Opportunities in the Third Quarter – Equity and Currency Markets

18 July 2018By Deepta Bolaky

STOCK MARKETS

After a stellar year for the stock markets, investors were entertaining the idea that equities will outperform in 2018 even though a correction above 15% was expected at some point. The U.S equity markets showed impressive strength in 2017 without experiencing the major pullbacks that often accompany rallies. The rally in the stock markets was mostly driven by global economic growth and impressive corporate profits. However, in February 2018, the CBOE Volatility Index jumped to 37.32 and there was a massive sell-off in the equity markets. There was no fundamental driver behind the sharp fall, but the slide started as investors panicked over a number of issues:

- S economic growth and rising interest rates

- Trade policy and protectionism measures

- Geopolitical risks

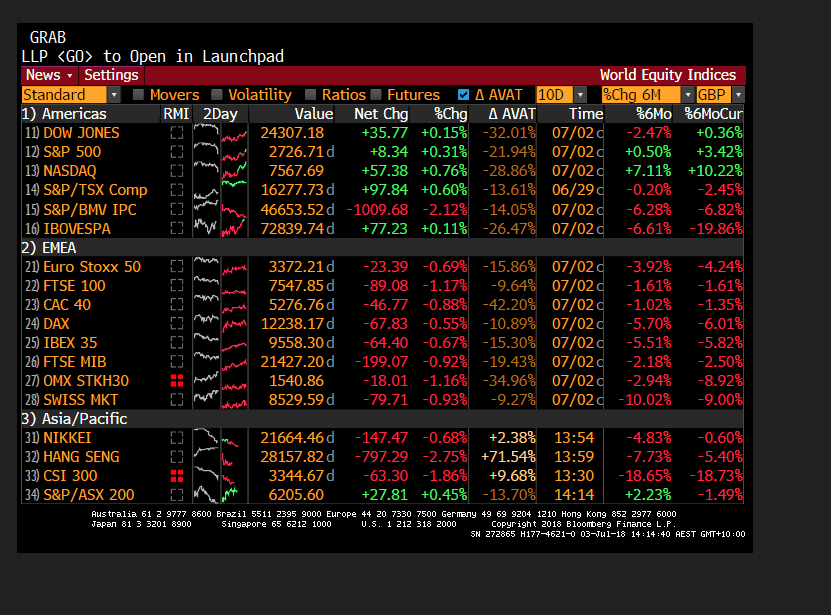

For the first half of the year, the EMEA region were in a sea of red while the S&P500, Nasdaq Composite and ASX200 stayed in the black backed by technological shares as investors were battling with two main challenges, namely trade uncertainties and interest rates.

World Equity – % Change in 6 months (Before the implementation of tariffs)

Each headline on trade tariffs were moving the stock markets, driving“panic selling” or the selling associated with the “risk of higher costs related to tariffs”. During these past couple of months, trade uncertainties and geopolitical risks have been weighing on the overall market sentiment, but the Asian and European stocks took a greater hit. Chinese stocks have emerged as the biggest losers and have even moved into a bear market.

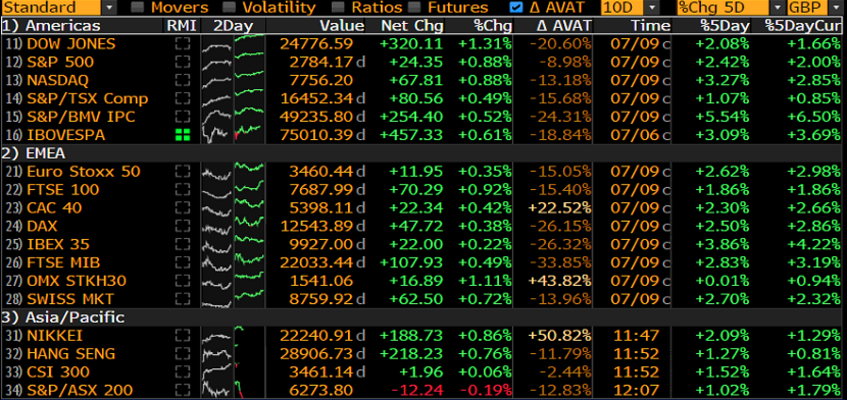

As soon as tariffs and counter-tariffs became a reality, weeks of volatility in the stock markets receded. Investors appear to have come to terms with the situation and risk sentiment has improved. As of writing, we can see that the stock markets are trending in positive territory.

