Final Quarter of 2018

2 October 2018

STOCK MARKETS

Investors have been entertaining the idea that the equity markets will outperform in 2018. After a stellar year in 2017 without any major pullbacks that often accompany rallies, bulls were confident on the global economic growth and robust corporate profits. The dynamics have since changed as protectionism measures, and a hawkish Fed kicked-in altering the spectrum of the buoyancy.

Trade noises have been the primary downside risk for the equity markets for the last two quarters. The performance of the stock markets across the different regions has been mixed. Despite being taken on a roller coaster ride, the US markets have remained strong supported by robust fundamentals and corporate earnings and have also seen a few record highs in the third quarter while the European lagged behind.

The Asian and Emerging markets were hit the hardest as trade tensions triggered a massive sell-off. There is a slew of reasons behind the vulnerabilities in those markets, but as trade became the real concern, investors panicked and sent the Chinese stocks in a bear market which revived fears of an emerging market contagion.

Quarter 4: Are there any signs of optimism?

Another round of tariffs in Q3 will likely affect sectors that were so far insulated from trade noises. Investors will remain wary in challenging all-time highs amid the current trade outlook.

However, the US stocks have lots of potential and optimism and should continue to climb through the fourth quarter but rising U.S budget deficit, heightened trade tensions, tightening monetary policy, an upcoming mid-term election and a threat of a yield curve inversion are the downside risks that will definitely take the bulls on a bumpy and challenging ride.

The fiscal risks in Italy and ongoing Brexit jitters are doing little to convince investors to put their money in the European markets. In the Asian and Emerging markets, it is too risky to try to “buy the dip” as fundamentals are still weak even though there has been an improvement recently. Investors will probably await for more concrete catalysts before stepping in to buy Asian equities again.

Even though the US markets have been favoured, the most significant headwind will be the November mid-term elections amid trade tariffs and rising interest rates. It is also worth noting that strong corporate earnings were mostly due to the tax cuts which only provide a short-term benefit.

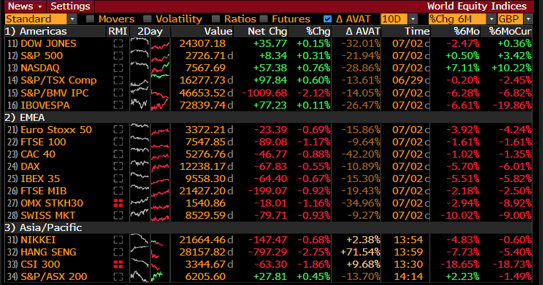

World Equity Indices- % Change (A sea of red for the first half of the year 2018)

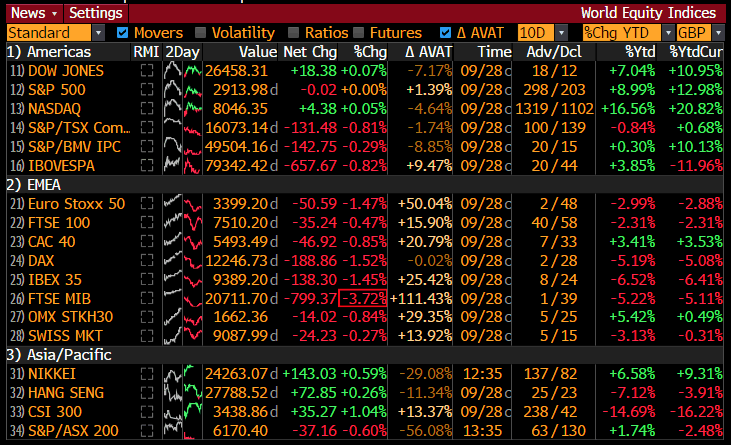

World Equity Indices- % Change (Year to Date 2018)- An improvement in the third quarter

Source: Bloomberg Terminal

CURRENCY MARKETS

Will the US dollar continue to rise is the main question at the forefront of traders’ mind as we entered the final quarter of the year 2018. In Q2, the US dollar buoyed and appreciated against the G10 currencies nearly all of the emerging currencies. The dominant driver was the policy divergence of the Fed compared to the other central banks. During trade uncertainties, the greenback also emerged as the safe-haven currency.

