Another Blow to the Emerging Markets

15 August 2018Emerging Markets (EMs) are being dragged down by the deepening crisis in Turkey. The collapse of the Turkish Lira has rattled the financial markets, ripped through the emerging FX markets and brought down the stocks markets at the start of the week.

Fears have gripped the EMs over various issues at once. EMs have received not one but several punches over the past few months, and are currently navigating in a challenging environment. This wobbly emerging market situation is forcing investors to remove their funds and go elsewhere.

The buzzword “contagion” is back on the minds of investors. The plunge of the Lira is forcing investors to consider the other instances where an emerging currency was able to pull down the global markets.

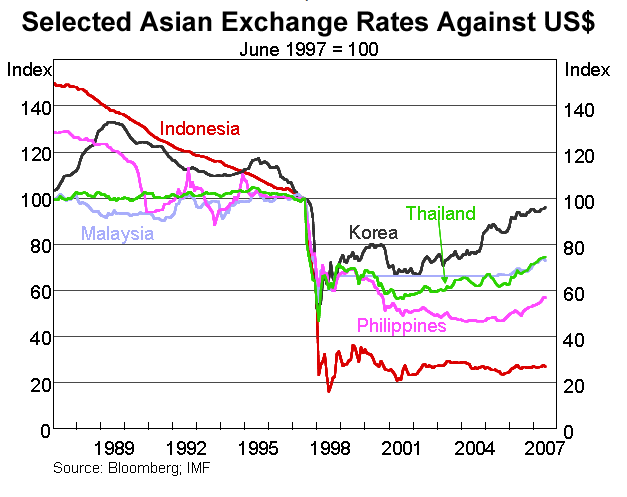

Asian Crisis (1990s)

Back in 1997, the crisis started when the Thai baht collapsed as it was forced to float on the exchange rate which in turn increased the country’s foreign debt burden. The financial contagion had spread across other emerging economies causing a “tsunami of devaluations” and had created fears of a worldwide economic meltdown.

At that time, nearly all Asian countries were pegged against the dollar and the scale of dollar borrowing was high as well. Some argued that the “Asian crisis” was a “Banking crisis” whereby the Asian economies took on too much foreign currency risks.

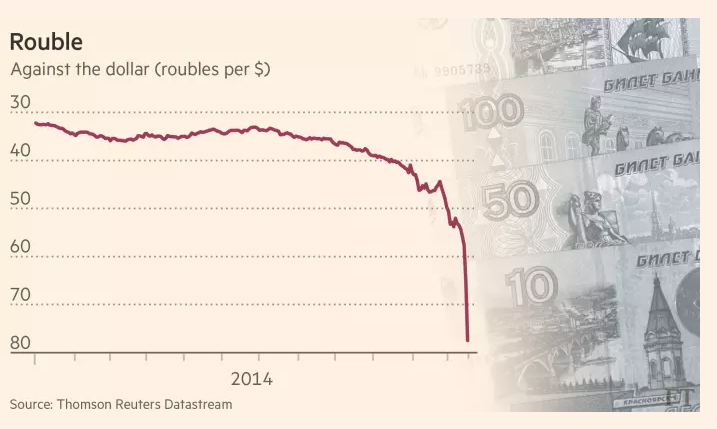

The Rouble Rout (2014)

A loss of confidence in the Russian economy and a fall in its oil exports had led to a decline in the value of its currency. The financial crisis was then further fueled by economic sanctions, which were placed upon Russia by developed countries as a result of Russia’s military intervention in the Ukraine. Fears that the recession in Russia could see money leaving out of emerging economies to more developed countries created a similar chaos in the markets.

The Rouble Rout was not a repeat of the Asian crisis as the emerging economies had learned from its lesson; Nevertheless, it had the same rhyme.

Turkey’s currency crisis

Turkey’s meltdown revived those fears and created panic across the global markets. The sudden fall of the Lira and the strength of the dollar have triggered a bloodbath in the EMs. The financial crisis in Turkey should not be looked at in isolation when analysing the current negative outlook in the markets. However, given its strong correlation with other emerging currencies, the turmoil in Turkey has prompted a deeper slide in the markets.

- Trade Tensions

The sell-off started by the US-China trade tensions incited a sudden reversal in the markets. The MSCI Emerging Market Currency which measures the return of major emerging currencies relative to the US dollar peaked at the beginning of the year to tumble following trade tensions. The index was at its strongest level at a time where EM assets rallied, commodity prices rose and there was a broad growth despite an environment of rising interest rate in the developed countries.

- US Sanctions

A series of US sanctions on several EMs at the same time is creating panic as investors are analysing the effects of those sanctions on the global economy and are taking positions accordingly. However, the goal of imposing the sanctions might not mitigate the impact of the new sanctions on global financial markets.

Gripped by trade and geopolitical risks, the emerging and developed markets are facing the power of a strong dollar. The US economy has strengthened, fundamentals are robust and the Fed is tightening the monetary policy. Therefore, countries with a large international debt positions will likely see their currencies weakened.

We have seen the sudden shift in the dollar and how the emerging and G10 currencies are performing against the US dollar. The “strong US dollar story” summarises the current trading environment in the currency markets. The effect of the plunge of the Turkish Lira rippled through the markets bringing down major developed and emerging currencies.

In the last 48 hours, we have seen anxieties building up and investors flying to safety to US denominated assets. Given that the situation in the EMs appear to have worsen, traders should be cautious when betting on EMs amid the plunge.

Investors will likely look for the immediate next line of fire and draw conclusions whether it is more than just a Turkey crisis. They will have to re-evaluate emerging assets compared to a strong dollar and a hawkish Fed.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

NAFTA Update – Have US Negotiations Progressed?

It’s been one year since the trade renegotiations on the North American Free Trade Agreement (NAFTA) between Canada, the United States and Mexico began. Since then we have seen tough rhetoric on how the agreement should look like moving forward from each country, especially the United States. But are we finally getting closer to an agreement? Ab...

Previous Article

No Turkish Delight – Is A Currency Devaluation Of 40% Justified?

Most political scientists believe that all problems in the world are related to politics, and most economists believe that all problems are rooted in ...