World Equity – % Change in 6 months (after the implementation of tariffs)

Trade tensions in the market were unpredictable and even though investors are wary, its effects on the equity markets might not be long lasting. In the third quarter, we may see investors trimming some of their equity exposure if trade tensions escalate. This trimming could also be encouraged by what we called the “summertime” on Wall Street.

Stocks with stronger future growth projections like the technology shares will most likely stay in high demand in the second half of the year 2018. However, performance of US stocks could be capped with the trade retaliatory responses from other countries. Aside from trade-related concerns, strong earnings expectations at the beginning of the third quarter may drive the equity markets higher.

Short-term traders should probably stay cautious and watch for warning signs that could cause a sudden change in direction. Trade tariff-affected sectors such as the automobile and commodities stocks, together with Chinese stocks, will likely stay under pressure as it is difficult for market participants to see an immediate end to the US-Sino trade tariffs. Investors should also keep an eye on the approach adopted by companies during the earnings season.

Long-term traders can be more strategic and look for market dips for buying opportunities. Interest rates will be a key driver to watch. An old stock market saying has resurfaced:

“Bull markets do not die of old age, but are killed off by the US Federal Reserve”

CURRENCY MARKETS

The US dollar gained impressively in the second quarter against G10 currencies. This growth of the greenback can be attributed to the following drivers:

- The strength of the US economy compared to other developed markets; and

- A hawkish Fed compared to the other central banks.

Recent job reports were also strong enough for markets to anticipate another potential rate hike in September but without the acceleration in wage growth, a fourth hike looks less likely. The upcoming CPI figures will provide more insights on the path of interest rate.

