Trading Forex – USD/CNH

27 March 2017Trading Forex – USD/CNH

The Chinese Yuan (RMB) has doubled its share of global currency trading from 2013 to 2016, advancing from the ninth place to the sixth-most traded currency pair, according to the triennial survey conducted by the Bank for International Settlements last year. This highlights the growing importance of the Chinese Yuan as a global currency.

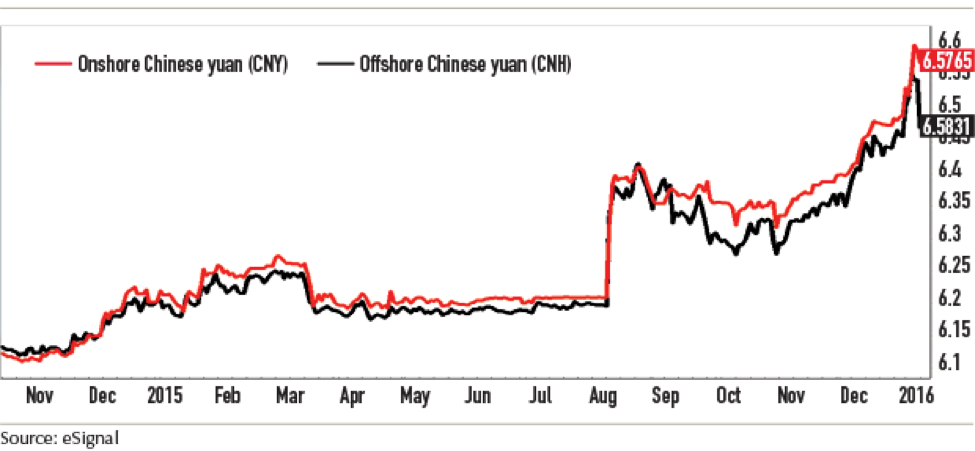

CNH (Chinese offshore yuan) and CNY (Chinese onshore yuan)

A crucial difference between the two is that CNY is strictly controlled by the People’s Bank of China and only traded domestically while CNH is allowed to trade outside the mainland – mostly in Hong Kong. The PBOC set the CNY rate every weekday and it can move within a 2% range during the day. Although the CNH rate is mostly determined by market forces, it tends to stay within close range of the CNY as per the chart below.

A Fundamental look – Spot USDCNH

U.S. and Chinese Industrial Production

Latest figures show that U.S. industrial production was unchanged in February following a 0.1% drop in January, with 0.5% rise of manufacturing output for its sixth consecutive monthly increase. Meanwhile, Chinese industrial production rose by 0.3% since January following a 0.2% decrease at the beginning of 2017. As coincident indicators of overall economic activity and GDP, these industrial production figures seem to influence positively on CNH more than USD before release of next month numbers.

U.S. and Chinese CPI

Chinese CPI weakened from 2.5% to 0.8% in March, 1.1% lower than market anticipation while U.S. CPI declined from 0.6% to 0.1% in the same month and was higher than market forecast. This change of U.S. CPI was in line with the prediction and even 0.1% higher, contributing to achieving target inflation and further revising up U.S. dollars. A declining CPI may be viewed as a positive on an already inflated Chinese economy.

With the lowest three-month implied volatility among emerging market’s currencies, Chinese yuan is stated by Chinese policy makers as “stable” with no surprise now. An increase in M2 money supply despite Chinese restrictions on capital outflows may put more pressure of the CNY.

U.S. and Chinese Trade Balance

7th March 2017 – $-60B, Chinese trade balance was much lower than forecast ($170B) and broke its long-term trend of trade surplus, levying a heavy burden on the depreciation of Chinese yuan. U.S. actual balance ($-48.5B) was slightly lower than anticipated ($-47B) leaving the USD unchanged.

U.S. Interest Rate Hike

As per market expectation, the Federal Reserve voted to raise benchmark lending rate by a quarter percentage point, to a range of 0.75% to 1%, on the early morning of March 16th (2pm, 15th March, New York time). An inflation target of 2%, full-employment and stable prices are starting to come together indicating further hikes this year, giving momentum to increased investor confidence about an improving US economy. The Fed statement still projected two more interest-rate hikes this year, offering a strong bullish sentiment for U.S. dollars in the medium to long term.

