US Markets Rise Ahead of GDP, Tech Outperforms, USD higher on JPY dip

30 March 2023US Stocks were firmer on Wednesday, with a reversal of yesterday’s session with Tech leading the charge higher the recent rise in bond yields lost some momentum , the Nasdaq 100 was up over 200 points and has now entered a technical bull market, rising 20% from its December low, while the S&P500 closed above its 50dma for the first time since March 6th.

Most of the flow into tech went into the mega caps , with Meta , Google ,Microsoft and Netflix all having big up days.

In FX markets the USD was mostly firmer despite improving risk sentiment, This improving risk sentiment did see an unwinding of safe haven flows into the JPY, which saw the USDJPY rally strongly which gave the USD a tailwind across the board.

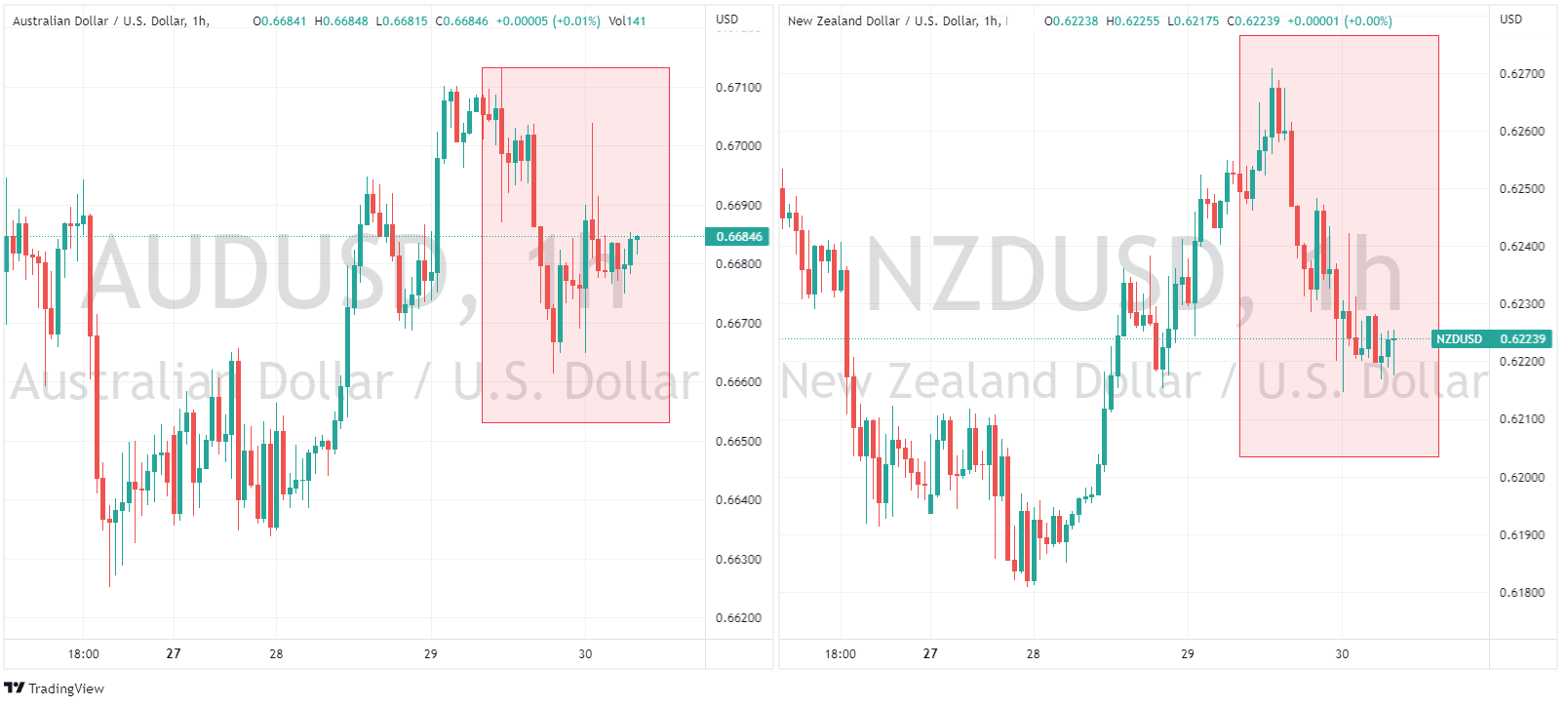

The AUD and Kiwi dollars were the next worse performers, the Aussie dragged down by a cooler than expected CPI figure yesterday, seeing further market pricing of a pause at next weeks RBA meeting.

