How to practically implement Long-Short strategies into your trading

10 October 2022Long and Short trading and investing strategies are often seen as advanced strategies only used for large hedge funds and large banks. However, retail traders can learn valuable lessons and ideas from this type of trading strategy that is usually reserved for institutional players.

What is a long-short strategy?

A long-short strategy as described by its name involves holding a basket of both long and short positions of assets all a part of a portfolio or a singular trading strategy. These assets tend to be equities securities or derivatives but can also be other asset classes such as commodities and FOREX. The idea behind the strategy is that due to the negative correlation between the shorts and long positions they cancel out much of the market volatility whilst at the same time profiting up movements in price in either direction.

Steps to develop a Long Short strategy

- Establish which assets classes you wish to trade

This step involves generating ideas for which asset classes you whish to trade. This may include FOREX, Commodities, Indices, or equities. For many traders, a combination of assets may produce an effective strategy. For example, someone may choose to allocate 60% of the portfolio to equities, 20% to FOREX and 20% to commodities or 100% to equities.

- Determine how many assets to hold with in strategy.

The aim of this section is to ensure that there are enough assets to be, diversified enough that a significant move in one direction will not blow the strategy out and to ensure. The strategy requires that enough assets are held to minimise the volatility. If too few assets are used, then the returns may not be consistent enough and prone to large gains and losses. A standard range may include 20 assets with the breakdown of long and short varying from strategy to strategy.

- Apportion the % of assets that will be held long and those that will be held short?

This step involves an element of discretion and is where the individual trader can utilise their own experiences and edge to enhance the strategy. For instance, some traders may choose to create a 50/50 split strategy. This means that exactly half the assets will be long, and half will be short. More specifically this split may occur via value weighting, number of assets or by price per share. Alternatively other strategies may involve having a lower proportion of short assets held, such as 20% Short and 80% long. These types of strategies may work better when in a trending market because the strategy can still make money on assets that are falling in value whilst also taking advantage of the strong overall market trend.

- Choosing the individual assets to be held

This is perhaps the most important step of the process. Choosing assets to hold can be a difficult task and may require both technical and fundamental analysis to find top performing assets to hold long and poor performing stocks to hold short. The craft of the long, short strategy is performed at this stage as a trader needs to find high performing or low performing assets.