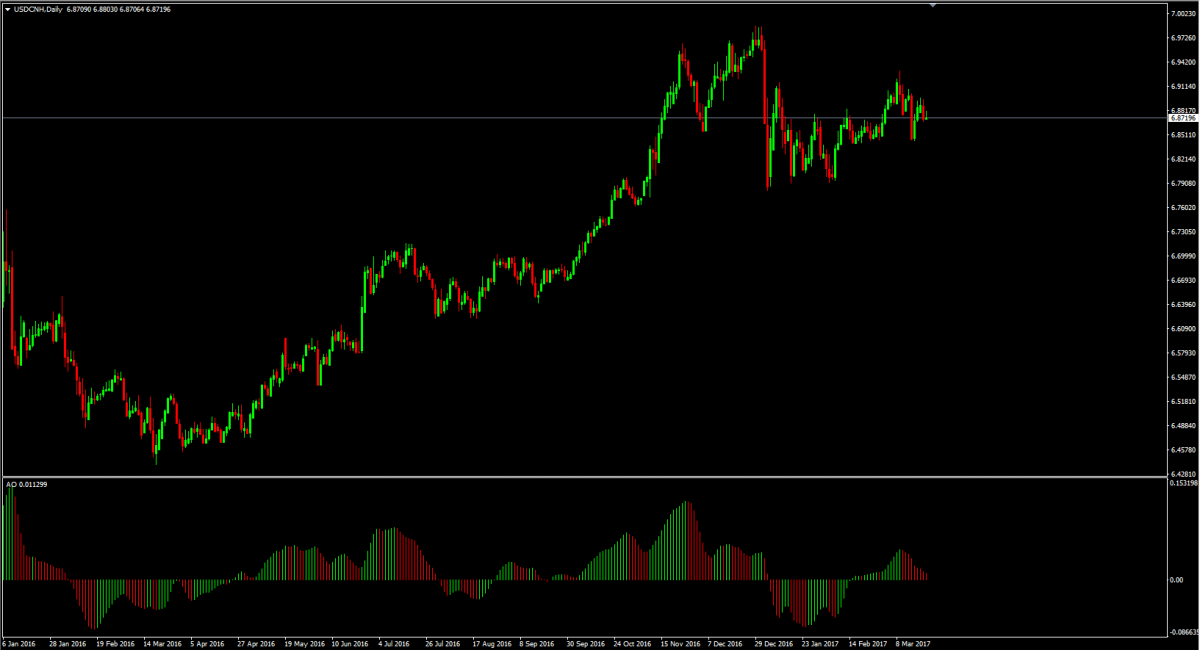

Source: GO Markets MT4 Platform

According to daily USD/CNH graph, it shows a clear-cut primary upward trend composed of increasing peaks and toughs since 2016, despite 3 retracements happened at the beginning of 2016, in July 2016 and at the end of last year. In 2017, a reversal has been pushed back since 2nd Feb suggesting a consolidation around ¥6.8720.

Further upside of USD/CNH looks likely and this uptrend seems likely to continue in the long run. For short-term speculators, keeping an eye on relevant policies and events as well as doing more detailed technical analysis are both required.

The Key Things Worth Nothing for Month Ahead

New York Time

| 10am, 28th March | U.S. Conference Board Consumer Confidence |

| 8.30am, 30th March | U.S. First Quarter GDP |

| 8.30am, 4th April | U.S. Trade Balance |

| 2pm, 5th April | U.S. FOMC meeting |

| 8.30am, 7th April | U.S. Unemployment Rate |

| 10pm, 12th April | China Trade Balance, industrial Production and First Quarter GDP |

| 8.30am, 14th April | U.S. CPI |

| 23rd April – 7th May | First Round of French Presidential Election |

By Irene Wang, GO Markets

For more resource on Forex trading check out our Forex Trading For Beginners introduction, Forex Trading Courses, open a Forex Demo Account or open a live Forex Trading Account.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Post Fed Rate Hike

Post Fed Rate Hike March 15th 2017 - The United States Federal Reserve (Fed) raised borrowing costs for the third time since the end of the financial crisis. An event so widely predicted that Bloomberg's World Interest Rate Probability was pegged at close to 100%. The Federal Open Market Committee (FOMC) decided to increase the federal funds rate b...

Previous Article

French Elections 2017: Trade with GO Markets

French elections 2017 With Brexit in full swing, Europe is getting ready for another political event and the people of France are going to deci...