US Stocks Rally on Economic Data and End of Quarter Flows Ahead of PCE Reading

31 March 2023US stocks rose again in Thursdays session on a mixture of “bad news is good news” and end of quarter flows as fund managers did some window dressing on their portfolios. The bad news was a rise in unemployment claims to 198k for the week, and a US GDP figure that came in below expectation at 2.6%. We also had a couple of Fed speakers that caused some volatility during the session.

The Nasdaq again led the charge higher with Megacap tech stocks outperforming, AAPL, TSLA and MSFT all had healthy gains, the Nasdaq is on track to have it’s best quarter since Q4 21, rallying over 17% in Q1 coming into the last trading session of the quarter.

Another indicator of market optimism was the Vix or “fear” index touching below 20 , The Vix has now retraced most of it’s gains after the collapse of SVB and Credit Suisse.

In FX , the USD was mostly lower with the markets in risk on mode , the EURUSD rallied on a weaker dollar and a German inflation figure that was hotter than expected, pushing above 1.09 and testing the highs set last week.

After yesterdays steep losses the Yen reversed reversed course, helped along by a fall in US 10 bond yields

Cyclical currencies were bid as well on a weaker USD and risk appetite , Cable touched on 1.24, testing it’s 2023 highs, the AUD and kiwi regained all of yesterdays losses, with the AUD settling above 67 Us cents.

Gold found support at its trendline and rallied above 1950 an ounce, this coincided with a selloff in bank stock at the time showing that gold is still benefitting from it’s safe haven status.

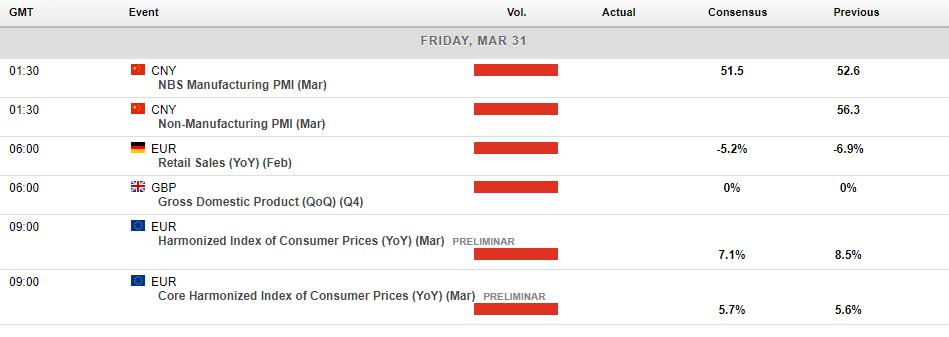

Today in economic news we have the Feds “favourite” measure of inflation, the Core PCE price index, which is expected to show a moderation in monthly inflation doen to 0.4% from the 0.6% in the previous reading. With the next Fed decision on a knife edge, some volatility around this figure should be expected.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

AUDUSD ahead of the RBA Cash Rate decision

This week, the Australian Consumer Price Index (CPI) y/y data was released at 6.8% (Forecast: 7.2% Previous: 7.4%) which signals a slowdown in inflation growth. In addition, the consecutive release of lower-than-expected CPI data highlights the possibility of a new trend of decreasing inflation for the Australian economy. With the view that infl...

Previous Article

US Markets Rise Ahead of GDP, Tech Outperforms, USD higher on JPY dip

US Stocks were firmer on Wednesday, with a reversal of yesterday’s session with Tech leading the charge higher the recent rise in bond yields lost s...