Short term break out on the EURUSD

26 October 2022The EURUSD is showing some signs of a potential short term break out on the daily and 4-hour time price charts. This is largely a technical breakout, although it is also supported by a shift in sentiment towards growth assets and away from the USD in the last week.

Technical Analysis

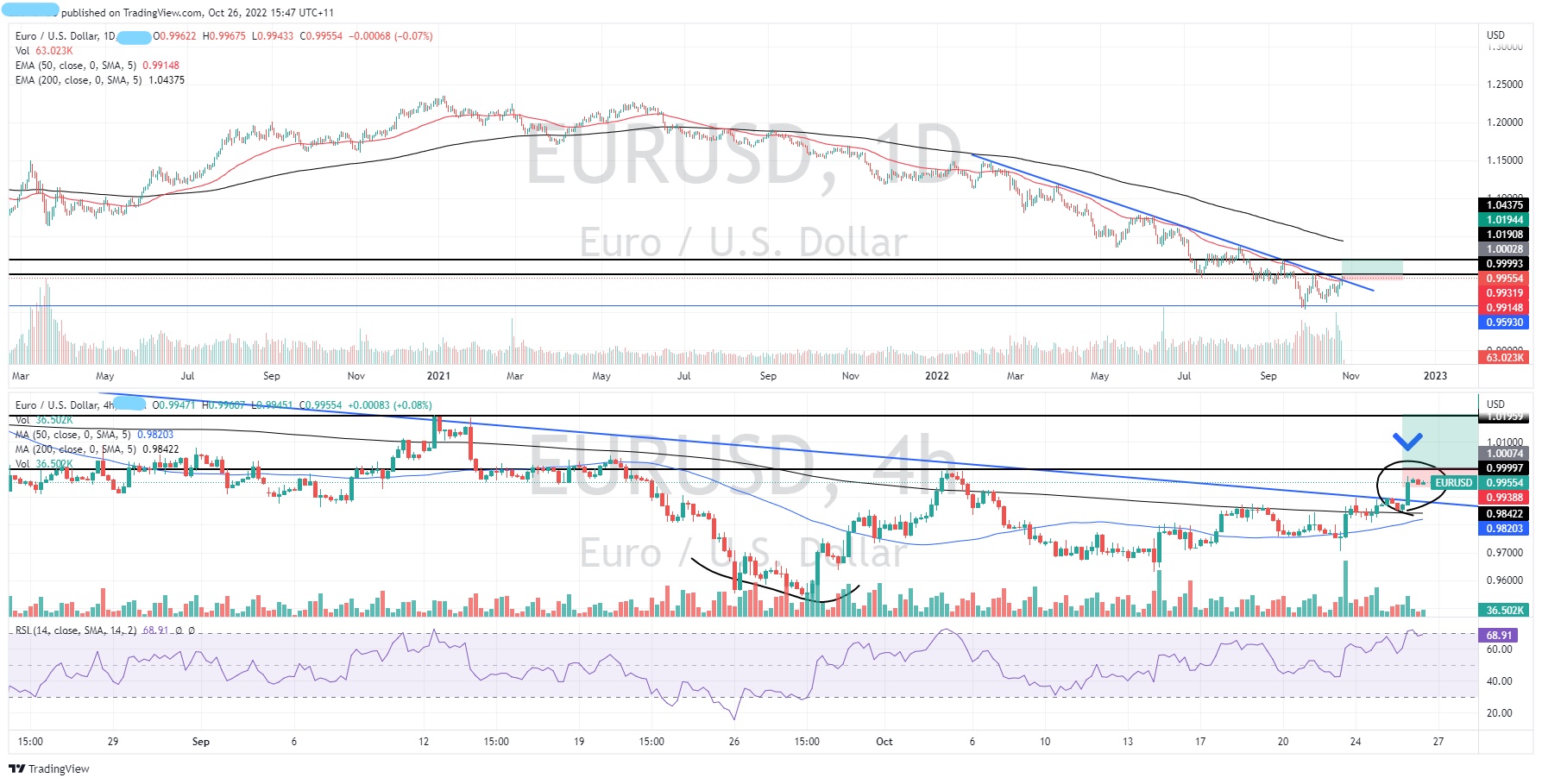

The daily cart shows a long term down trend with the price respecting the trend. On the daily time frame, the price has broken through the trend line. In addition, the price has broken above the 50 period Exponential Moving Average. This represents a short-term support level and a good position for a trailing stop loss or hard stop loss.

Looking at the 4-hour chart provides a more direct profit target and entry trigger. The chart shows that the candle sticks are forming into what may become a flag. An entry based on the current price action may be triggered by a breakout of the flag past 1.000 which is also the parity level. This level also presents as the neckline for a double bottom. This further indicates a potential bottom, or a reversal is about to take place. Using the 50-day Exponential moving average as the position for the stop loss at 0.9914, and the next resistance as a profit target at 1.0200 gives the trade yields a Risk Reward ratio of nearly 2.7.

With volatility surrounding the market being relatively high there is still risks with this trade and traders should be aware of potential macro factors that may impact on the trade.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

CPI figures released for Australia

The Australian Consumer Price Index, (CPI) data was released earlier today with the figures coming out higher than expected. The CPI provides important information about the change in the price of goods and services purchased by consumers, by measuring household inflation and includes statistics about price change for categories of household expend...

Previous Article

US stocks rally during cash session, futures down after market as Microsoft and Alphabet earnings disappoint.

US equities markets had another strong session as a flurry of weaker than expected housing and consumer confidence figures kept the Fed pivot dream al...