- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- USDCHF pair retraces as price level indicates a potential entry opportunity

- Home

- News & Analysis

- Forex

- USDCHF pair retraces as price level indicates a potential entry opportunity

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUSDCHF pair retraces as price level indicates a potential entry opportunity

19 October 2022 By GO MarketsThe USD had a pullback in recent days as equities have rebounded allowing for other strong currencies such as the CHF to see

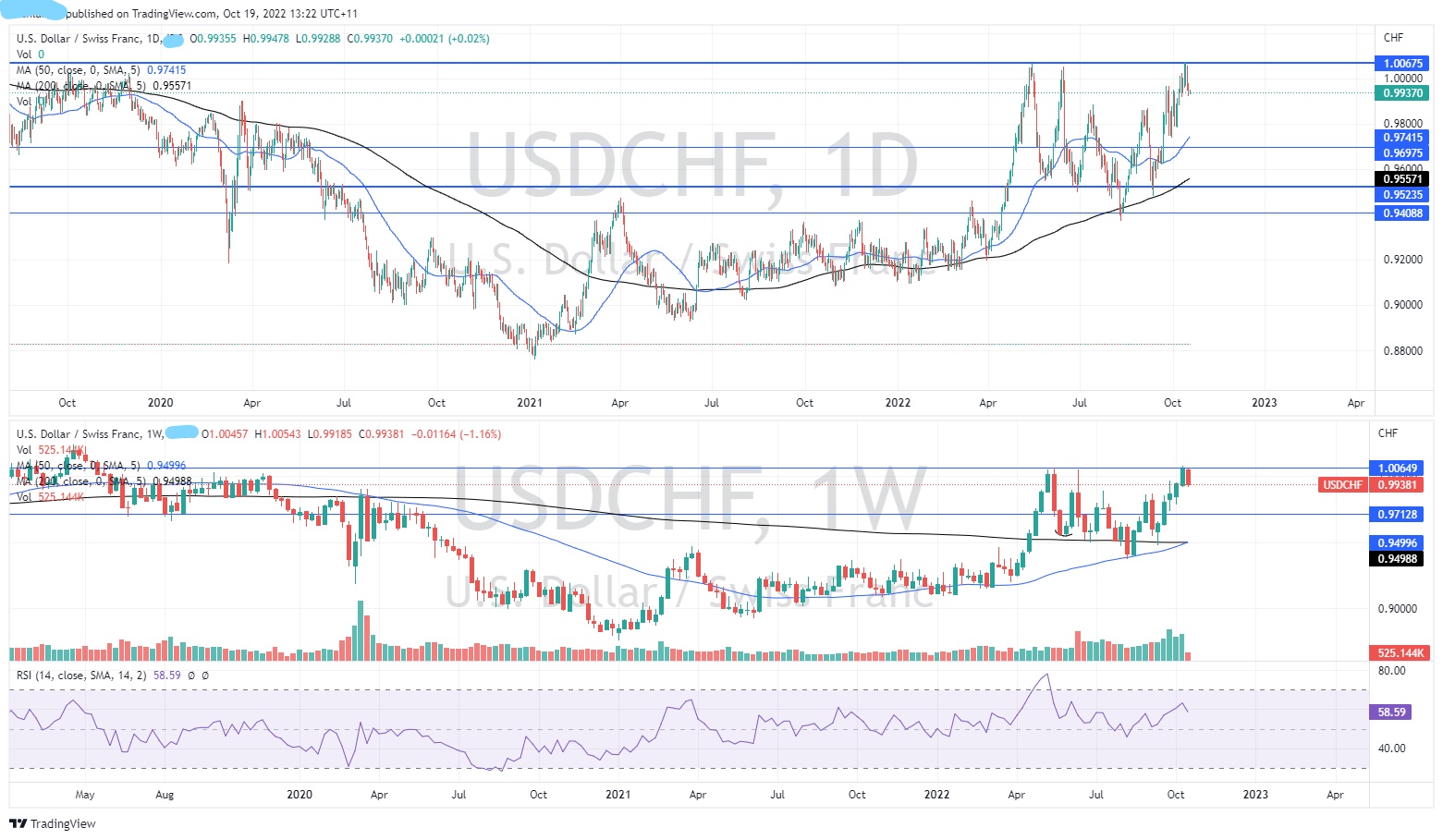

From a technical perspective the chart shows some interesting price action that may indicates an important inflection point for the price. On the weekly chart, the price has been in a long-term range between 0.87 CHF and 1.03 CHF. With the USD being so strong over the last year, the price has been consolidating towards the top of the range. The weekly chart also shows an important pattern forming which is a golden cross. This is when the shorter, (50 week Moving average) crosses over the longer (200 week moving average) which is usually a signal of the Bears taking control. However, looking at past price history this golden cross has not been a particularly accurate indication of a strong rise in price. Rather it indicates just how choppy the price action is.

On the shorter, daily time frame, the price has had a significant sell off to begin this week. Twice, the price has failed to break out of this range, and therefore the price may fall back down to the bottom of the range or at least test the support at 0.98326. If the price can drop lower, it may fall right to the bottom of the range. On the other hand, both prior sell offs involved aggressive red sell candles. In this case there has only been one so far. Therefore, waiting for the next sell candle may provide a good entry signal to go short. Alternatively, if the price can base and consolidate it may indicate that a breakout to the outside is about to occur. With economic data related to inflation still to come, the USD may till rise again supporting a potential break.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Tesla Q3 revenue falls short of Wall Street expectations – price target raised by Bank of America

Tesla Inc. (NASDAQ:TSLA) reported its Q3 financial results after the closing bell on Wednesday. World’s largest automaker exceeded earnings per share (EPS) estimates for the quarter but fell short on revenue. Revenue reported at $21.454 billion (up by 56% year-over-year) vs. $21.982 billion expected. EPS at $1.05 per share (up by 69% year-over...

October 20, 2022Read More >Previous Article

Qantas shares price lift off, but Dividends on hold for FY22

Qantas Airways Limited (QAN:ASX) is the flagship carrier of Australia and the country's largest airline by fleet size. The company has had a resurgenc...

October 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading