Walmart tops expectations for Q2 – the stock is up

17 August 2022Walmart tops expectations for Q2 – the stock is up

Walmart Inc. (WMT) announced its Q2 financial results before the market open on Wall Street on Tuesday.

World’s largest supermarket chain reported results that exceeded analyst expectations, sending the stock price higher.

The company reported revenue of $152.859 billion (up by 8.4% year-over-year) vs. $150.994 billion expected.

Earnings per share reported at $1.77 per share for the quarter vs. $1.62 per share estimate.

Doug McMillon, President and CEO of Walmart commented on the latest results: ”We’re pleased to see more customers choosing Walmart during this inflationary period, and we’re working hard to support them as they prioritize their spending. The actions we’ve taken to improve inventory levels in the U.S., along with a heavier mix of sales in grocery put pressure on profit margin for Q2 and our outlook for the year. We made good progress throughout the quarter operationally to improve costs in our supply chain, and that work is ongoing. We continue to build on our strategy to expand our digital businesses, including the continued strength we see in our international markets.”

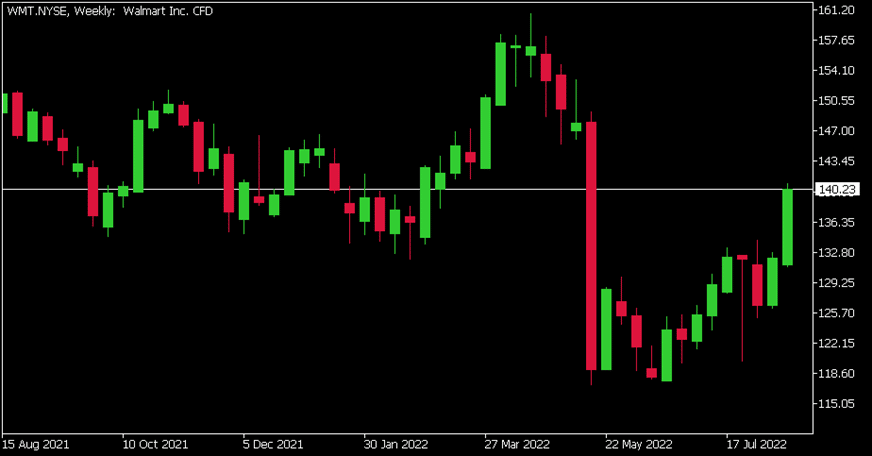

Walmart Inc. (WMT) chart

The stock was up by over 6% on Tuesday, trading at $140.233 a share.

Here is how the stock has performed in the past year:

- 1 Month +8.62%

- 3 Month +7.14%

- Year-to-date -2.74%

- 1 Year -6.62%

Walmart price targets

- Deutsche Bank $142

- Raymond James $140

- BMO Capital $160

- Cowen & Co. $150

- Morgan Stanley $145

- UBS $152

- Credit Suisse $133

- Wells Fargo $130

Walmart is the 14th largest company in the world with a market cap of $383.98 billion.

You can trade Walmart Inc. (WMT) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Walmart Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

US Indices hit three-month highs on solid Walmart earnings, meme stocks pump and dump

US got off to a flying start in Tuesdays session after retail giant Walmart (WMT.NYSE) reported much better results and forward guidance than the recently lowered expectations of analysts, sending the stock soaring over 5%, and dragging the whole consumer discretionary sector with it. See Analyst Klavs Walters Walmart report for an in depth view...

Previous Article

Oil continues its sell-off as it drops after weaker Chinese and US economic figures

Oil has continued its tumble from its March 2022 high of $131 per barrel down to $82 a barrel. The drop has been in response to weak economic figures ...