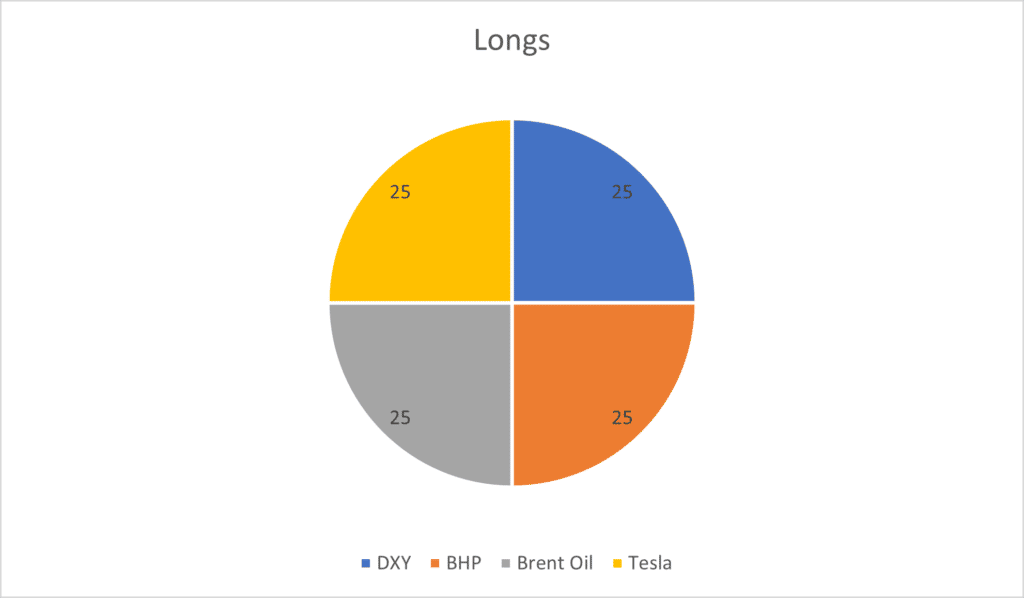

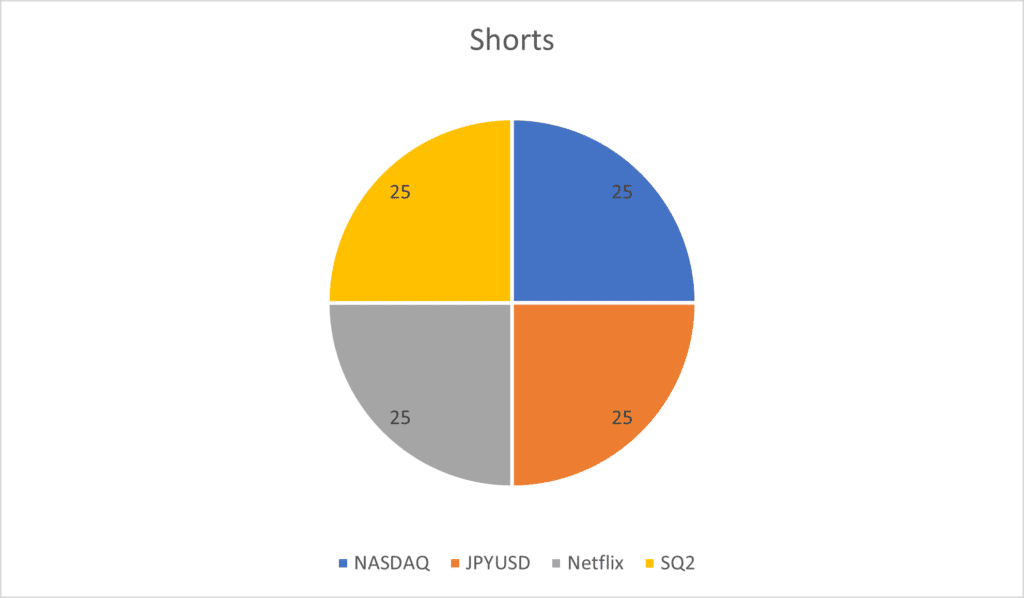

An example of a 50/50 Long Short Portfolio construction is shown below. (NOTE this is a fictional Long Short portfolio and is not a real strategy or portfolio)

Positives of a Long Short Strategy

- A long-short strategy may be able to avoid volatile returns and the effect of a choppy market because the short positions can reduce negative returns if the market is falling, and long positions can take advantage of the market is lifting.

- if a trader can effectively allocate their Longs and shorts, profit can be effectively achieved in most market conditions.

- Allows a trader to utilise their ‘edge’ for a wider array of assets.

Disadvantages

- This approach requires active portfolio management. As positions are constantly changing and weightings for different assets change, adjustments may need to be made to ensure that the strategy continues to balance.

- A Long Short strategy also generally requires a longer time frame then other scalping strategies or intraday strategies.

- Having short positions means that the holder of the short is at risk of short squeezes. A short squeeze is something that anyone wishing to short should be aware of. It occurs when to many short positions attempt to close their positions at once. This can cause a spike in the price and may force bigger positions to close, further driving up the price.

Ultimately, a Long Short strategy for trading and investing can be a way to achieve more stability in volatile market conditions and provide a way to capitalise on market movements in both directions. Even just understanding how a Long-Short strategy works can provide traders and investors with enhanced understanding of how market forces impact on trading and potentially provide new strategies.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Is Ethereum Deflationary? And is it a good thing?

What is a deflationary Cryptocurrency? A Deflationary Cryptocurrency is one that burns, (mints) its supply. This process lessens the number of coins or tokens on the market over a specific period (generally a year), which reduces supply and increases the price. In general terms, ensuring that there isn’t an oversupply of a currency can ...

Previous Article

The week ahead – Big US data in the spotlight as the markets still dance to the Feds tune.

The first week of Q4 proved to be a volatile one in global markets. US equities got off the best start to a quarter since 2009 (Best start of Q4 since...