Wheat Trading Opportunities

26 July 2022Wheat Trading Opportunities

Wheat is a well-known soft commodity that is vital for any kind of bread product. It also has important uses for the feedstock for cattle which is vital in economies with large agricultural sectors. The supply and demand for wheat can be volatile with changes occurring for a multitude of different reasons. The most recent spike in price was caused by the Russian and Ukraine Crisis. The soft commodity saw a large spike largely due to the economic sanctions placed on Russia and supply chain pressures that the war caused in Ukraine. Both countries are large exporters of wheat with Ukraine producing about a fifth of the world’s high-grade wheat and 7% of all wheat across the world. Therefore, the supply shock had a large effect on the supply available driving up the price. Some of the other countries that produce the bulk of the worlds supply include China, the USA, Canada, Australia, and India were able to benefit from the higher prices.

A strong USD

Like all commodities, wheat is quoted in USD. This means that when the USD is strong, the price of the commodity becomes weaker because the producer must sell their produce for less. Due to recent market volatility the USD has risen as investors have looked to the USD for safety. This has in turn negatively affected the price of wheat

The Price of Oil

The price of oil plays a role in the overall price of wheat. This is because oil is an important input cost for wheat. Oil is needed for both the transportation and the actual farming of wheat. As the price of oil increases the costs must then be offset by the wheat producers who then raise their resale price. Therefore, when forecasting what the price of wheat may do in the future, assessing the future of the price of oil can be a helpful tool.

Emerging economies

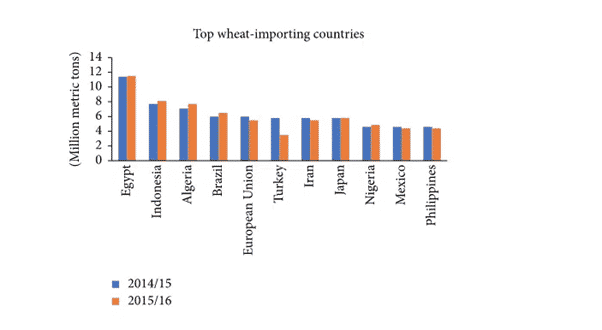

Countries with developing economies tend to be higher importers and consumers of wheat. In addition, countries in the Middle East and Africa import lots of wheat because they do not have an environment that is conducive to producing wheat. For instance, in countries in the desert such Egypt where there is little water, and it is exceptionally dry such as Egypt very little wheat is produced. This explains why Egypt is one of the highest exporters of wheat and if the demand from these countries it would likely impact on the overall price.

Technical Analysis

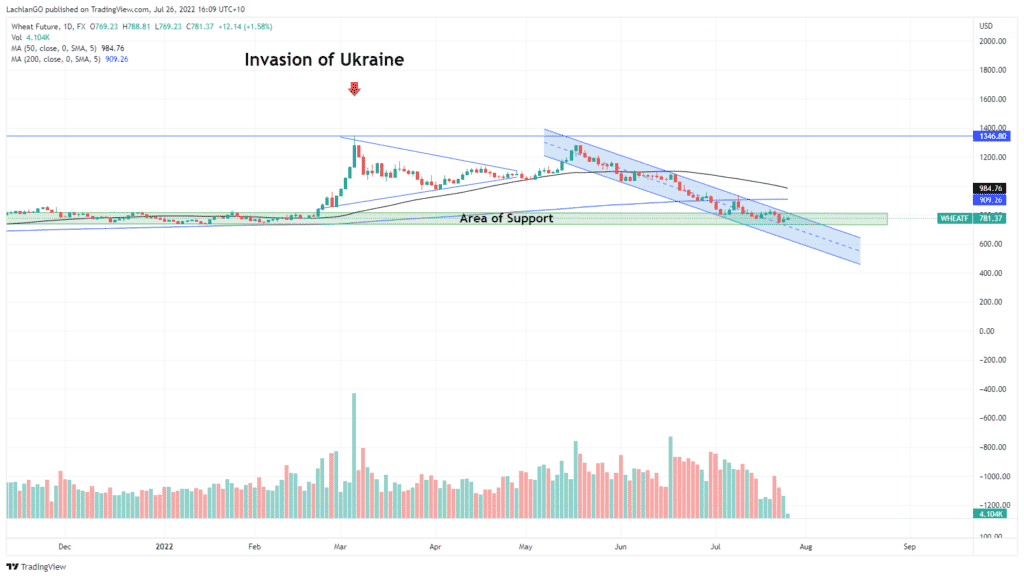

The price chart of wheat tells an important story. It can be observed that the wheat futures initially spiked at the beginning of the war in Ukraine as the market reacted to the initial supply shock. The price then moved into a tight consolidation tightly before breaking out towards the highs. However, this breakout failed, and was unable to rise above the key resistance level at $1354. The price of wheat then entered a downward trending channel where it currently remains.

The price has also broken down below the 200 Day Moving Average which does not bode well for bullish moves in the short term. Before this break down, wheat had not fallen substantially below the 200-day moving average since June 2020.

On the other hand, the price is currently sitting in the top half of the channel. The price may be able to break out of the channel to the upside. In addition, it is also sitting in area of long-term support between 750-850 USD.

Wheat Future Contract CFD’s can now be traded on MT5 on GoMarkets platforms

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Wall St tumbles on recession fears, the Fed in focus

US equities sold off throughout the session in risk-off trading with a backdrop of corporate warnings from heavyweights Walmart (WMT) and McDonalds (MCD) , weak economic figures and a downbeat tone from Europe as their gas squeeze continues. A larger than expected decline in U.S consumer confidence, down for a third straight month, saw the narra...

Previous Article

Tech and Bitcoin drop, Oil and Gas jump in mixed US session

US stocks were mixed in a quiet session, the Dow and S&P 500 eked out small gains whilst against a backdrop of a the Federal Reserve meeting on We...