US equities fall on soft data and re-ignited banking fears

26 April 2023US stocks were broadly lower in Tuesday’s session as another US bank teetered on the verge of collapse and weak Consumer Confidence figures saw investors heading for the door.

In a continuation of banking jitters, First Republic Bank (FRC) plunges to record lows after an earnings miss and reporting record deposit outflows seeing the stock price plunge over 50% to hit all time lows and dragging the broader market down with it, The Russell 2000, where most of these mid-sized banks are listed , took the brunt of it, crashing 2.4% on the session to be the worst performing major US index. A weaker than expected Consumer Confidence figure , coming in a 101.3 vs an expected 104 also created headwinds for equities.

FX Markets

The USD caught a bid on the back of a nervous market, seeing safe haven flows. The US Dollar index looking to test the 102 level before finding resistance just below at around 101.95

The Euro fell victim to the stronger greenback, with EURUSD losing hold of the 1.10 handle. It also wasn’t helped by a less hawkish tone from ECB speakers Lane and Villeroy than we’ve had recently from ECB officials, there is a turning in expectations of the size of the next hike from the ECB with economists starting to favour a 25bp hike over a 50 which was the base case until recently.

Despite a strong USD , the Japanese Yen saw decent gains against the greenback due to safe haven flows and a fall in US bond yields, this came despite some dovish commentary from the new BoJ governor Ueda during the Asian session. USDJPY pushing down past last weeks lows before finding support at 133.37.

Commodities

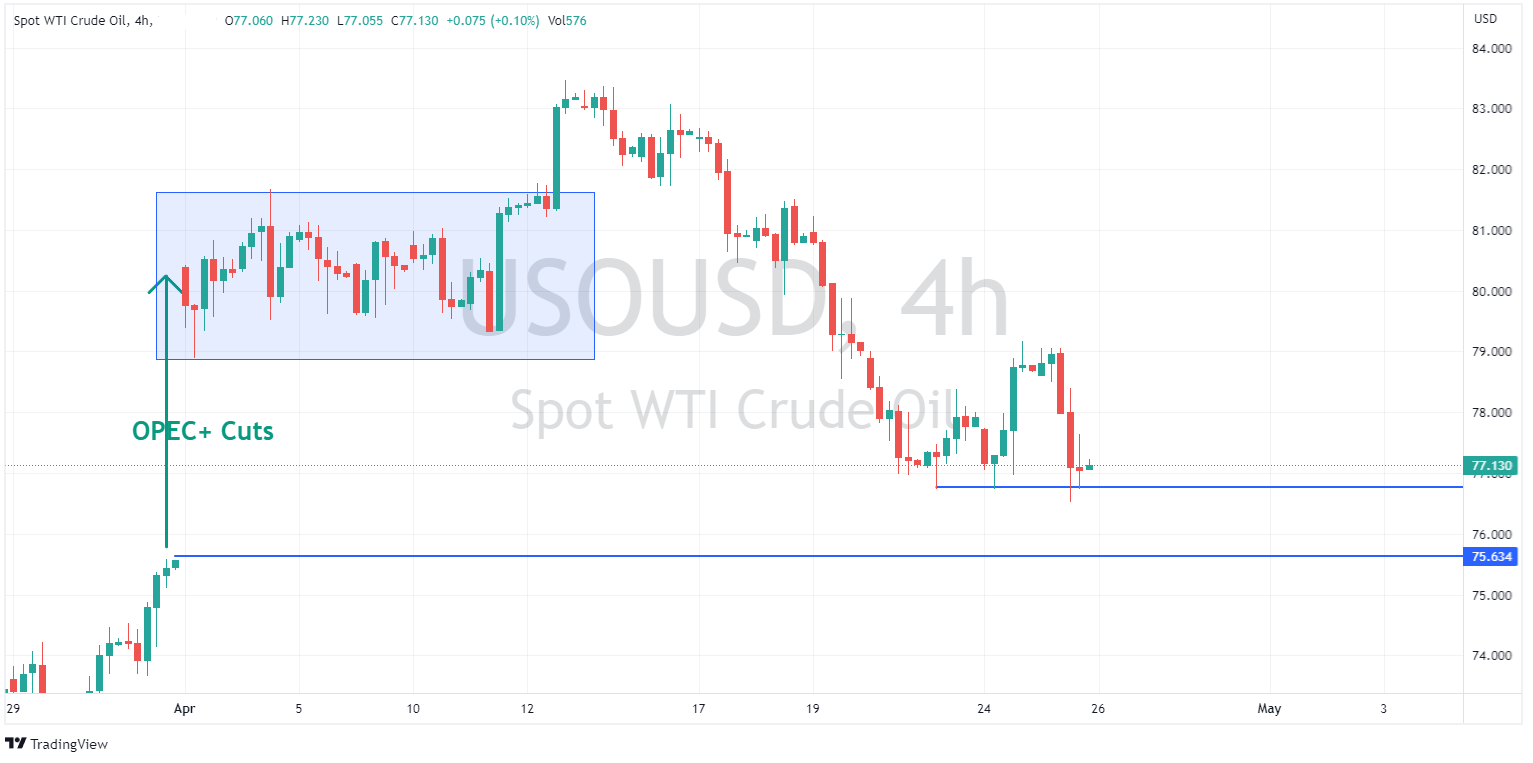

US Crude oil continued it’s push lower in seeming determination to fill the Post OPEC+ production cut gap, seeing a 76 handle before again finding support at around Friday and Mondays lows. A stronger USD and economic growth concerns seeing to be the main driver.

Gold – The bulls vs bears battle for 2000 continued in Tuesdays session with the gold price again seeing volatility around this area, XAUUSD briefly pushed through but was rejected to see the price settle around the 1997 level. XAUUSD has traded around 2000 in a fairly tight range for almost two weeks now, 2015 to the upside and 1970 to the down being major levels to watch.

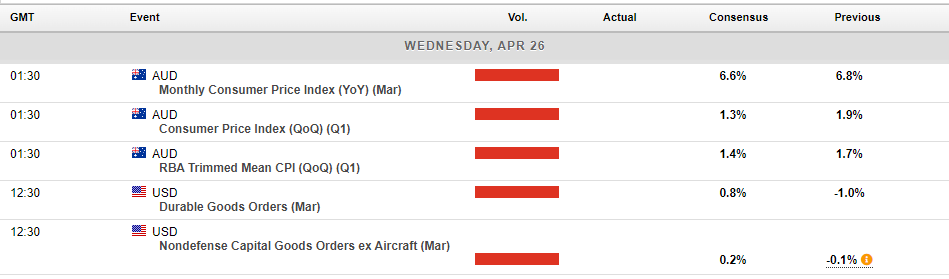

In today’s economic announcements, the main risk event will be Q1 Australian CPI figures released at 11:30 AEST, this figure will be pivotal to next weeks RBA rate decision, where the futures market currently is pricing in an 80% chance of a hold, a hot figure here could see those odds shift dramatically and see some big moves in the Aussie Dollar.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Market Analysis 24-28 April 2023

XAUUSD Analysis 24 – 28 April 2023 The gold price outlook is positive in the medium term. Although the close of last week's sell pressure bar indicates a loss of buying momentum. But the price is still above the 1960 support or the last high of the price in the Weekly time frame, which is very likely that the price will continue to swing o...

Previous Article

Microsoft posts better-than-expected results

US technology giant Microsoft Corporation (NASDAQ: MSFT) released the latest financial results for the quarter ended March 31, 2023, after the market ...