- About

- About

- About GO Markets

- Our Awards

- Legal Documents

- Contact Us

- Trading

- Trading

- Products Overview

- Forex CFDs

- Share CFDs

- Index CFDs

- Metal CFDs

- Commodity CFDs

- Treasury CFDs

- Platforms

- Platforms

- Platforms Overview

- MetaTrader 4

- MetaTrader 5

- Tools

- About

- About

- About GO Markets

- Our Awards

- Legal Documents

- Contact Us

- Trading

- Trading

- Products Overview

- Forex CFDs

- Share CFDs

- Index CFDs

- Metal CFDs

- Commodity CFDs

- Treasury CFDs

- Platforms

- Platforms

- Platforms Overview

- MetaTrader 4

- MetaTrader 5

- Tools

- Home

- News & Analysis

- Economic Updates

- Housing Market and the Federal Election

- Consumer Price Index

- Wages Price Index

- Retail Turnover

- Consumer Confidence

- Unemployment

- A faltering economy and a property slump

- A Federal Election with a close call between Labor and the Coalition

- Trade tensions between the US and China.

News & AnalysisHousing Market and the Federal Election

“Labor – A fair go for Australia”

“Liberal – Building our economy and securing our future”

“Nationals – A strong vote for regional Australia”

“Greens – A future for all of us”

“The Centre Alliance – Making sure South Australia always comes first”

The economy is facing fundamental challenges, and the recent figures of the following key macro-economic factors are showing further signs of weakness:

The calls for a rate cut are growing louder, and recent economic data releases are raising the bets that RBA will cut rates sooner than later.

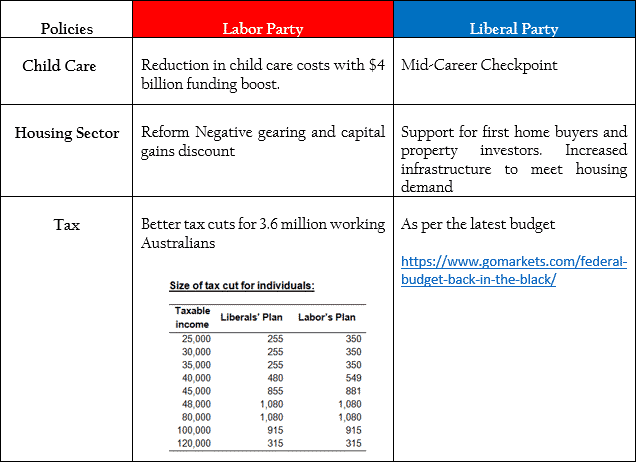

However, the Federal Election will also have the potential to change how our economy works as political parties come with an agenda which will have implications on the Australian economy. Below is a table that depicts some of the main policies adopted that two main political parties:

The Housing sector is a significant concern for the Australian fragile economy. The Reserve Bank of Australia (RBA) is trapped as altering interest rates will affect the housing market directly. A cut could fuel demand and pushing prices higher again, even though, stricter lending requirements might help to lessen the lift in home prices to some extent in the near-to-medium term.

Adding to the current uncertainty of the housing market, the outcome of the Federal Election will also have huge implications on this sector.

This is why the subject of “Negative Gearing” and “Capital Gains Discount” dominated headlines during the election campaign.

The implementation of both at once can put pressure on the housing sector and consequently affect economic growth

Taking a look at the local currency, AUD is under siege and sliding under the influence of:

The effect on the local currency after the election will depend on the composition of the Parliament- whether the implementation of policies will be difficult or not according to the majority. It is unlikely that the Aussie dollar will see any significant relief rally as short-term factors are looking quite bearish.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

European Parliament Election 2019

European Parliament Election 2019 The 2019 EU Parliament election is one of the most important ones for the bloc amid the rise of nationalism and populist parties. Brexit is also the constant reminder that leaving the EU would not be easy and the election is, therefore, providing some fresh insights on the balloting across the 28 European Union c...

May 27, 2019Read More >Previous Article

Option traders – Time to Hedge your Currency Risk?

Many traders utilise options amongst their investment strategies either for income or capital growth. As with Forex and CFD trading, options offer ...

May 17, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- About