- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Geopolitical Events

- Greece’s Bailout Comes to an End – A Goodbye to the Troika

- Home

- News & Analysis

- Geopolitical Events

- Greece’s Bailout Comes to an End – A Goodbye to the Troika

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAfter eight long years of crisis whereby Greece endured stringent budget austerity programs, the country’s bailout will finally come to an end. Greece will therefore have to finance itself by borrowing on international bond markets.

Before the bailout Greece was battling massive debt, loss of investment and huge unemployment. Nearly €300bn were provided in “emergency loans” in three consecutive bailout packages. A long period of austerity helped Greece to avoid Grexit and started to grow again.

Even though the exit is a big positive “milestone”, Greece is going to remain under enhanced surveillance given the unpopular amount of the bailout.

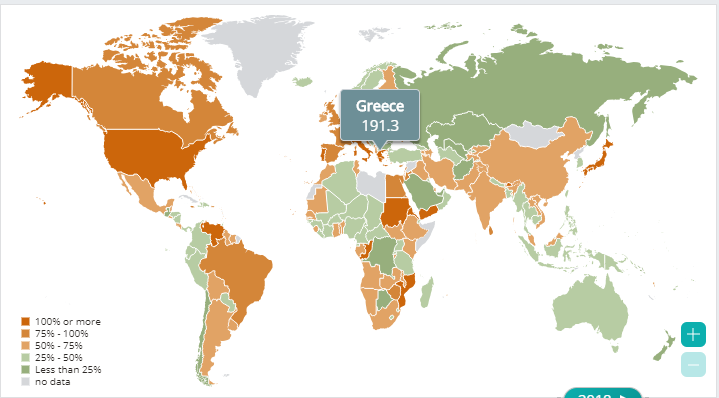

Government Gross Debt as a % of GDP

Source: International Monetary Fund, World Economic OutlookThere are hopes that Greece might be a “success story” just like Portugal, Spain, Ireland, and Cyprus but the debt problems in Europe are far from solved. A huge debt in Greece and Italy will remain the lurking financial threat to Europe.

Net ECB Lending (Greece, Ireland, Italy, Portugal and Spain)

Source: Bloomberg TerminalAside from debt problems, the European Union is also facing other key challenges:

Anti-austerity Government in Italy

The debt problem in Italy has now turned into a political one. The rise in anti-austerity government is a political crisis that calls into question the survival and stability of the European Union and its shared currency. It shows that the Eurozone problems had not be laid to rest.

Brexit

Brexit had elevated fears that other countries might follow the same step which is a crucial threat to the bloc. The recent elections within Europe had revealed a rise in European populist parties. This created a situation that feeds fears that all is not well in the Euro.

Trade Tensions

The EU’s divided union prevents the EU to act in unison to fight the US on trade-related matters. A wobbly European market due to the current trade risks coupled with geopolitical risks are constant threats for the common currency as European members with a fragile economy will suffer.

Investors are indecisive on whether to return which might explain Europe eagerness to paint Greece as a “comeback story”. Greece’s bailout coming to an end is good but it still has a long way to go. Debt problems in Europe remain a big threat and the political situation in Italy is an even bigger issue than Brexit.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

Jackson Hole Symposium: Why Is It Important?

All eyes will be on the Jackson Hole in Wyoming this week, where the annual Jackson Hole Economic Symposium will be held by the Federal Reserve Bank of Kansas City. This years symposium will take place from 23rd until the 25th of August and the topic for the upcoming event will be “Changing Market Structure and Implications for Monetary Policy”...

August 22, 2018Read More >Previous Article

August No Ordinary Month For GBPJPY

As Brexit concerns continue to weigh heavy on Pound Sterling crosses, there's not much to discuss from a technical perspective. Evidence of an overall...

August 20, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading