- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- US–China Trade Gap at Record High

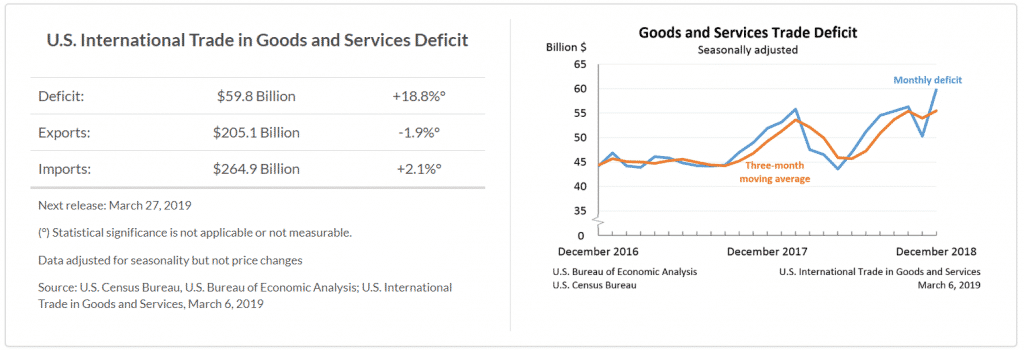

- Imports rose to $264.9bn, a rise of 2.1%. Tax cuts are boosting consumption and demand for imported goods has increased.

- Exports dropped to $205.1bn which is a fall of 1.9%. A rising dollar is making the US less competitive and its exports more expensive.

News & AnalysisUS-China Trade Gap at Record High

Trade Deficit a Decade High- Was a Trade War Worth it?

The Trade Deficit reported mid-week surprised the markets as it climbed to a decade-high. We also note that the US-China trade gap has reached a record high. It is worth thinking whether President Trump did the right thing in engaging in a trade war with its peers. From the fresh figures received this week, investors are thinking the same:

Was all the trade tensions that had taken the financial markets on a volatile ride worth it?

After two months of rally, investors were waiting for more concrete details on the trade negotiations. Lack of developments has been oscillating risk sentiment in the equity markets this week as they are reluctant to push the rally further. The trade deficit is a blow for President Trump because the tariffs widened the deficit instead of narrowing it.

Trade is one of the President’s main campaign promises and investors struggling to find a firm direction amid lack of clarity on the trade front, slowing global growth and the widened trade deficit. The trade data has overshadowed the news that both nations are in discussions and that an agreement can be reached by the end of the month.

Are President Trump’s own policies are making it hard for him to realise his campaign promises?

At this stage, both countries are eager to strike a deal as trade tariffs are putting pressure on their respective economy.

Even if a deal is into place, will a reduced deficit with China be enough to reduce the US trade deficit?

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk .

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Are You Appropriately ‘Aroused’ for Peak Trading Performance?

There is NO such thing as emotionless trading AND in many respects, it may be considered that it is a good thing too. After all, correctly targeted emotions will allow you to: Have an exciting, compelling trading purpose that drives you to do the hard yards with your learning (we know some people fail to complete a course or put learning into ac...

March 8, 2019Read More >Previous Article

Margin Call Podcast – S1 E8: Adam Taylor | Head of GO Markets London

Adam Taylor (Linkedin) is a Director of GO Markets London. Adam has a brilliant ability to see patterns, whether it’s playing Chess, or using Po...

March 6, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading