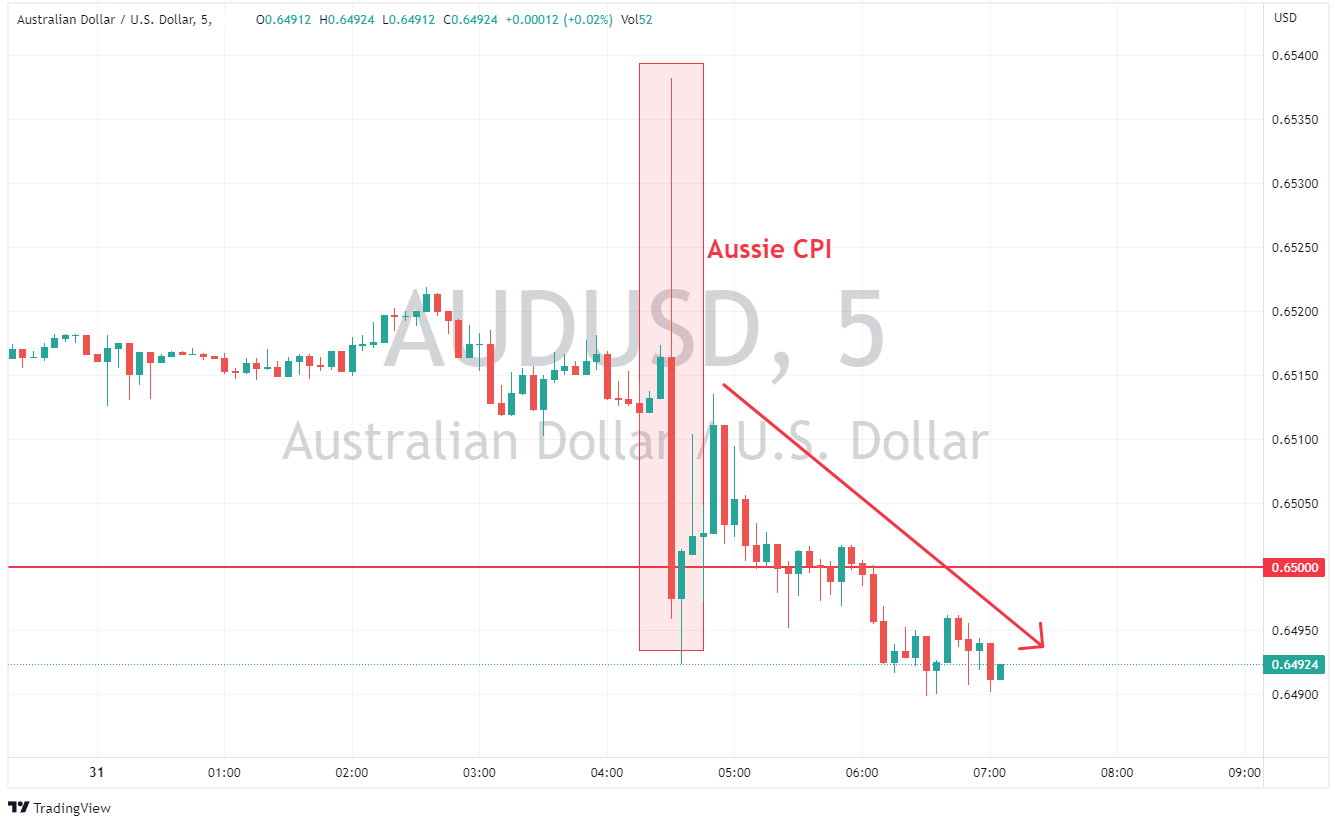

Initial reaction in AUDUSD was predictable, with a sharp spike to the upside as markets repriced the RBA odds, this has quickly retraced though and AUDUSD has now breached the major support at 0.6500.

While this move in AUDUSD might seem unexpected, the main driver of this pair for a while now has been risk sentiment, poor global risk sentiment = AUDUSD down, rather than the actions of the RBA.

The optimism from what was seen as a “done deal” on the US debt ceiling has soured somewhat as the deal does not look so “done” as squabbling in various factions of the Republican and Democrat parties threaten to derail it. We can see this in equity markets having a rough ride, with US futures pointing to a gap down in their cash session later today.

What next for AUDUSD?

Having broken the 0.6500 level, the next real support from a chartist view is the next big figure at 0.64 where we had a lot of chop and support/resistance switching places in late 2022.

Whether we test that or not I believe will depend on debt ceiling progress this week, USD is likely to remain well bid while risk appetite is shaky purely on safe haven flows, cyclical currencies like AUD, NZD and GBP to a lesser extent will all struggle in this environment. If we do get a confirmed deal this week(i.e. voted successfully through Congress), then those haven flows should unwind seeing AUDUSD rally if risk appetite returns to the market.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

US stocks rise to start the new month on debt ceiling optimism, data and Fed speak – NFP ahead

Major US indices broadly rallied in Thursdays session as the US debt ceiling can got kicked another two years down the road after a deal was passed through Congress, US data and Fed speak also supported a narrative shift in expectations of how hawkish the Fed is going to be going forward. The Nasdaq again led gains, (+165 points / 1.28%) , The N...

Previous Article

Asian markets looking to open lower after mixed US session

Major US indices finished mixed in the US Tuesday session with AI-mania propping up the Nasdaq to a green finish while continuing debt ceiling jitters...