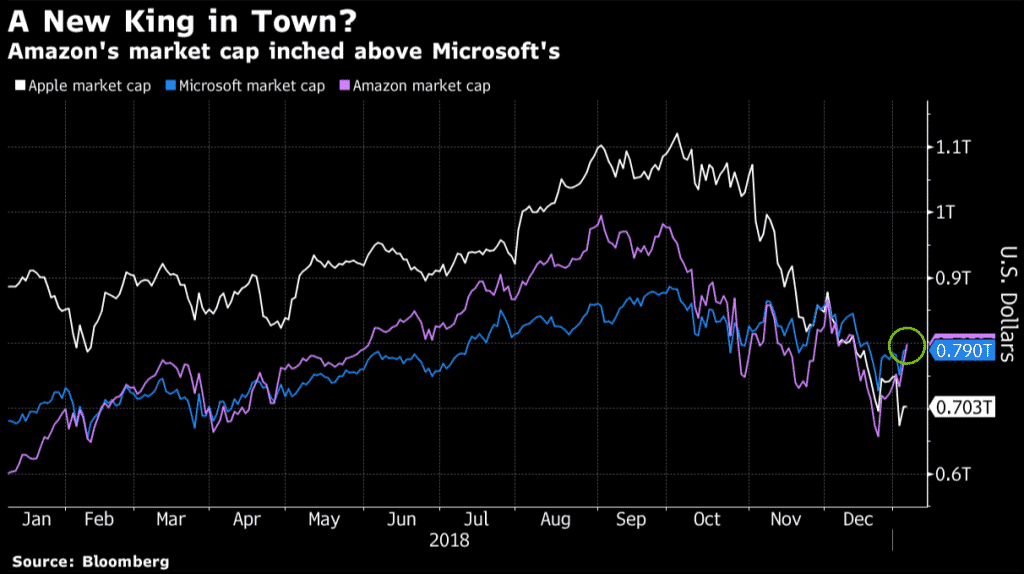

Amazon Acquired Market-Cap Title

8 January 2019

After a turbulent year for the technology giants, Amazon was crowned leader of the technology sector by market capitalisation on Monday.

It has surpassed Microsoft to become the “New King in Town”.

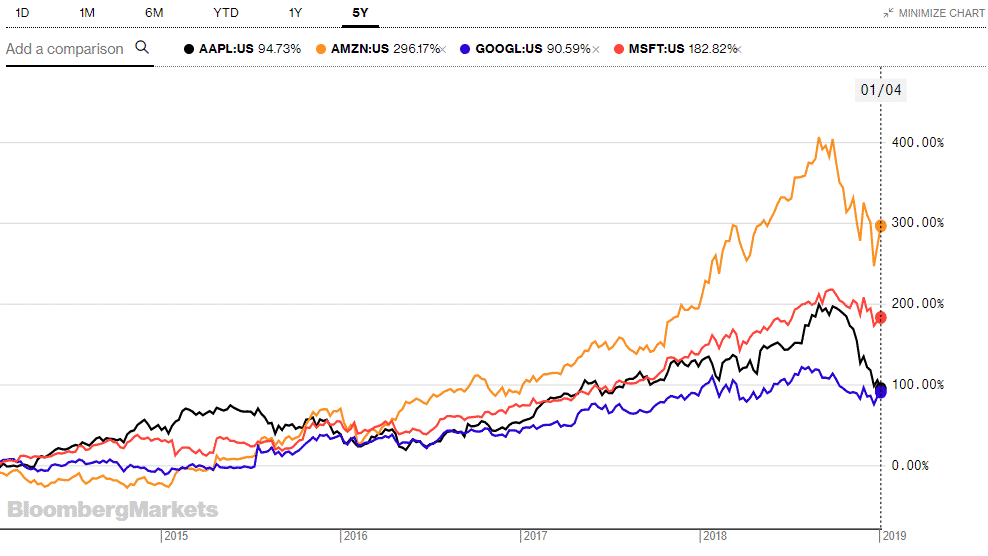

Technology stocks have been the primary driver of the global stock markets in the past decade. The overall performance of the tech sector was outstanding since the financial crisis. However, 2018 has shown us that the tech giants are facing their own unique challenges and went into a freefall.

