Opportunities await trading the JPY

31 August 2022With central banks aggressively hiking interest rates to combat inflation, one specific country stands alone in maintaining a dovish stance. The country is Japan, and the consequence of the Central Bank of Japan’s ultra-dovish policy has been a massive weakening of its currency. Against almost all other currencies the JPY has been depreciating aggressively. Specifically, the USD/JPY and the NZD/JPY are shaping as potentially trading opportunities. Both trading opportunities are largely based on a technical breakout as opposed to a pure fundamental breakout.

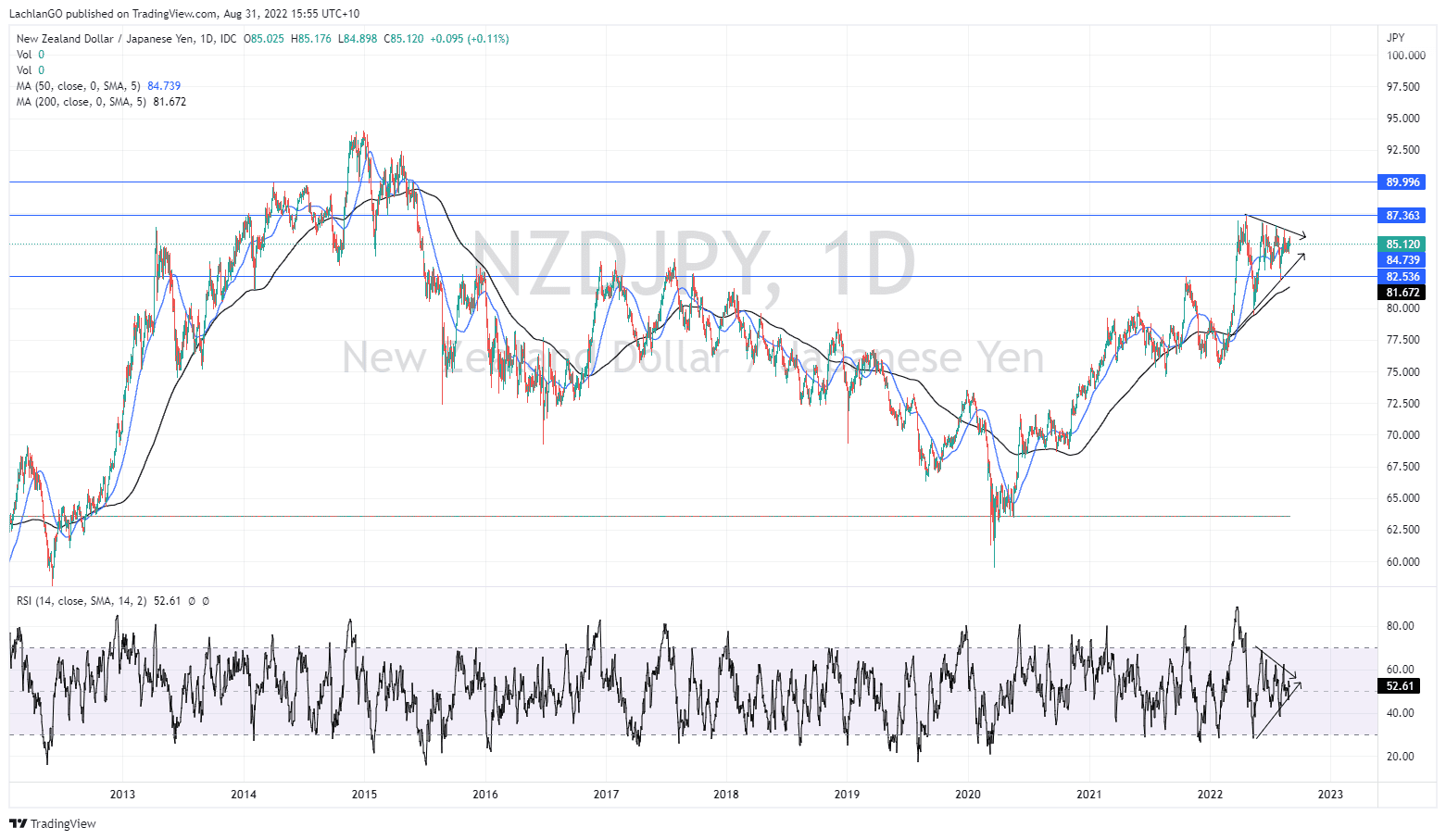

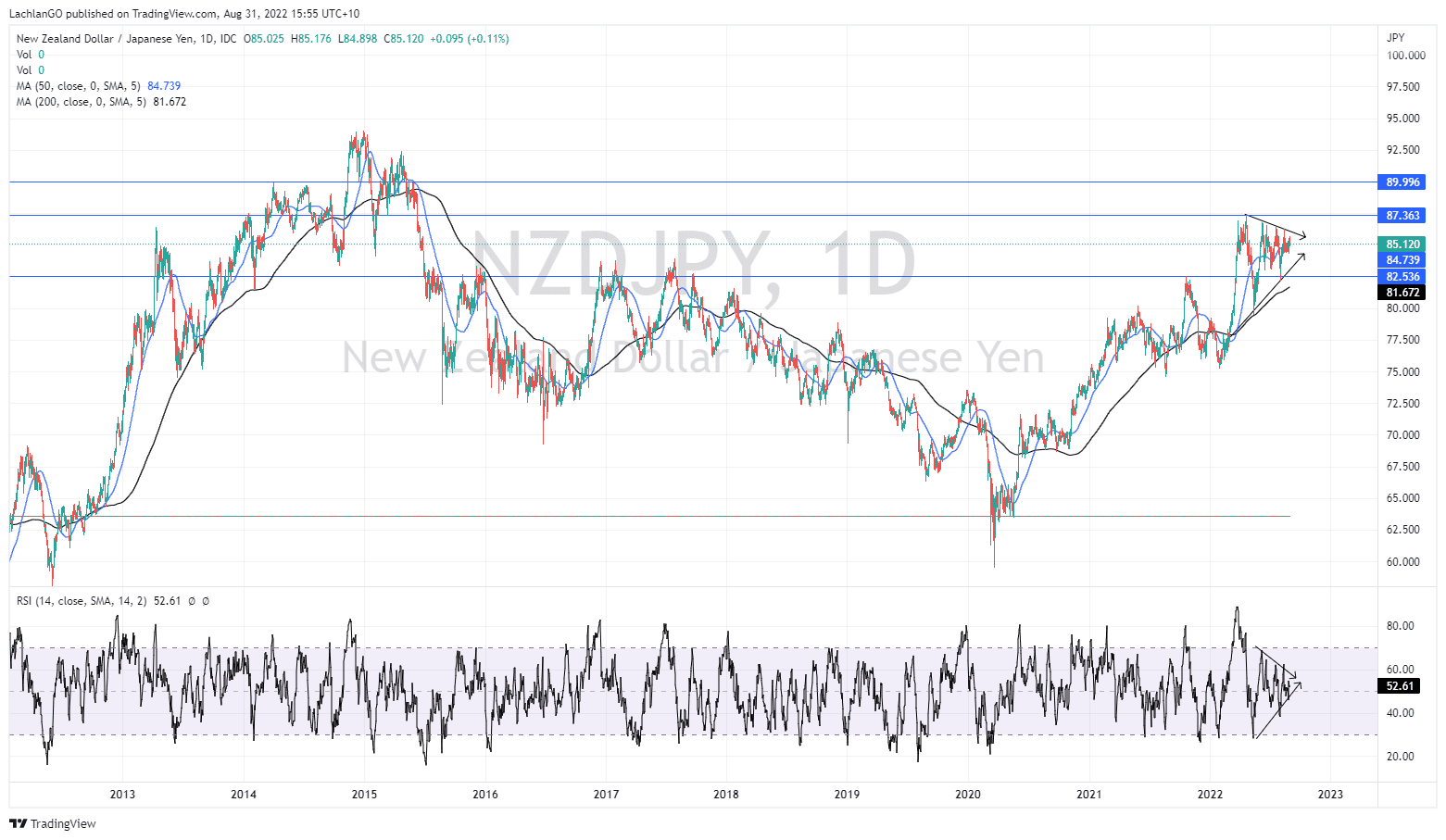

NZD/JPY

This currency pair is forming into a symmetrical triangle pattern. Importantly the price has been contracting and the range getting smaller. This shows that the price is reaching an equilibrium point between buyers and sellers. However, at some point and the price will not be able to contract further and will have to break out either to the upside or the downside. The general rule of a symmetrical triangle is to wait until the price breaks before taking a position because the price has not indicated if it will break upward or downward. In addition, the RSI indicates a similar pattern showing consolidation in the same type of triangle. Therefore, a break of this RSI triangle may correlate and support a break out on the actual price.

