How to optimise your dividends and maximise your returns?

20 January 2023What is a dividend?

A dividend is a payment made by a company to its shareholders to give back some of its profits or return. Dividends are most often paid to shareholders, annually, semi-annual, or quarterly. Non annual dividends that are paid periodically are known as interim dividends. Companies can also pay dividends at their discretion, and these are known as special dividends. Companies that issue dividends are usually very mature and stable businesses with steady cash flow. Index funds, or ETF’s will often also pay dividends from as they receive dividends from their underlying holdings. In Australia, well-known companies that issues consistent dividends include ‘Big 4’ banks, BHP, Rio Tinto Wesfarmers, and Qantas just to name a few. In the USA, the big banks such as JP Morgan and other mature company’s such as Walmart and Coke Cola.

Important Terms

Dividend Yield – The dividend yield is the total value of all dividends paid in the year divided by the share price. Alternatively, it can be thought of as the dividend return on the market value of the share.

Ex-Dividend Date – This is the date in which a holder of stock must possess the stock to receive the dividend payment.

Dividend Payment date – This is the date in which the payment is made.

Do Dividends even matter?

There are theories that suggest dividends don’t really provide any benefit for holders as they are just eating into the overall Compound Annual Growth Rate of the price. This is because once a dividend is paid the share price should adjust to account for the payment that has been made to the holder.

For example, company A has a share price of $100 and issues a $1 dividend. Therefore, after the payment date, the price should in theory drop down to $99.

Consequently, those who oppose dividends as opposed to the being paid a dividend it a holder of a top performing share could just sell a certain number of their units to in some respects pay themselves a ‘dividend’.

On the other hand, companies that pay dividends generally allow the holder to participate in what is known as a ‘reinvestment plan’. This is a scheme in which the company allows holders to reinvest their dividends back into the company’s shares and use the payment to purchase more of those shares allowing for compounding. These schemes often operate without needing to pay commission and sometimes the shares are discounted. The reinvestment plan also removes certain tax liabilities.

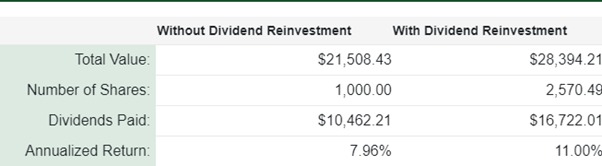

For instance, look below at an example of theoretical share that trades.

Price = $10.00

Number of shares at inception = 1000

Total Investment = $10,000.00

Annual Dividend growth =1%

Annual share price growth = 1%

Time period = 10 years

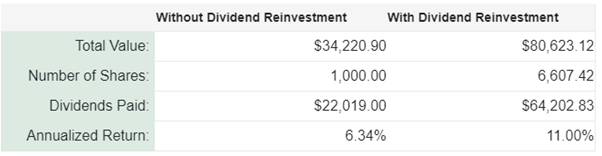

Below is the same share but with a change in the timeframe of 10 to 20 years.

This highlights how important having as much time in the market as possible can make a huge difference to the overall returns of a reinvestment strategy/portfolio. The return for 10 years with reinvestment is around 1.32 times the amount for without reinvestment. Having the same investment for an extra 10 years will yield a return a result 2.35 times better than if the dividends are aid in cash.

Can you live off dividends?

Dividends payments have created an ideal or goal in which traders and investors strive for is to ‘live off’ their dividends. Creating a portfolio that is heavily weighted towards dividend stocks can be a way in which to have a periodic income to supplement a pension or salary. This process involves developing a large enough portfolio that can provide these periodic dividends to a level that will cover the cost-of-living requirements. Choosing high quality, high yielding investments can provide this outcome for those who are savvy.

Below is a list of ETF’s and ASX Listed Stocks with the highest recent Dividend Yields?

List of ETF

| Code | Company | Price | Yield | Gross | DRP | 1yr Return |

| IVV | Ishares S&P 500 ETF | $37.63 | 16.67% | 16.67% | Yes | -10.40% |

| IHVV | Ishares S&P 500 Aud Hedged ETF | $37.06 | 14.93% | 14.93% | No | -16.90% |

| HACK | Betashares Global Cybersecurity ETF | $7.57 | 8.99% | 8.99% | No | -23.30% |

| SLF | SPDR S&P/ASX 200 Listed Property Fund | $11.28 | 7.45% | 7.52% | No | -16.01% |

| VAS | Vanguard Australian Shares INDEX ETF | $91.89 | 6.92% | 8.86% | Yes | -2.18% |

| ILC | Ishares S&P/ASX 20 ETF | $28.95 | 6.67% | 9.35% | Yes | +2.77% |

| STW | SPDR S&P/ASX 200 Fund | $67.10 | 6.43% | 8.42% | Yes | -1.19% |

| A200 | Betashares Australia 200 ETF | $123.01 | 6.35% | 8.35% | Yes | -0.98% |

| IOZ | Ishares Core S&P/ASX 200 ETF | $29.87 | 5.96% | 8.06% | Yes | -0.53% |

| VHY | Vanguard Australian Shares High Yield ETF | $69.87 | 5.93% | 8.31% | Yes | +5.46% |

| SFY | SPDR S&P/ASX 50 Fund | $65.77 | 5.78% | 8.01% | Yes | +1.78% |

| VSO | Vanguard MSCI Australian Small Companies INDEX ETF | $64.70 | 5.54% | 6.32% | Yes | -10.81% |

| MVA | Vaneck Australian Property ETF | $21.20 | 5.14% | 5.25% | Yes | -13.43% |

List of ASX Stocks

| Code | Company | Price | Yield | Gross | DRP | 1yr Return |

| TER | Terracom Ltd | $0.99 | 20.20% | 24.53% | No | +360.46% |

| CRN | Coronado Global Resources Inc | $2.125 | 19.72% | 19.72% | No | +40.26% |

| MFG | Magellan Financial Group Ltd | $9.35 | 19.14% | 25.46% | No | -53.25% |

| YAL | Yancoal Australia Ltd | $6.53 | 18.85% | 18.85% | No | +123.63% |

| ACL | Australian Clinical Labs Ltd | $3.065 | 17.29% | 24.70% | Yes | -43.24% |

| NHC | New Hope Corporation Ltd | $6.67 | 12.89% | 18.42% | No | +177.92% |

| SIQ | Smartgroup Corporation Ltd | $5.41 | 12.20% | 17.43% | No | -25.48% |

| TAH | Tabcorp Holdings Ltd | $1.115 | 11.66% | 16.66% | Yes | +13.99% |

| BFL | BSP Financial Group Ltd | $4.80 | 11.36% | 11.36% | No | +12.41% |

| GRR | Grange Resources Ltd | $1.07 | 11.21% | 16.02% | No | +30.49% |

| LFS | Latitude Group Holdings Ltd | $1.42 | 11.06% | 15.79% | Yes | -31.73% |

The final word

Ultimately dividend portfolios can be a great step in achieving financial security and freedom and is also a great way to diversify a portfolio or trading strategy.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Market continues to consolidate as technology sector begins to rev its engines

The equities market continues to show positive signs as hopes for a pivot from the major central banks continued. The Nasdaq closed the week 0.72% higher and had a powerful Friday session in which jumped 2.66% higher. The S&P 500 dropped 0.66% lower and the Dow Jones fell by 2.70% for the week as the market shifted back into higher growth asset...

Previous Article

Natural Gas price continues to tumble, but the bottom may be near

The price of Natural Gas has continued its drive back down after peaking in the middle of last year. The price has had an aggressive sell off after an...