Oil continued its rise

5 August 2016Upcoming News

» 10:30pm Employment Change – CAD

» 10:30pm Trade Balance – CAD

» 10:30pm Unemployment Rate – CAD

» 10:30pm Average Hourly Earnings – USD

» 10:30pm Non-Farm Employment Change – USD

» 10:30pm Unemployment Rate – USD

The BOE delivered on market expectations overnight with a rate cut to historic lows of .25%. Even though the cut was fully priced in it didn’t help the GBP/USD as it lost over 150 pips post release. Oil continued its rise adding another 70 cents after a very soft Asain session. European stocks had a very strong session backed by the rate cut from the BOE. The FTSE100 increased by 105.76 points in contrast, US stocks had a quiet night in trade. The S&P500 barely changed up by 0.02%.

RBA statement, there are current concerns over the AUD and China. They’re keeping the current direction for the GDP and CPI outlook. Japan’s real wages rose the most in 6 years but this figure is exaggerated by the effect of falling prices. The AUDUSD today has been in one way traffic, buyers have taken it past its .7640 resistance level. Local stocks have been flat and the JPY has been in a tug of war battle throughout the day. The JPN225 started strongly but has been struggling to hold it’s open. AUS200 has been very quiet but is still holding above its short term 5490 support level. The USD has mainly been weaker so far today. Tonight we have average hourly earnings, the non-farm payroll employment change, and unemployment figures coming out at 10:30pm AEST. The market is looking for 0.2 increase in earnings, 180K increase in the employment change and a slight decrease in unemployment to 4.8%. Any big misses in the employment change will cause USD and equity index volatility.

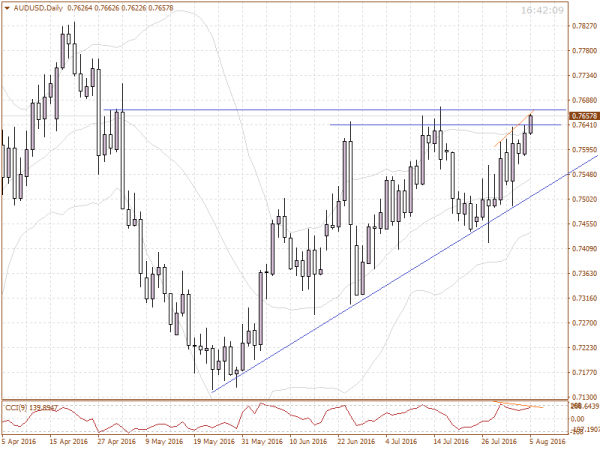

AUDUSD – Another very strong session so far today. We have seen a break out of the .7640 resistance point that goes back to the 24th of June. We have one more clear resistance point to be tested at .7670. For the moment the current uptrend looks very strong. One thing to note, we have had a breakout and divergence is starting to build. No indication a turn is coming but it’s something to keep an eye on.

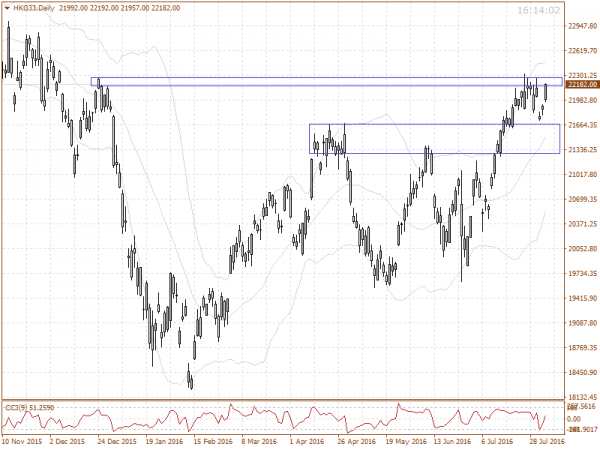

HKG33 – Testing highs closing highs today. A strong rally today has seen prices hit 22175 closing highs. This area lines up with a previous high set in December 2015. A break above 22285 reconfirms the current trends strength. A fail at this area could see a retest of the 21580 to 21320 area.

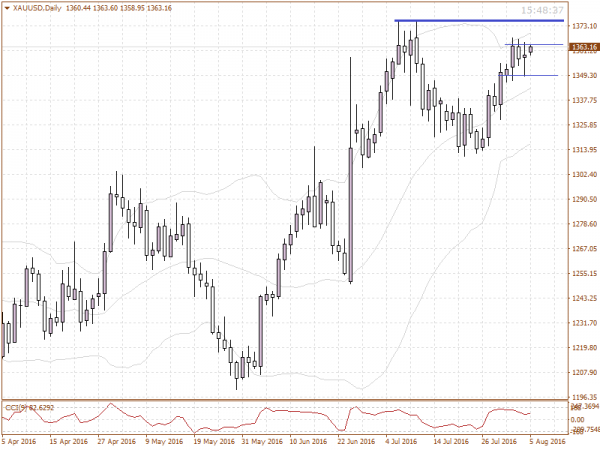

XAUUSD – Buyers have returned after yesterday’s short-term weakness. Yesterday’s reversal was a key in buyer commitment in the short term, but I still see 1367 – 1374 as levels that need to be closed above. 1374.88 has proven to be a turning point and holds significance. Step one in the short term is a move over the current short term resistance seen at 1363.55.

Good Trading.

Please note that trading oil CFDs, Forex or Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. You should only trade if you can afford to carry these risks. Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies. All times are in AEST.

Written by Joseph Jeffriess, GO Markets Market Strategist

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

NAB tips two more RBA rate cuts

Upcoming News » 6:30pm Manufacturing Production – GBP Overnight we saw small drops on the DOW and S&P500, Gold settled around its lows still finding support around 1333.50. Oil rallied higher with hopes OPEC will stabilize supply. The USD was mixed as the AUDUSD tested highs. The USDJPY rallied by 37 pips to test short a term high of 102.55...

Previous Article

Eyes are on the BOE tonight for the rate decision

Upcoming News » 9:00pm BOE Inflation Report - GBP » 9:00pm MPC Official Bank Rate Votes - GBP » 9:00pm Monetary Policy Summary - GBP » 9:00pm...