Key Events in the Week Ahead – BoJ meeting, US GDP, Aussie CPI

24 April 2023Coming off a choppy and mostly directionless week for Global Markets, this coming week looks to be more of the same as we enter the Federal Reserve blackout period ahead of their pivotal meeting on May the 3rd.

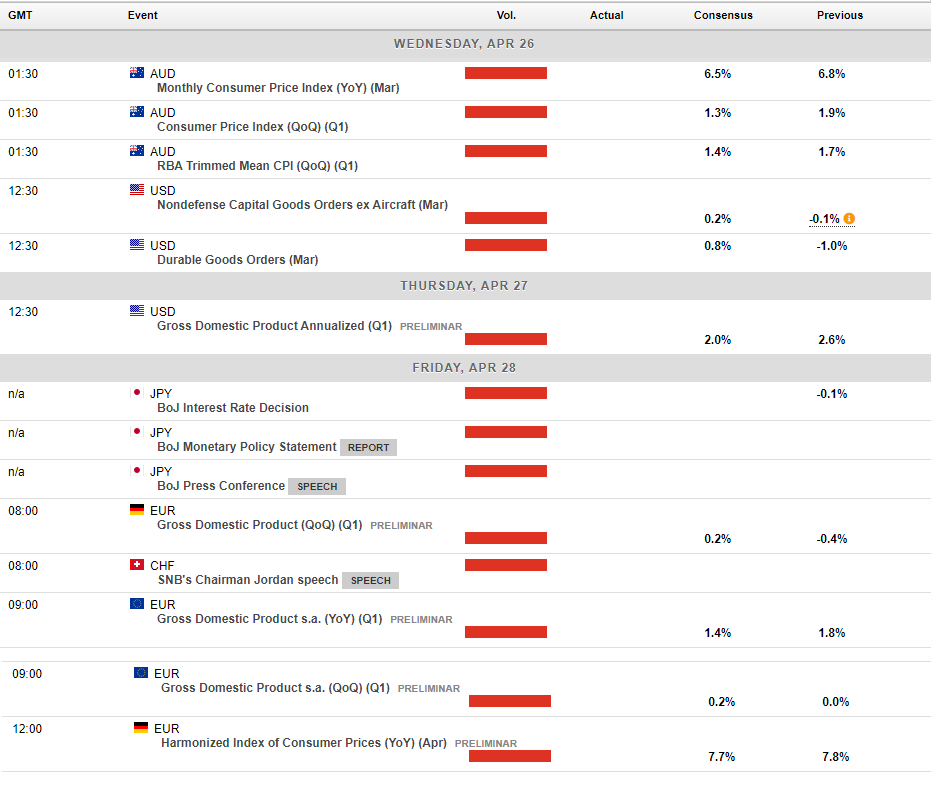

While the economic calendar is light, there are a few risk events that could see some volatility in the markets, starting Wednesday with Australian CPI figures.

Australian CPI (Wednesday)