In Q3, trade tensions escalated, but markets appeared to come to terms with the consequences, and the currency markets swung from risk-off to risk-on sentiment given the fragility of risk appetite. Overall, the bid momentum of the US dollar eased, and other major currencies started to rebound while some emerging currencies like the Turkish Lira and Argentina Peso fell in the bear market territory.

Unfortunately, other bearish factors aside from the interest rate differentials prevent major rival currencies from advancing significantly higher against the US dollar. Those factors are likely going to carry through in the fourth quarter.

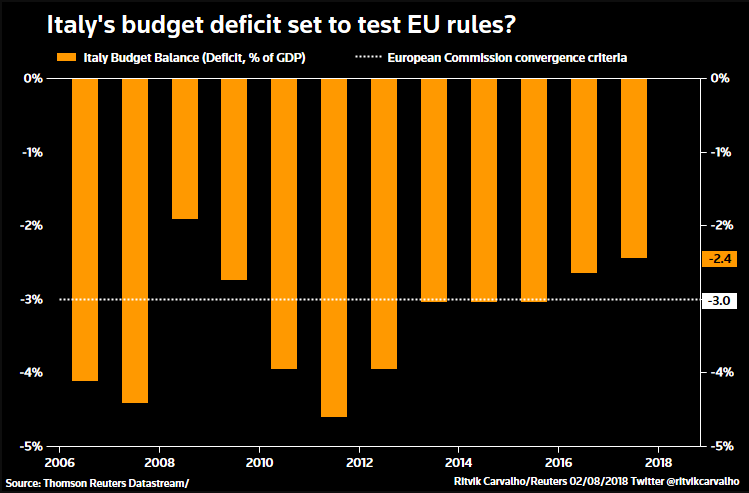

Euro: Trade concerns, Italian budget risks and Brexit uncertainties are the few issues that are putting bulls on edge. Italy proposed a deficit of 2.4% of GDP to spend on promises of the ruling parties; lowering the retirement age, cut taxes, invest in infrastructure and boost welfare. The deficit is definitely below the 3% EU deficit ceiling, but the EU was hoping that Italy will reduce its deficit to curb its massive Italy has the second largest public government debt pile in Europe after the Greeks. The debt to equity ratio in Italy currently stands at 131.81% of its GDP, and market participants are questioning whether Italy will be able to repay its debt.

Italian Finance Minister Tria has been seeking for a 1.6% deficit, and the lift in debt prompted a sell-off of bonds while the euro slumped. Rating agencies initially postponed their outlook to consider the fiscal plans. All the attention will now shift to the rating agencies. Aside from those risks, the Euro was more stable in Q3 and appear to be somewhat biased on the upside, but trading will likely be choppy.

Sterling: The Pound has proved resilient recently on the back of reliable data and positive Brexit news. However, Brexit concerns are back on the table as Theresa May’s own party members join EU in rejecting her Brexit plan and are suggesting that her own time in office is limited. After a flurry of resignations and fighting her party for the Chequers plan, its rejection by the EU left the Prime Minister in an awful Brexit headlines will stay the primary driver of the Sterling pairs in the fourth quarter.

Antipodeans: AUD and NZD pairs were amongst the worst performers against the greenback in the G10 currencies. AUDUSD has been trading in a bearish channel since the beginning of the year. NZDUSD is also trading in a downtrend. Subdued inflationary pressures and a dovish central both are weighing on the Antipodeans. A lack of key positive catalysts is preventing the currencies to make a clear break to the upside.“Policy divergence” and “Trade Tensions” remain the factors engulfing the FX markets and will probably continue to do so in the final quarter. As of writing, news on a new trade deal between the US-Canada-Mexico emerged and lifted the Canadian dollar.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Top 5 Oil Exporters In The World

There has been quite a lot of talk about oil in the news recently with some analysts suggesting the price could reach $100 per barrel, which would be the highest since 2014. Whether that will happen, that is another story. In this article, we take a look at world’s largest crude oil exporters. Saudi Arabia Saudi Arabia is the world’s largest c...

Previous Article

The Most Traded Currencies In The World

The Forex market is the largest in the world with around $5 trillion average daily trade volume. It dwarfs the daily trade volume of the New York (N...