New Zealand see unexpected contraction after Quarter figures released

16 June 2022The New Zealand economy took a hit in the first quarter as Covid 19 ran rampant and interest rates rose as the Reserve Bank of New Zealand increased interest rates to combat inflation. The contraction was exaggerated as imports were reduced.

Growth across the country was slowed. Production based output or the GDP fell by 0.2% which was below the analyst’s expectation of a 0.6% increase. The figure was also a substantial level below the 3.0% rise seen in the December quarter. Primary industries drove the decrease. Lower output in the food, beverage, and tobacco manufacturing industry as well as the agriculture, forestry and fishing industries were key reason for the reduction in growth. Housing prices dropped as the rising interest rates began to hit mortgage holders in the hip pocket. Prices dropped 5.6% in the three months to May. The Reserve Bank of New Zealand also tempered its expectations predicting a modest 0.7% increase for the March quarter.

New Zealand spent much of the quarter fighting the Omicron spread of Covid-19. It was the real time the small island country had to deal with a significant covid outbreak. Despite this, domestic travel data remained strong. The country also in a bid to help the travel industry, opened it borders to international visitors.

The Reserve Bank has already raised interest rates five times since October in a bid to stem inflation from getting worse. The Bank also made it clear that slowing down inflation would take priority over protecting the economy against a recession.

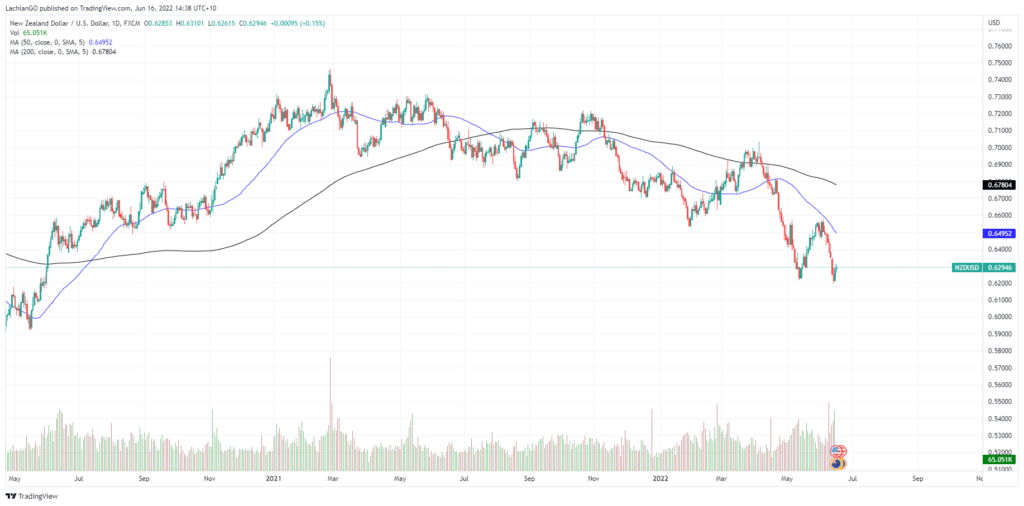

The New Zealand dollar dropped on the news before rallying and is currently buying 0.63 USD. The NZD recovered after the drop before settling. The NZD.USD pair has been in a downward trend since March 2021. It has seen a recent test of the 2-year lows.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Crypto’s week of horror ends in a new 18 month low

As the week comes to an end, many cryptocurrency investors grow increasingly nervous. This emotional sentiment has resulted in bitcoin’s new 18 month’s low price, since December 2020. It has also caused a well known crypto company, Celsius, to suspend client’s withdrawals. Bitcoin started the week at $27,000 USD which was a 10% decreas...

Previous Article

Are ETFs really Passive?

What is an ETF Most people have heard of ETFs but not everyone knows what they are. An ETF is an Exchange Traded Fund and they are extremely popula...