The Week Ahead – Deutsche Bank wobbles, AU, EU and US CPI

27 March 2023With a volatile week behind us in equities, FX and commodities as traders were taking stock of the continuation of the banking crisis coupled with multiple Central Bank meetings, this upcoming week looks positively quiet in comparison. Though with growing rumours of banking giant Deutsche Bank wobbling (it’s share price is down over 24% in the last 3 weeks) and the key inflation figures out of the US, EU and Australia nothing can be taken for granted in the current market environment.

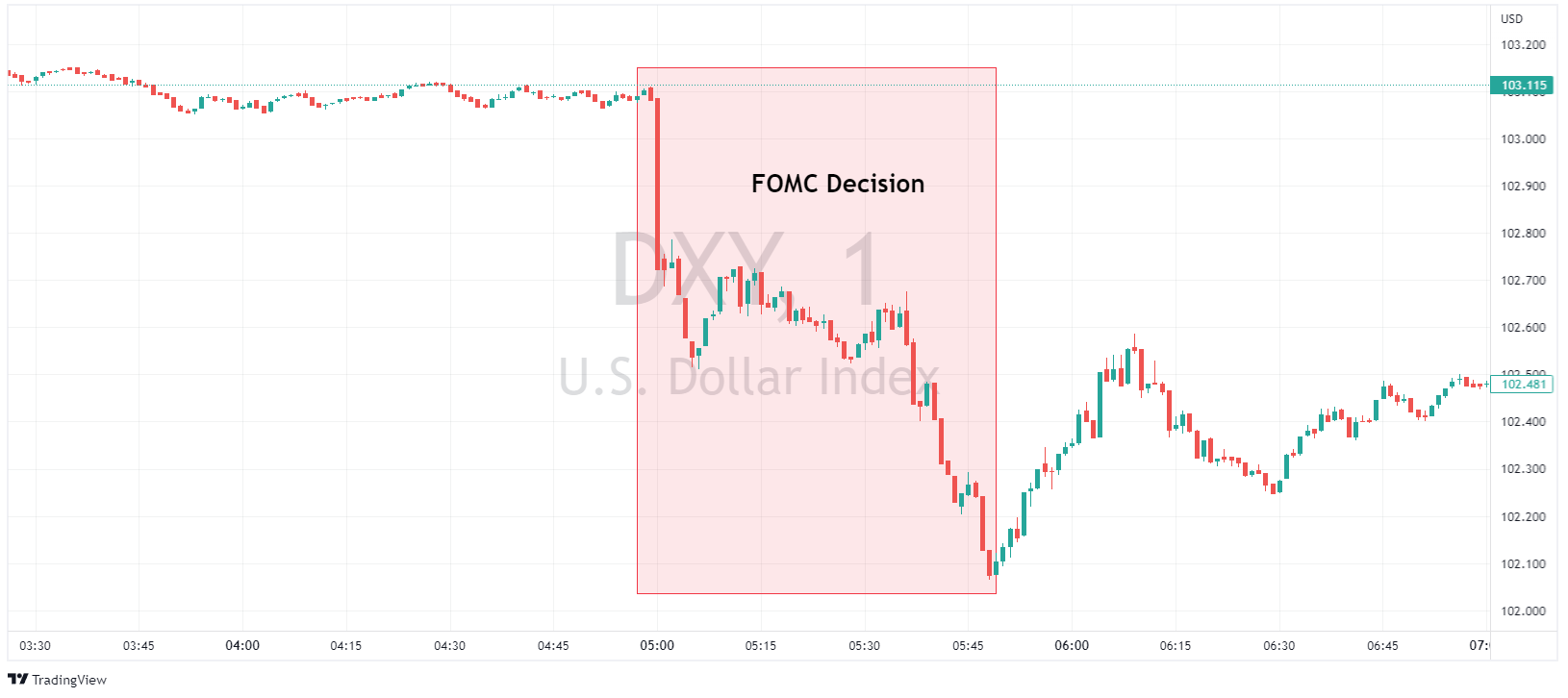

Last week we saw the Fed, SNB and BoE all hike rates as expected, the Fed and the BoE 25bp and the Swiss 50bp, there were indications the end was near though, especially from the Fed who’s language changed from ongoing rate increases “will be appropriate” to “may be appropriate”, this saw a big sell off in the USD

