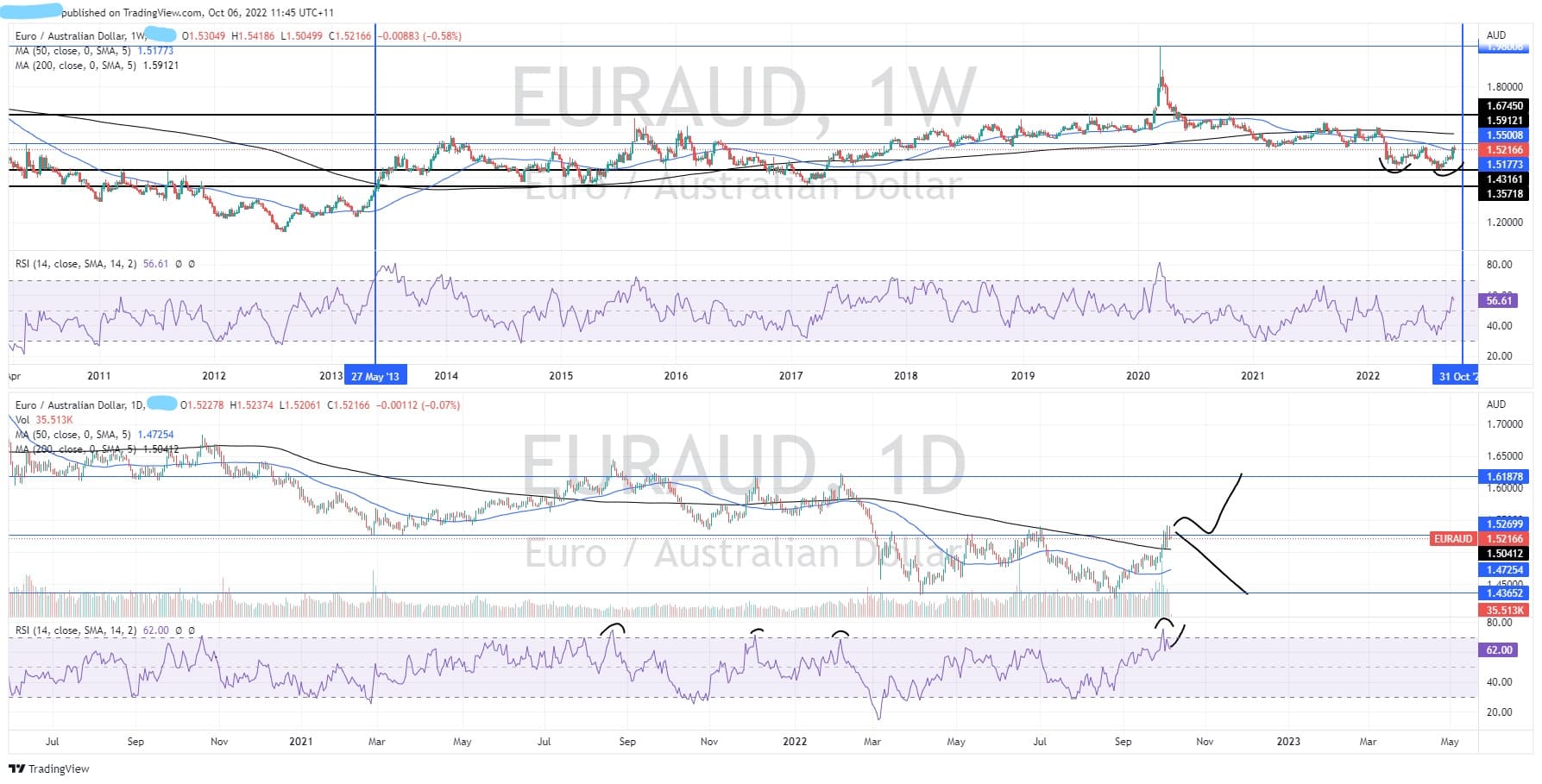

EURAUD testing mean of long-term range

6 October 2022The EURAUD buoyed by a weaker Australian Dollar lighter lighter monetary policy from the Reserve Bank of Australia, (RBA) has seen the currency pair move with some momentum in recent days and weeks. The RBA came out in its most recent meeting and raised rates by an unexpectedly low 25 bps vs 50 bps. This helped equities and housing stability but pushed the AUD to very lows levels. The Euro on the other hand has suffered with geopolitical conflicts and recessionary pressures that have hit major players in the Union. With Germany in particular suffering quite large inflationary issues putting severe pressure on the EUR. After to dipping to as low as 1.42 AUD in both April and August this year, the pair has been able to move back into the major range that the price has been holding since 2013, excluding the commencement of the pandemic.

Technical Analysis

The weekly chart as discussed above highlight that this pair does not usually trend and if it does trend it tends not hold the trend for very long. Rather the price tends to hold a range with breaks of range usually the outcome of extreme economic events such as the GFC or the pandemic before retreating into the range. The weekly chart also indicates that the price may be ready to reverse back up as seen by the double bottom pattern that has formed. The neckline needs to be broken by the price at 1.54 for the pattern to be confirmed. The question is whilst this price is showing signs of a reversal, the price is sitting just on a significant resistance area.

The daily chart shows an interesting case for either a breakout or a breakdown. Firstly, the price has so far not broken out completely and is still consolidating at the neckline. In addition, the price is overbought to a high level and on previous occasions when it was this overbought, it has fallen back down. However, it is possible that the RSI is also just consolidating and getting ready to breakout. This chart needs a little bit more time to be sure of a direction, however a potential long target if it breaks out to the long side could be 1.60 and to the short side if it fails could be 1.42.

With economic still to flow for both Australia and Europe the EURAUD is definitely one to keep an eye on.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

US stocks dump and pump as strong data cools Fed-pivot hopes

US equities declined after a record two day winning streak, a volatile and choppy session ultimately ending with the S&P500 down 7.65 points (0.2%) The Nasdaq (NDX100) saw the biggest swing, from down almost 2.5% at the European close, all the way back up to +0.5% until a very late session sell-off saw it finish down 0.25% The chopp...

Previous Article

Risk on continues as equities, Bitcoin and commodities pump, USD dumps

Q4 has continued with a bang in Tuesdays session with US stocks posting their biggest two day gain since April 2020 and the best start to a quarter si...