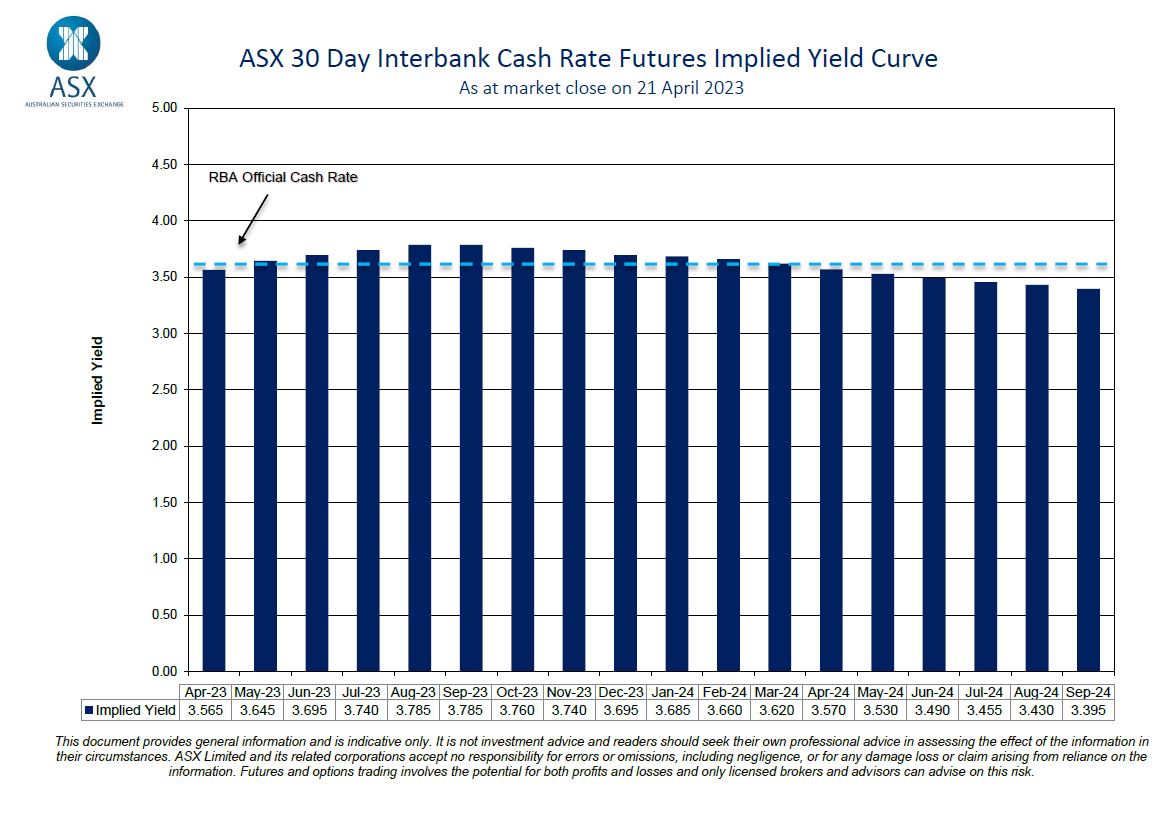

March inflation is expected to fall from the February reading of 6.8% YoY as prices continue to moderate in the face of , up until recently, a relentless hiking cycle from the RBA. The consensus is a drop to 6.5% YoY but there are some major analysts calling a sub 6% figure. With Markets split somewhat on what the RBA will do next week (Futures market pricing in an 80% chance of a hold, 20% of 25bp hike currently) a lower than expected figure would give the RBA all the reason it would need to hold, a big beat would make their decision difficult and see a sharp rally in the AUD you would expect.

USA – GDP, and Core PCE inflation reading

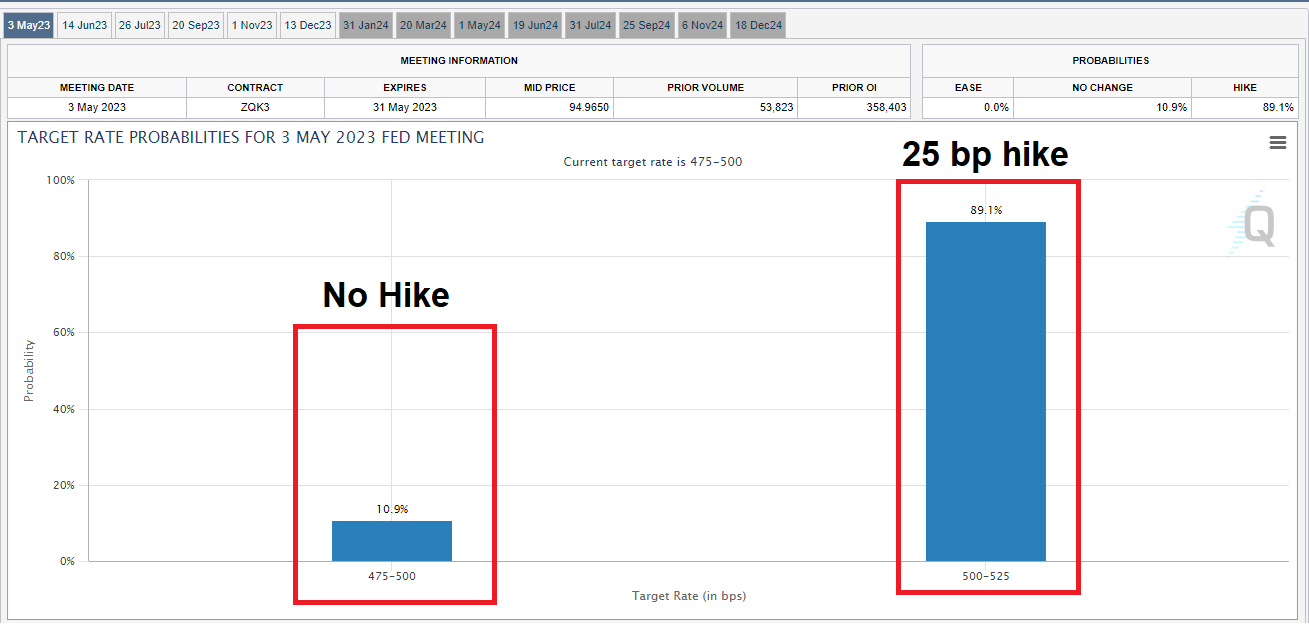

Coming into the Fed blackout window it is hard to see the needle being moved on a FOMC rate hike at their May meeting with this weeks data. Fed Fund futures are currently pricing in a 89% chance of a 25bp hike, and with no shortage of hawkish comments from Fed members last week it would take some very big misses in this weeks data to see the markets reprice that prediction.

First quarter GDP is the highlight of the data releases where a fall to 2% from the previous reading of 2.6% is expected, this will not be enough to dissuade the Fed from hiking rates I would think.

Core PCE inflation will be released on Friday which is expected to show it holding at 0.3% MoM.

Japan – BoJ’s first meeting with new governor

The Bank of Japan will hold its first policy meeting under the leadership of Kazuo Ueda on Thursday, while Ueda has so far been happy to follow the accommodative policies of his predecessor it seems it will be only a matter of time before the Bank makes further adjustments to it’s controversial Yield Curve Control policy. This meeting probably won’t have too much in it to move markets, but the BoJ has surprised in the recent past (December meeting comes to mind) so it’s still a possibility we could see some volatility in the Yen over this meeting.

This weeks full economic calendar below:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

The Coca-Cola Company announces Q1 results

The Coca-Cola Company (NYSE: KO) announced the latest financial results for the first three months of 2023 before the market open in the US on Monday. The US Beverage company posted solid results for the quarter, beating both revenue and earnings per share (EPS) estimates. Company overview Founded: January 29, 1892 Headquarters: Atlan...

Previous Article

Procter & Gamble Company exceeds expectations – the stock rises

Procter & Gamble Company (NYSE: PG) announced third quarter fiscal 2023 before the opening bell in the US on Friday. World’s largest consumer...