The Week Ahead – Figures to watch

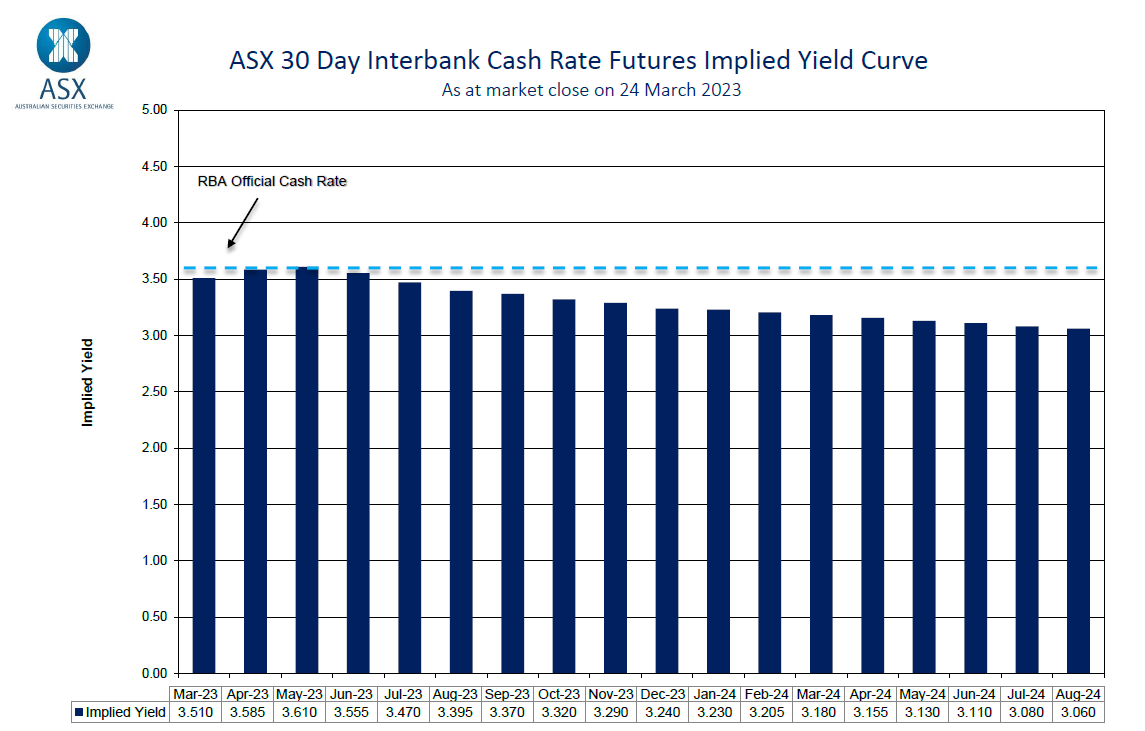

On Wednesday we have Australian CPI, this is a pivotal reading with the market now pricing in a pause from the RBA at their next meeting a weak reading will support the RBA hints from their last meeting that they are close to a peak, an upward surprise would see a repricing of those odds and see a decent move higher initially in the AUDUSD.

On Thursday, out of the EU we have German CPI, where the reading is expected to moderate from last months big beat, again with the ECB still talking tough about their future hiking, we should see some volatility in the Euro on this figure.

