US stocks surge on bounce in regional banks and debt ceiling optimism

18 May 2023Major US indices finished solidly in the green in a broad rally as risk appetite returned to the market amid optimism debt ceiling negotiations and a reassuring update from regional bank Western Alliance (WAL) which reported growth in its deposits. The Dow was up over 400 points, or 1.24% while the Russell 2000 outperformed, up over 2%, flying on a tailwind of the recovery in regional bank stocks which saw KRE (regional banking ETF) surge over 7%.

KRE chart, 7% rally in Wednesday’s session stalling at a key resistance level:

FX Markets

USD was bid despite the risk on trading conditions, although this did seem to put a limit on the Dollar’s gains, while the move higher in UST yields capped a further pullback. The Dollar Index rose to highs of 103.12 before paring beneath 103 and hovering around 102.85 throughout the latter part of the session.

JPY, and other traditional haven CHF, were weaker against the USD as risk appetite returned with the surging US equity market. The move higher in US yields and strong jump in equities was the primary driver of the moves in the Yen which has benefitted greatly recently from haven flows and lower US yields.

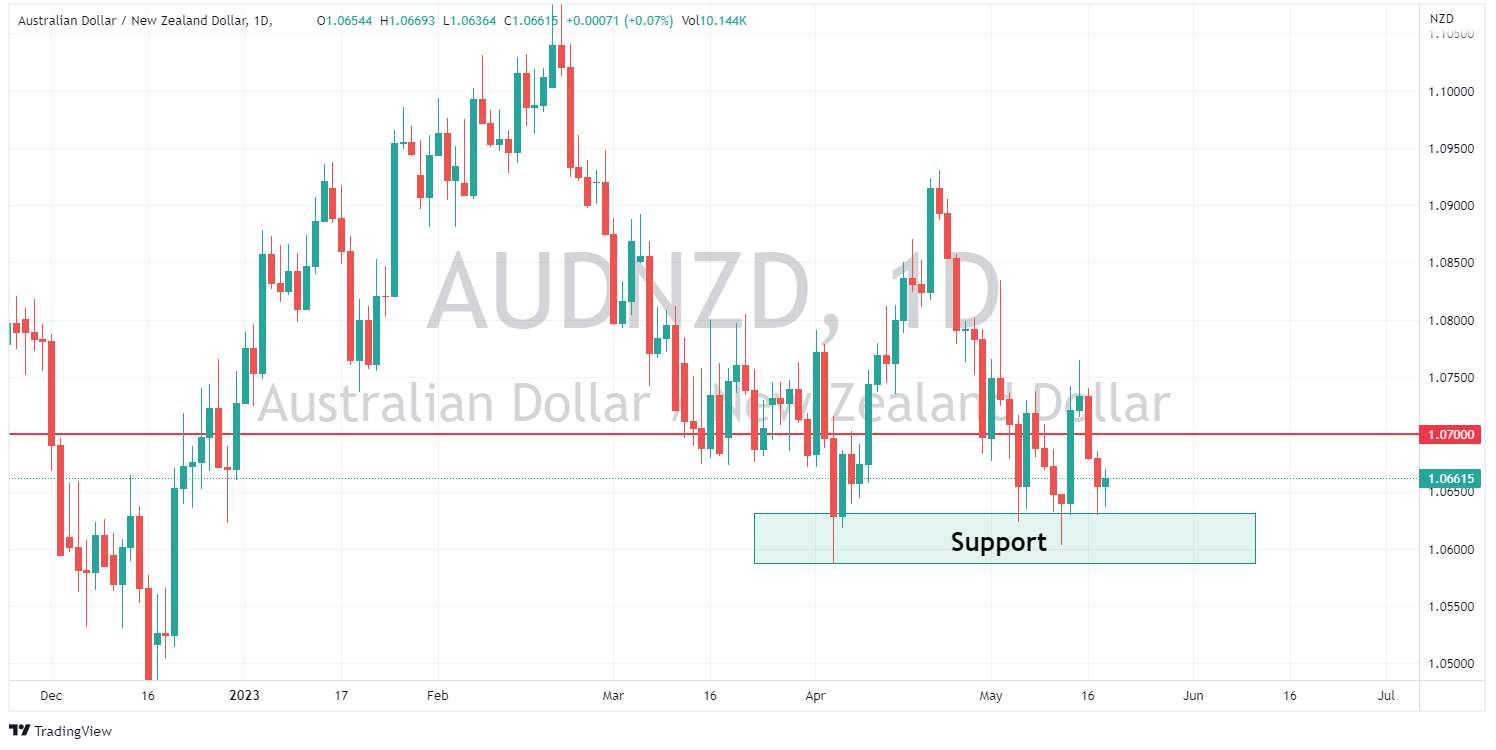

Cyclical currencies, AUD and NZD benefited from the risk on mode of the market, both making gains against the USD. The NZD outperformed after ANZ hiked its terminal rate forecast for the RBNZ to 5.75% by July, while it also sees a 25bp hike in June but sees a 20% probability of a 50bp hike. This saw AUDNZD further decline, pushing down to a low of 1.0630 and testing its recent support zone before bouncing modestly.

Commodities

Gold – a perfect storm of a stronger USD, Risk appetite and higher US treasury yields saw XAUUSD dump, breaking through the 2000 support level, and testing the major support level at 1975 before finding any buyers. 1975 was the bottom of the XAUUSD tight range we saw most of April and is a major level to watch.

Crude Oil soared in Wednesdays session, despite a big crude build, as debt ceiling anxiety waned and risk on returning to the market spurred growth hopes, USOUSD breaking it’s upper trend line to rally to a 73 handle before pulling back.

Today’s economic announcements see to important jobs reports, first up is the Australian April employment figures at 11:30 AEST. The unemployment rate is expected to hold steady at 3.5% while jobs created is forecast to come in at 24.8k. AUD and ASX volatility expected.

Later in the session US unemployment claims will be released where a drop to 253k from the previous 264k is expected.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Market Analysis 15-19 May 2023

XAUUSD Analysis 8 – 12 May 2023 The gold price outlook is generally positive in the medium term. Although the close of last week's sell pressure bar indicates a significant loss of buying momentum, due to the sell-off during the week but the price is still moving above the 2000 support level after a rebound to test and then rebound. It...

Previous Article

Target beats estimates – the stock is up

Target Corporation (NYSE: TGT) announced Q1 financial results before the market open in the US today. The company posted solid results beating reve...