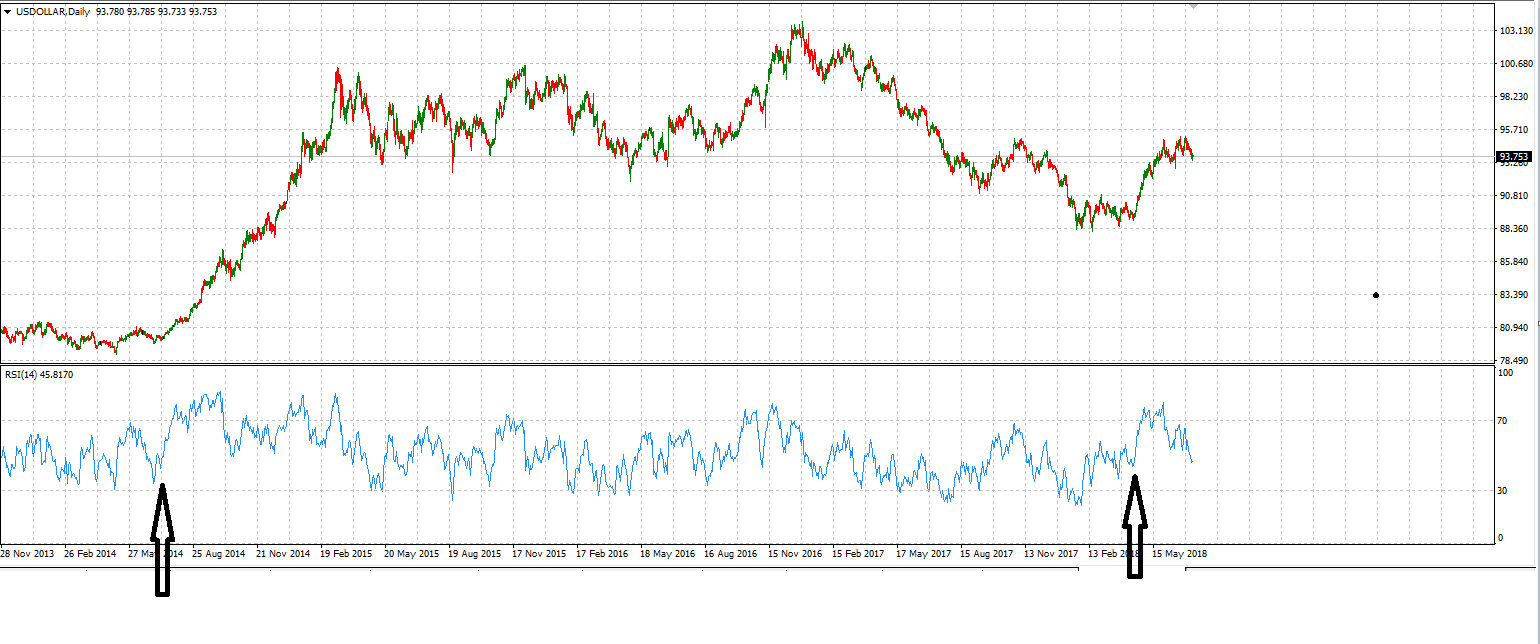

On the technical side, analysts see the strength in the US dollar since mid-April as a reversion. When RSI approaches 40, it is normally used as “a buy signal” which has helped the greenback to bounce back. This particular situation is similar to the one that had occurred back in July 2014.

Both the fundamental and technical sides provided support to the US dollar’s bullish momentum. A hawkish Fed is calling for a higher dollar but it is important to note that the dollar is navigating through a difficult global environment. The drop in US Consumer Sentiment Index and Economic Optimism in June shows that consumer confidence has taken a hit despite a strong US economy.

Unlike the bullish USD, the Euro has been under pressure due to the ongoing political turmoil in Europe that is threatening the unity of the European bloc. The ECB’s dovish view, US trade tariffs on European cars, and slower growth have undermined the recovery of the EUR.

British Pound is also facing the same fate with growing uncertainties around Brexit. Despite strong economic data and a hawkish BoE, the local currency is unable to sustain gains, due to Brexit jitters. If Theresa May manages to push through the soft Brexit deal, the Pound might recover a semblance of normality.

However, now that the implementation of the tariffs has become a reality, we have seen that investors are coming to terms with the situation and the “panic-selling” has scaled down.

The wave of optimism is being felt across both the equity and currency markets.

For instance, the performance of the US dollar in the second quarter compared to the start of the third quarter is significantly opposite.

Similarly, the Euro has seen a slight improvement and has appreciated against more pairs within the G10 currencies since we stepped into Q3.

The British Pound also found some support at the beginning of this quarter compared to the previous one.

Recently, some ECB policy makers have expressed their views that they support an interest rate hike earlier than projected. In the UK, strong data is also supporting an August hike. This might help to bridge the gap between European central banks and the Fed. Currently, both EUR and GBP pairs are finding short-term buyers as the risks on the political front are undermining their performance.

As political tensions recede, we can see those currencies emerging slightly stronger against the US dollar. Investors might want to keep monitoring data to see if there is a pick in the Eurozone area and in the UK to help form buying positions.

From a global perspective, we can see that countries affected by tariffs are seeking unity among themselves against the US. Such retaliatory measures might bring more volatility in the markets in the coming weeks.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Dollar Index Treading on Familiar Ground

If you’re familiar with the US dollar Index, you might have noticed it has moved in a repetitive pattern for the past few years. You need to treat every six months as a cycle, at the end of this cycle (June, December), the Fed will generally raise interest rates. Here’s a look at how this pattern may look: The Cycle Jan-Feb and July-Aug ...

Previous Article

Premium MT4 Trading Tools

As a pioneer of providing MetaTrader 4 in Australia since 2006, our premium MT4 trading tools help provide you with real time trading alerts and a sui...