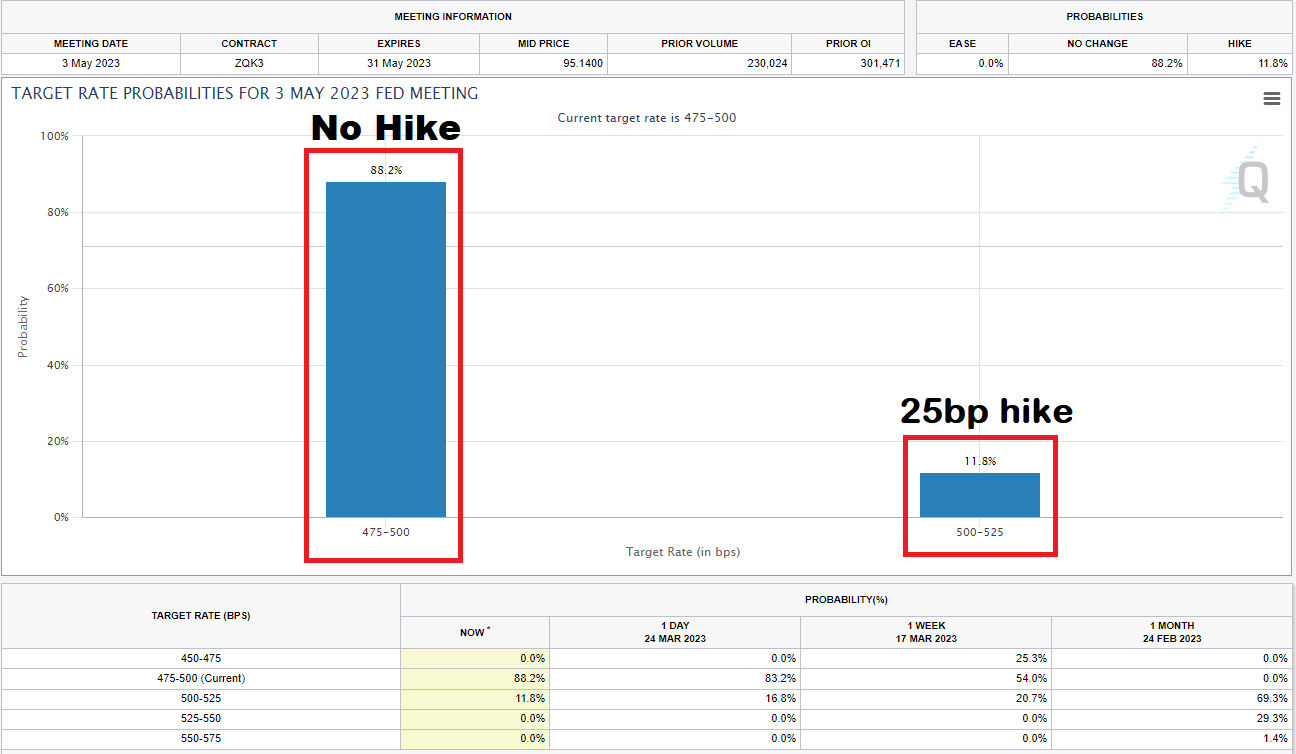

Then on Friday, the Feds favourite CPI figure, the Core PCE will be released. Fed Fund futures are currently pricing in a 88% chance of a hold at the next meeting of the FOMC, so a hot reading here could see a big re-adjustment of those odds, sending the USD spiking higher and putting pressure on bond prices. The next FOMC meeting is not until May, so the odds are likely to change as new data becomes available between then and now.

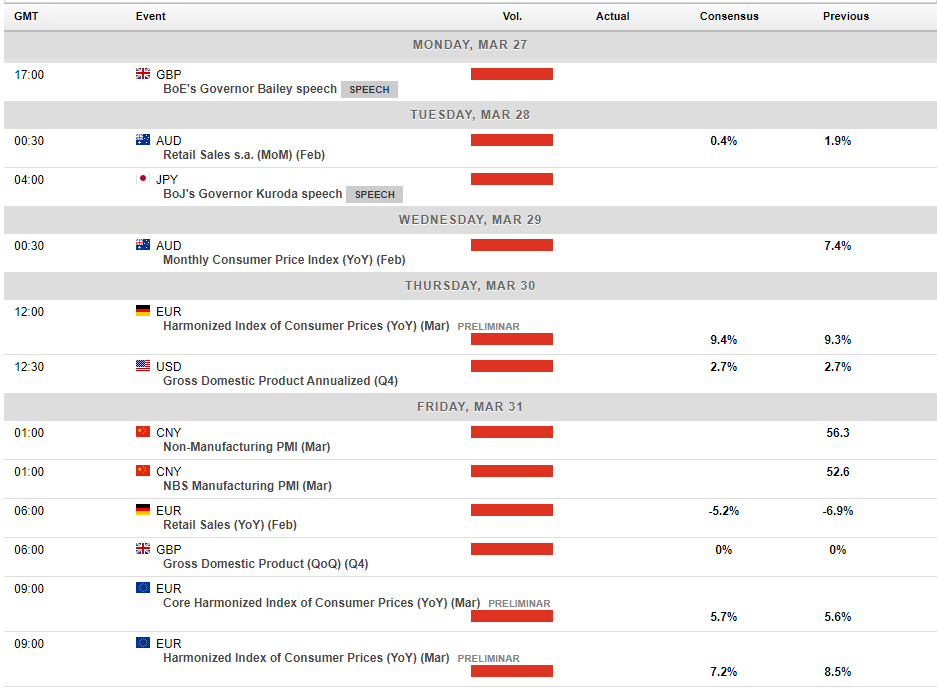

Full calendar of the weeks major announcements below:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Market Analysis 27-31 March 2023

XAUUSD Analysis 27 – 31 March 2023 The gold price trend can be viewed both positively and negatively in the short and medium term. As the close of last week's Doji bar indicates hesitation in the market. Although the previous three weeks, gold has had strong and consistent buying momentum since the beginning of March. But even so, the g...

Previous Article

Bollinger Bands – what are they and how can you use them in FX day trading

Bollinger Bands are one of the most popular indicators that FX and CFD traders use, invented in the 1980’s they are a technical analysis tool that a...