In September 2018, Amazon reached the 1 Trillion Club (please link words to this article- https://www.int.gomarkets.com/review-of-year-2018/) just over a month after Apple reached the same milestone. Since reaching this historic high, Amazon’s share price has dropped and dipped below the $700bn market cap in December 2018.

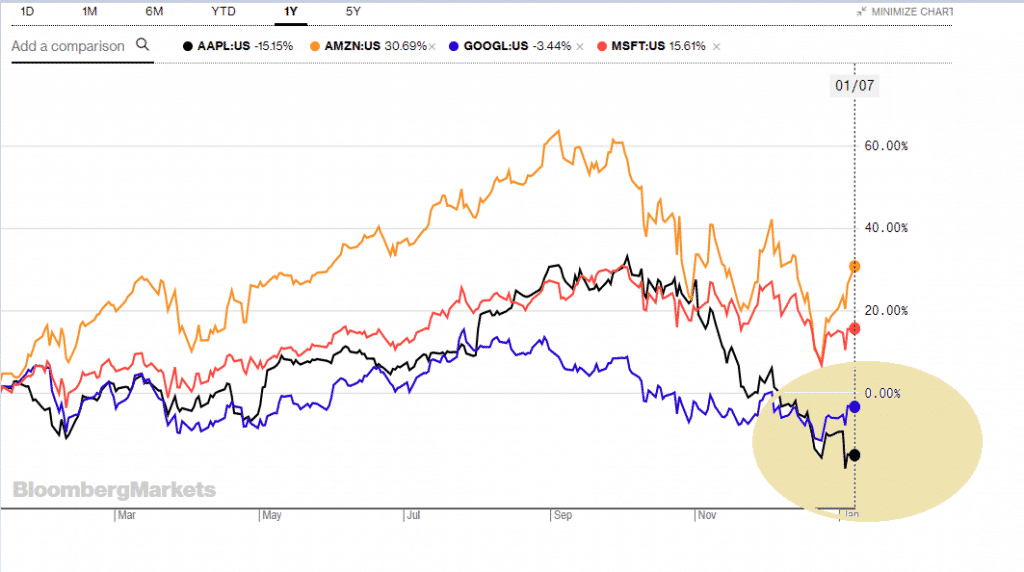

Apple, Amazon, Google and Microsoft had been trading on a clear uptrend chart in the past decade, but 2018 took them all on a bumpy ride. The below charts depicts the performance of the four tech giants:

- 5-Years: The performance of these tech growth stocks has been impressive which explains why they were the favourite investments for the past decade.

- 1-Year: Out of the four, only Amazon and Microsoft managed to stay in positive territory.

- Year-to-date: Apple is the only one on the back foot despite more optimism in the air. Apple’s CEO issued a rare revenue warning that is undermining its recovery.

What’s next for these tech stocks? Volatility has been the dominating theme in 2018 and fears have hit stocks hard. After a painful end in 2018, it was a better start for stocks than anticipated. These stocks are expected to bounce back during the course of 2019. However, investors will be more careful in their positionings as the strong confidence in the FAANG group has somewhat faltered.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Brexit- A Decisive Week

The Parliament Vote is the pivotal stage for Brexit. If the Brexit deal is accepted, Britain will exit the EU in an orderly way. However, if the proposed Brexit deal is rejected, there will be many uncertainties to follow. Market participants will have to wait and see how Brexit will unfold as and when more information or decisions will be ...

Previous Article

Main Macro Themes In 2019

After a stellar year in 2017, investors were taken aback by the massive swings in the markets in 2018. The turmoil in the financial markets has c...