Is the SP500 ready for next move down?

7 December 2022The major American Indices have begun the last month of the year with in an extremely bearish state as recessionary fears rise to the surface again. With the positive sentiment relating to a potential pivot from the federal reserve seemingly disappearing, thoughts of a hard landing have become increasingly prominent. Even with an expected slowdown in interest rate hikes many analysts fear that it won’t be enough to pull the economy out of a recession or even a soft landing.

Technical Analysis

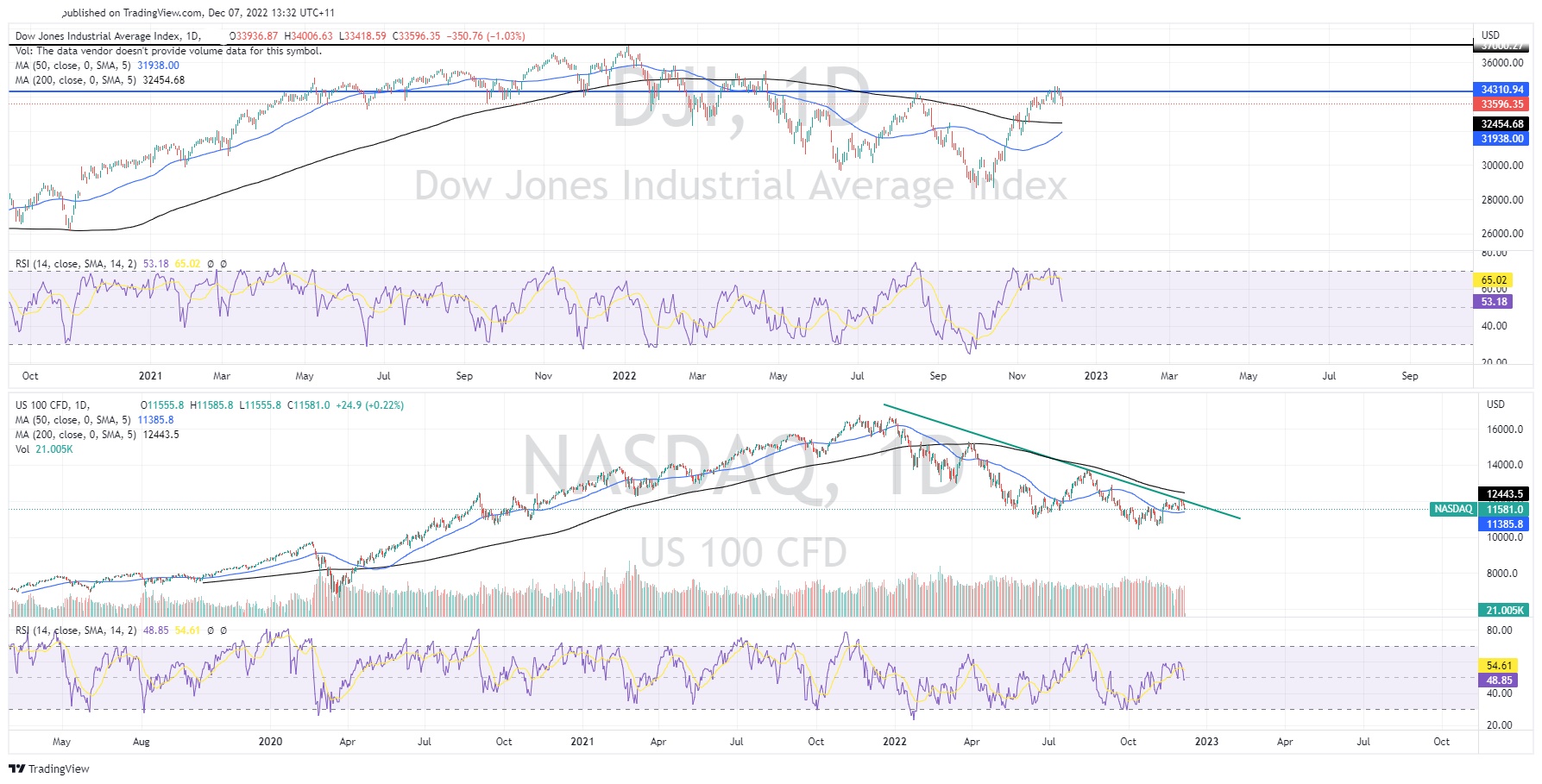

The S&P500 has seen a major pivot off its long term down trend. The index has fallen by nearly 4.5% too begin the month and is showing a very similar price action to the three last downward moves. In addition, the 200-day moving average has once again acted as significant resistance for the index as it tried to reverse out of the down trend. The RSI has also seen a break of its upward trend adding to the confirmation of the overall breakdown as buying has become exhausted. Moving forward, there is likely to be some potential support in the short term near 3900. However, if this support fails then the secondary target or support levels is a 3800 and then 3504 after that. Therefore, there is potentially a large swing to the downside if the sentiment becomes worse and selling continues.

The NASDAQ in particular has been following a similar trend to the S&P500 whilst the Dow Jones Index has been the more resilient of the US Indices. However, both of them have also felt the selling pressure from the S&P500 and the negative sentiment trickle down. The NASDAQ in particular has faced a difficult time as the growth and technology sectors are smashed with the recessionary talk and inflationary pressures.

With the end of the year fast approaching, the prospect of a Santa rally looks less promising with the sentiment in the market at the moment.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Oil continues to fall amid news of price cap

The primary reason for the drop in price is the economic slowdown that has become prevalent in the global market. As fears of a recession continue to grow, the price of Oil has continued to drop. To make matters worse, the G7 have set a $60 per barrel price cap. This price cap was created to restrict Russia’s ability generate revenue from its oil...

Previous Article

AutoZone results beat expectations

AutoZone Inc. (NYSE: AZO) reported the latest financial results for its first quarter of fiscal 2022 (12 weeks) that ended on November 19, 2022. Th...