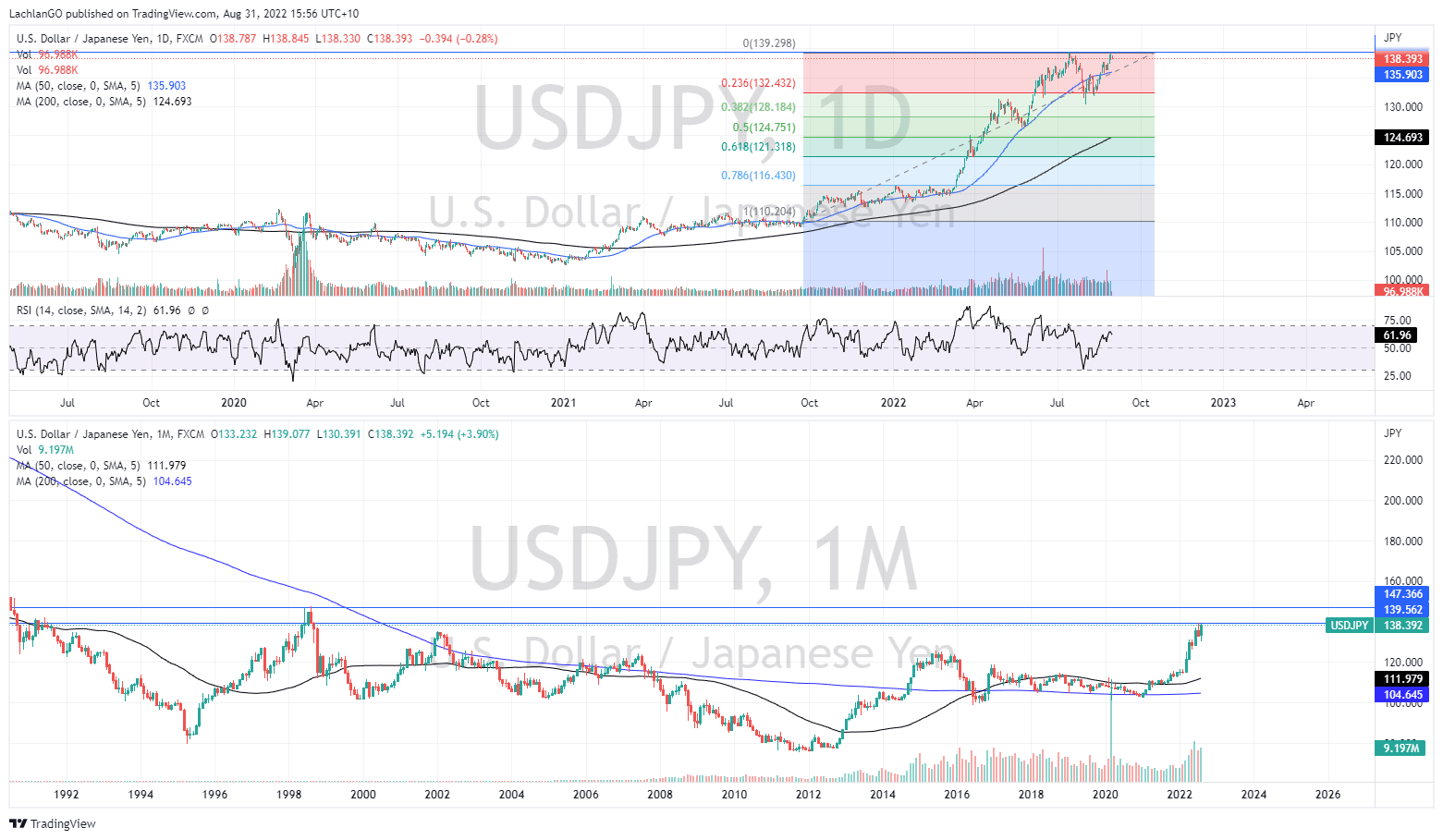

USD/JPY

This pair has seen an even more extreme move upward. After pulling back to the recent support at the 23.6% Fibonacci retracement level, the price has risen again and is looking to test the highs at 139.5 JPY. In order to find a new target the chat needs to be zoomed out to the monthly in order to see the next resistance point which is at 145JPY. This would also take the price to almost 25 year highs. With more economic data to come out of the USA later this week.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

US equities extend losses into month end on weak US job data and hot EZ inflation

All major US indices were down for a fourth straight session as hawkish rhetoric from Central bankers and persistent inflation continues to keep the markets well in risk off mode. Futures were pointing to a positive going into the session, but hot Eurozone inflation figures and a disappointing ADP employment figure saw markets turn around and se...

Previous Article

What is Fundamental Analysis, News and Fundamental Trading?

Have you ever heard the saying, “70% of trading is in the head”? This is because the markets are mostly moved with sentiment, a good barometer...