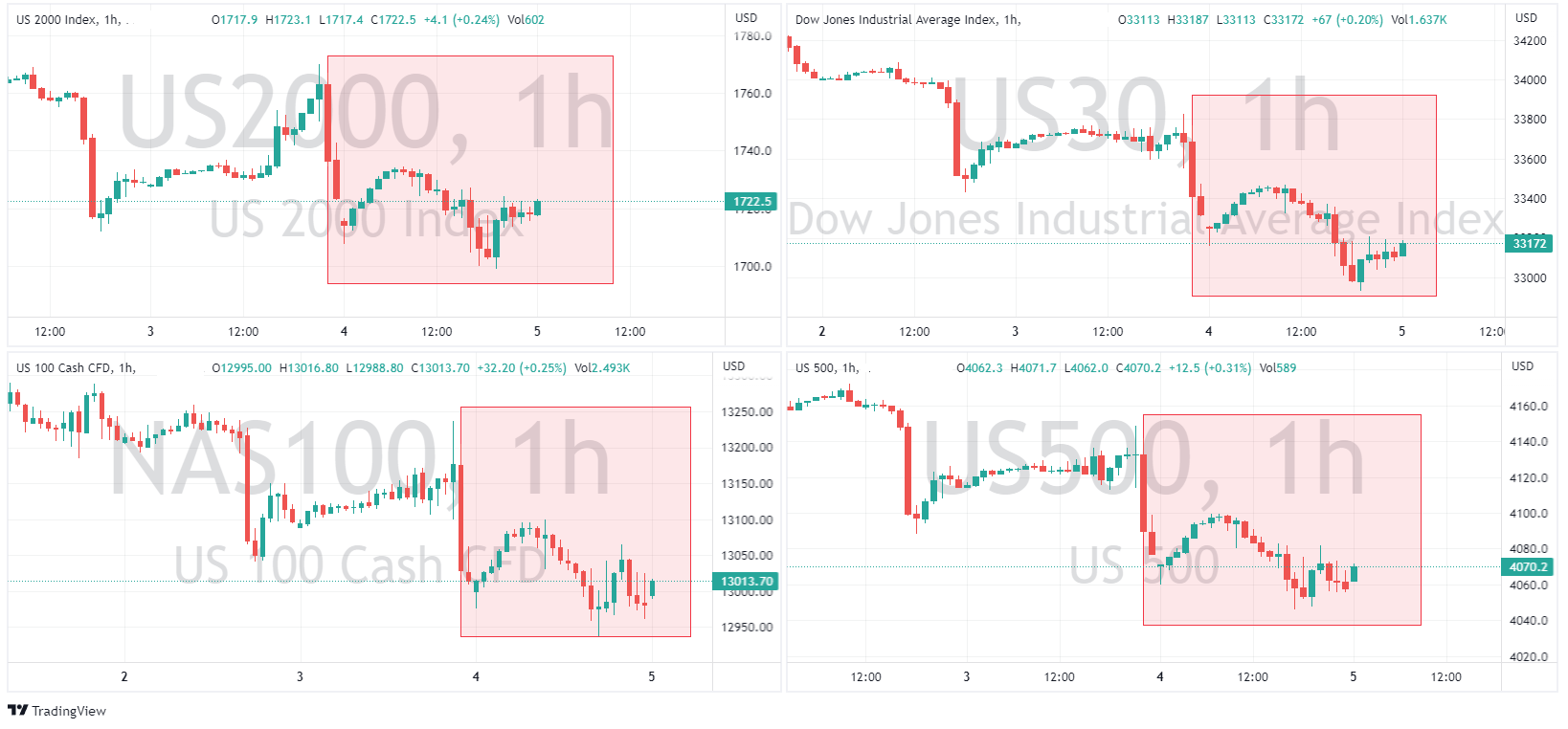

US stocks sink in risk off session as banking sector woes continue to weigh

5 May 2023US stocks indices finished in the red in a choppy session with more regional bank selling, mixed data releases (including a surge in US Labour Costs) and another hike out of the ECB keeping traders busy.

All four major indexes finished broadly lower with financials leading the declines as more headlines hit the newswires regarding issues with regional banks seeing the Russel 200 as the worst performer, down -1.2% on the day.

The ECB hiked rates 25bp as most analysts expected in a seeming compromise between the hawks and the doves, and stated that the tightening was based on their judgement that the “inflation outlook continues to be too high for too long”. At the follow-up press conference, Lagarde stated that today’s decision “was not a pause” and the ECB still has “more ground to cover”; a comment which gave today’s announcement a more hawkish skew than the initial policy statement, with markets fully pricing in another hike at their June meeting, and a 60% of one more in July.

FX Markets

The USD saw modest gains in Thursday’s session, primarily driven by weakness in the Euro post ECB and benefitting from the risk off tone in the market, the US Dollar index again finding support at the 101 level.

