Buying entry forming on EUR/NZD?

28 October 2022The EUR has been rebounding strongly on the back of being sold off for much of the year. With inflation at record highs and a cost of living and energy crisis, the currency has become extremely weak, even dropping below parity with the USD. However, in recent week, the EUR has begun putting in a bottom. The ECB last night decided to raise their official rate by 75 bps. which along with a dovish statement caused a sharp drop in the EUR.

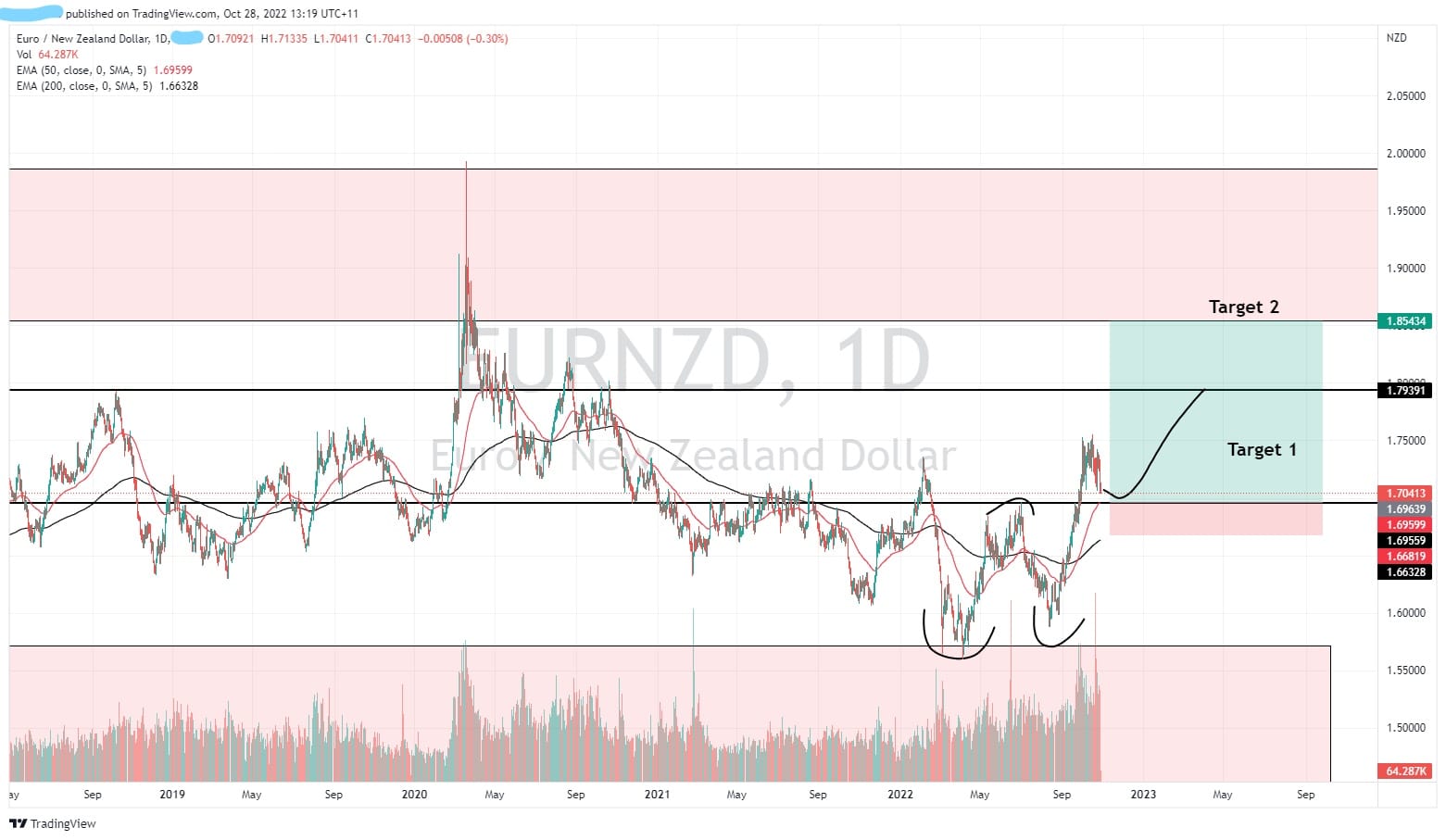

On the weekly chart, the price has largely been in long term range with some exceptions relating to large economic events. Although, the price has been known to spike at various stages of economic volatility. The chart shows that the price has been quite choppy between the range of 1.4000- 1.8500.

The daily chart shows a potential double bottom that has been forming. The two bottoms are near 1.5700 and the neckline at approximately 1.7000. The price already broke through the neckline and is nearly ready to retest the area as support. If the price can bounce off the neckline, it may have a primary target at 1.80, and then a secondary target of 1.8500. Waiting for ether a strong rejection candle or a consolidation near the neckline may provide a significant risk reward of near 3.5 or higher.

With inflation data the ECB still providing important information there may be some headwinds for the EUR as the region continues to deal with inflation.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

The Week Ahead – The Fed takes centre stage along with the RBA and BoE in a data heavy calendar

With the bulls fully in charge, global markets head into the first week of November with one of the most important economic calendars we’ve seen this year to look forward to. Risk-on has certainly been the narrative in October so far, with the Dow Jones index surging 5.89% last week, up 14.4% for October and on track, coming into its last trad...

Previous Article

Why you need to be aware of Stop Loss Hunting

Stop loss hunting is frustrating, annoying and can be detrimental to any retail trader. The premise of stop hunting is that large systemised...