World’s Largest Banks

7 May 2018World’s Largest Banks

By Klavs Valters

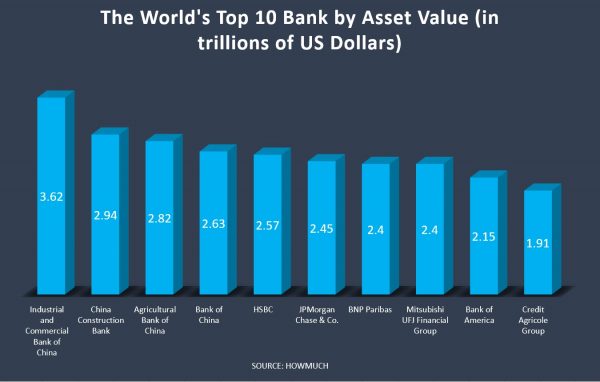

Banks play a significant role in our day-to-day lives and as the global economy continues to expand year-on-year, they will continue to do so. Even though the United States has the largest economy by Gross Domestic Product (GDP), China dominates the list of the biggest banks in the world (by asset value), with four banks coming from the world’s most populated country. But who are the top 10 of the world’s largest banks?

1. Industrial and Commercial Bank of China

It’s the biggest bank in the world measured by assets, which is worth of $3.62 trillion. Despite its status as a commercial bank, it is owned by the state. Its services include credit cards, loans, business finance and money management for high net worth individuals and companies.

2. China Construction Bank

With assets of $2.94 trillion, China Construction Bank is the second biggest in the world. The bank offers corporate banking, which deals with credit, company e-banking, credit lines as well as commercial loans. It has around 13,629 domestic branches as well as overseas branches in Hong Kong, Seoul, Singapore, Tokyo, Kuala Lumper, Melbourne, Sydney, Auckland, Luxembourg, Frankfurt, Barcelona and London.

3. Agricultural Bank of China

Founded in 1951, the Agricultural Bank of China is the third largest bank in the world with assets of $2.82 trillion. The bank deals with small farmers and large agricultural wholesale companies but also works with non-agricultural companies. The Beijing-based bank also has branches in Tokyo, Sydney, London and New York.

4. Bank of China

The Bank of China is the second largest lender in China overall and the largest lender to non-institutions. It offers investment banking, insurance and investing services as well as personal loans, debit and credit cards, mortgages and insurance. Bank of China is the most globally active out of the Chinese banks, with branches in around 27 countries including Australia, Canada, Germany, Russia, Italy, and the United Kingdom to name a few.

5. HSBC

HSBC is a British multinational banking and financial services company. The bank has offices in 80 countries around the world and it provides private banking and consumer finance as well as corporate banking and investment services. HSBC has total of $2.57 trillion in assets.

6. JPMorgan Chase & Co.

JPMorgan is the largest US bank and worlds second most valuable bank by market capitalization. It offers investment services, wealth management, asset management and securities. It has total assets of $2.45 trillion, making it the sixth largest in the world.

7. BNP Paribas

BNP Paribas is a French international bank with offices in over 70 countries around the world. The bank was formed when Paribas and Banque Nationale de Pairs (BNP) merged in 2000. It is the largest French bank and has assets of $2.4 trillion.

8. Mitsubishi UFJ Financial Group

Mitsubishi UFJ Financial Group is a Japanese financial services company with headquarters in Tokyo. It was founded in 2005 when it was announced the plans to merge UFJ with the Mitsubishi Tokyo Financial Group and it is now world’s 8th largest bank with assets worth over $2.4 trillion.

9. Bank of America

Bank of America is a US bank with headquarters in Charlotte, North Carolina. It is the second largest bank in the US and offers services for personal banking, small and medium size businesses as well as large corporations. With assets around $2.15 trillion, it’s the 9th largest bank in the world.

10. Credit Agricole Group

10th largest bank in the world and 2nd largest in France is the Credit Agricole Group. It was founded in 1894 with headquarters based in Montrouge, just outside of Paris. The bank has a history of working with the farming industry and has assets of up to $1.91 trillion.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Federal Budget 2018: A Mixed Reaction

Federal Budget 2018: A Mixed Reaction By Deepta Bolaky Treasurer Scott Morrison handed down his third incorporating tax cuts, superannuation benefits, aged care spending and significant infrastructure spending. The highlight is its plan to hand out $140 billion in tax cuts over the next 7 years possibly making the budget a strong “pre-election�...

Previous Article

First Quarter Overview – Massive Swings and Volatility in Stock Markets

First Quarter Overview - Massive Swings and Volatility in Stock Markets First quarter of the year ended with markets experiencing massive swi...