The Euro was weaker after the ECB rate decision which opted for a 25bp hike, disappointing the Euro bulls who were positioned for 50bp hike. Also comments from Christine Lagarde that rates were approaching a “sufficiently restrictive level” was taken as dovish.

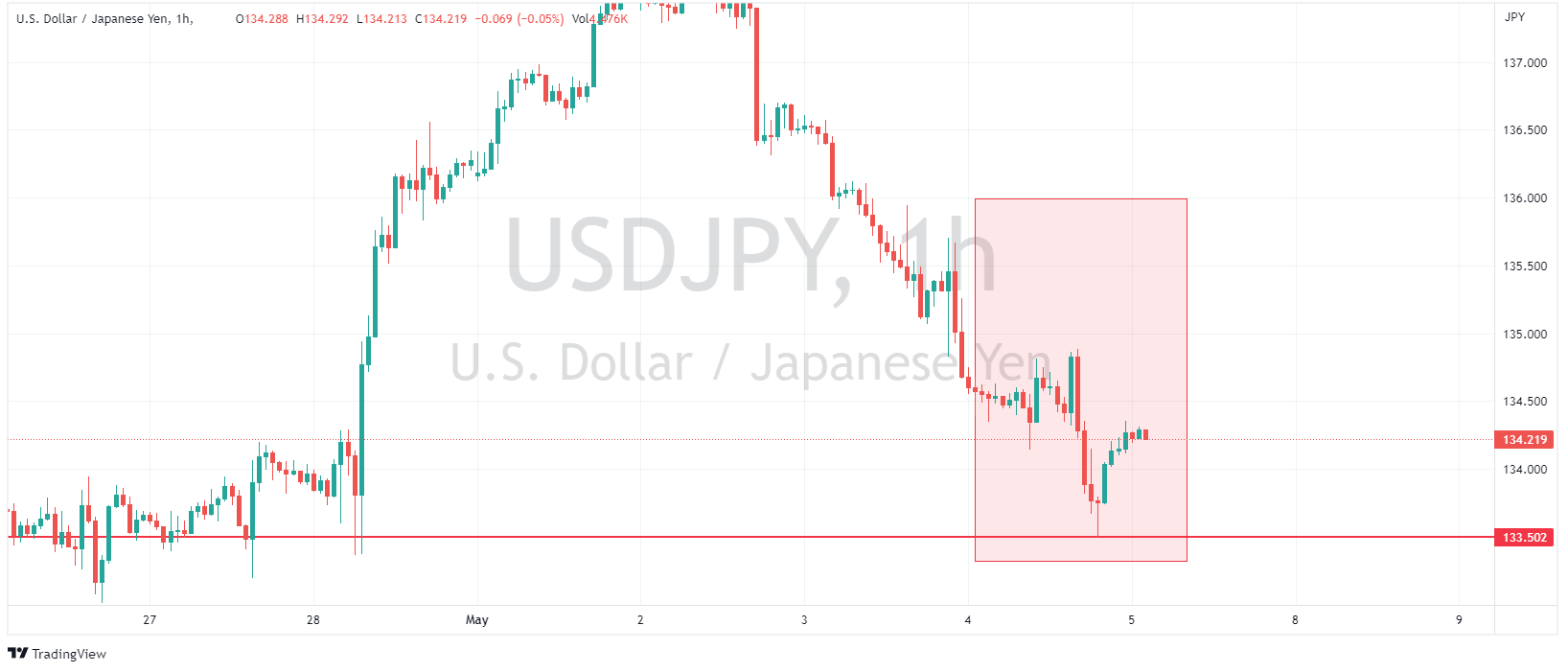

The Yen was stronger on the session on safe haven flows and downside in global bond yields post ECB. USDJPY fell below 134.00 to lows of 133.51 where it found some support and rose back to a 134 handle.

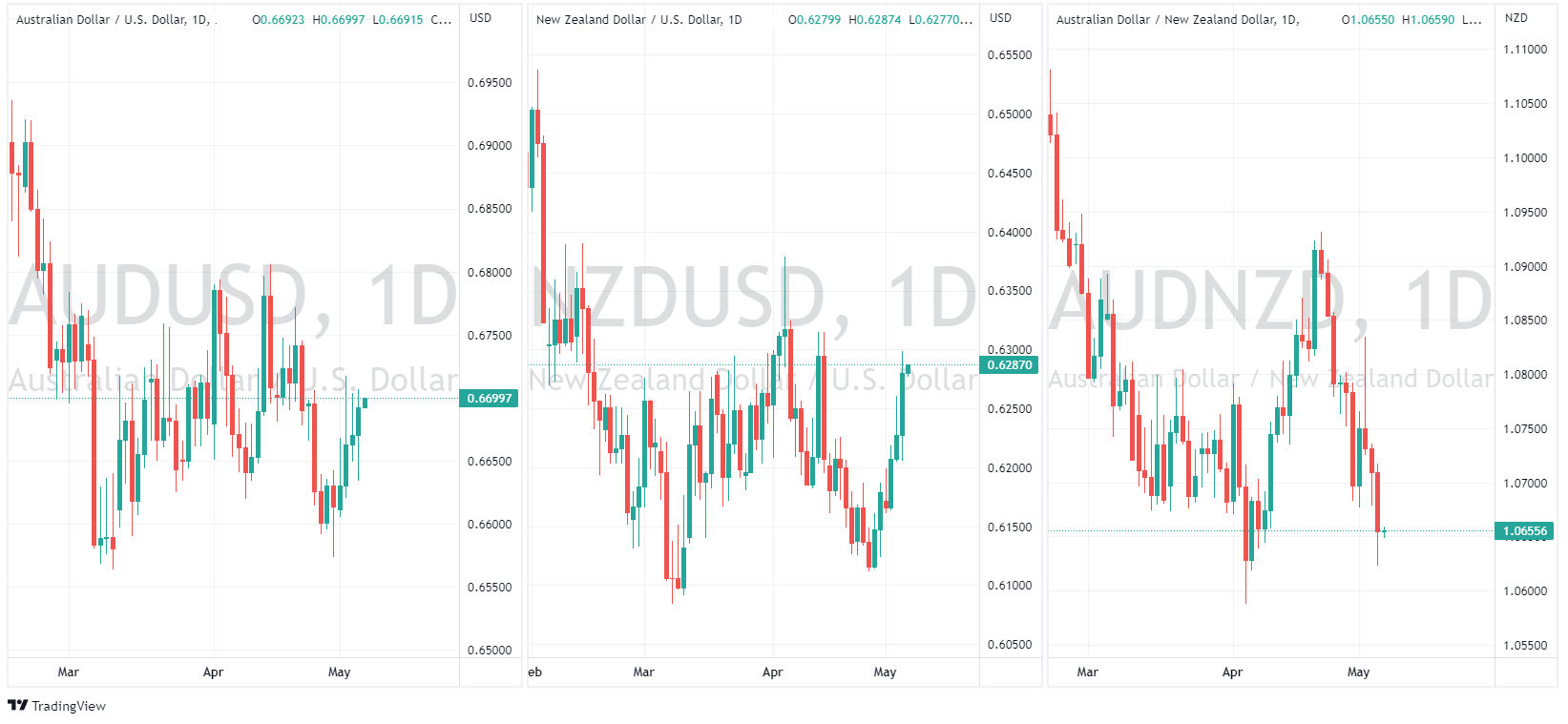

Despite poor risk sentiment both AUD and NZD managed to gain against the USD, with AUDUSD testing the 0.67 resistance level, NZDUSD the 0.63 level. The Kiwi did outperform the Aussie again, with AUDNZD falling below the psychological 1.07 level.

Commodities

Gold kept it’s gains from the breakout move up post PacWest trouble news, haven flows , softer bond yields and continuing concerns about the US banking sector supporting the precious metal, XAUUSD touched on 2060 USD an once, before retracing modestly. Until these banking issues are seen to be resolved, gold is looking to continue this uptrend.

Crude oil finished mostly unchanged on the session, though there was some volatility before it got there with USOUSD dumping, then pumping before drifting back to unchanged. The volatility seemingly caused by comments from Russian Deputy PM Novak saying Russia “abides” by its oil output cuts, followed by bullish commentary from Shell (SHEL LN) CEO said they are getting close to levels of Chinese oil demand last seen in 2019.

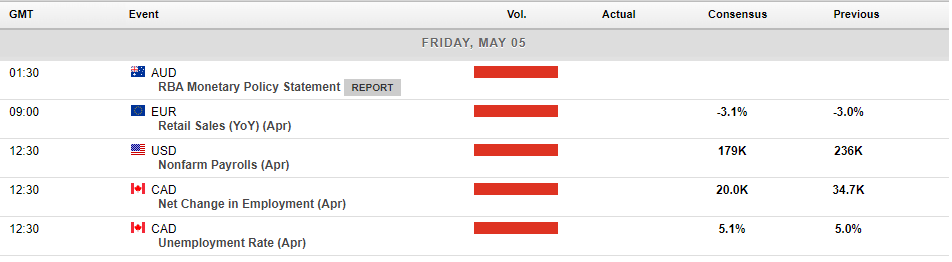

In economic announcements, today’s major risk even will be Non-Farm payrolls released in the US at 12:30 GMT. As always expect some extreme volatility over this figure, especially coming just after a FOMC meeting as markets start to try and price in what the next move from the Fed will be (currently futures showing a 90% of a hold at their June meeting)

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

ECB hikes rates to 3.75%

Following the lead of the US Federal Reserve, the European Central Bank (ECB) announced its decision to hike rates by 25 basis points, taking interest rates in the Eurozone to 3.75% overnight. In the lead-up to the ECB meeting, there was some market speculation for a potential 50bps hike, which saw the EUR/USD trade to a 12-month high, reaching the...

Previous Article

Apple posts strong results

World’s largest company Apple Inc. (NASDAQ: APPL) announced the latest financial results after the market closed in the US on Thursday. After disap...