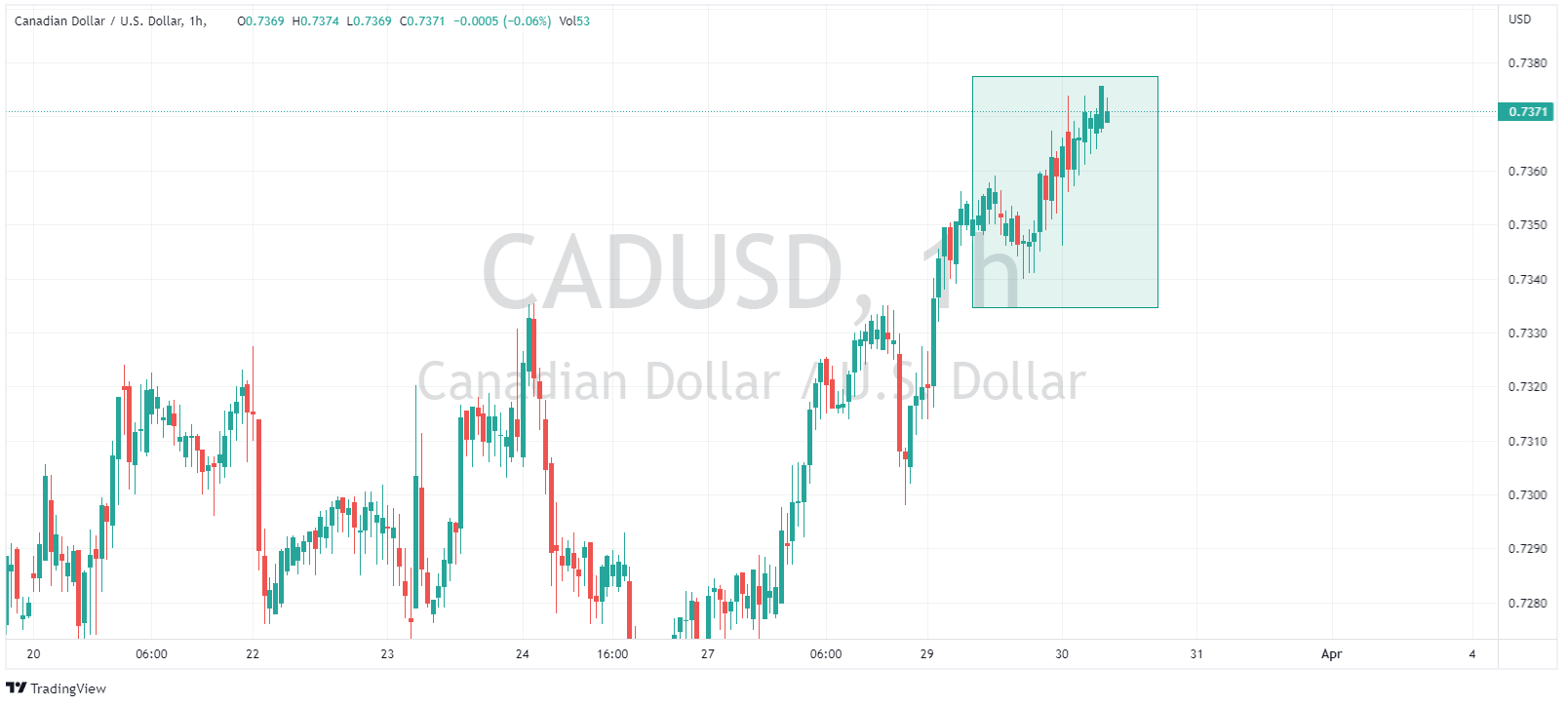

The outperformer was the Canadian dollar, given a tailwind by a rebound in oil prices and comments overnight from the Deputy Governor of the BoC regarding their QT programme.

In commodities, gold was down slightly, but held up pretty well considering USD strength and an improvement in risk sentiment, finishing the day above $1960 USD an ounce.

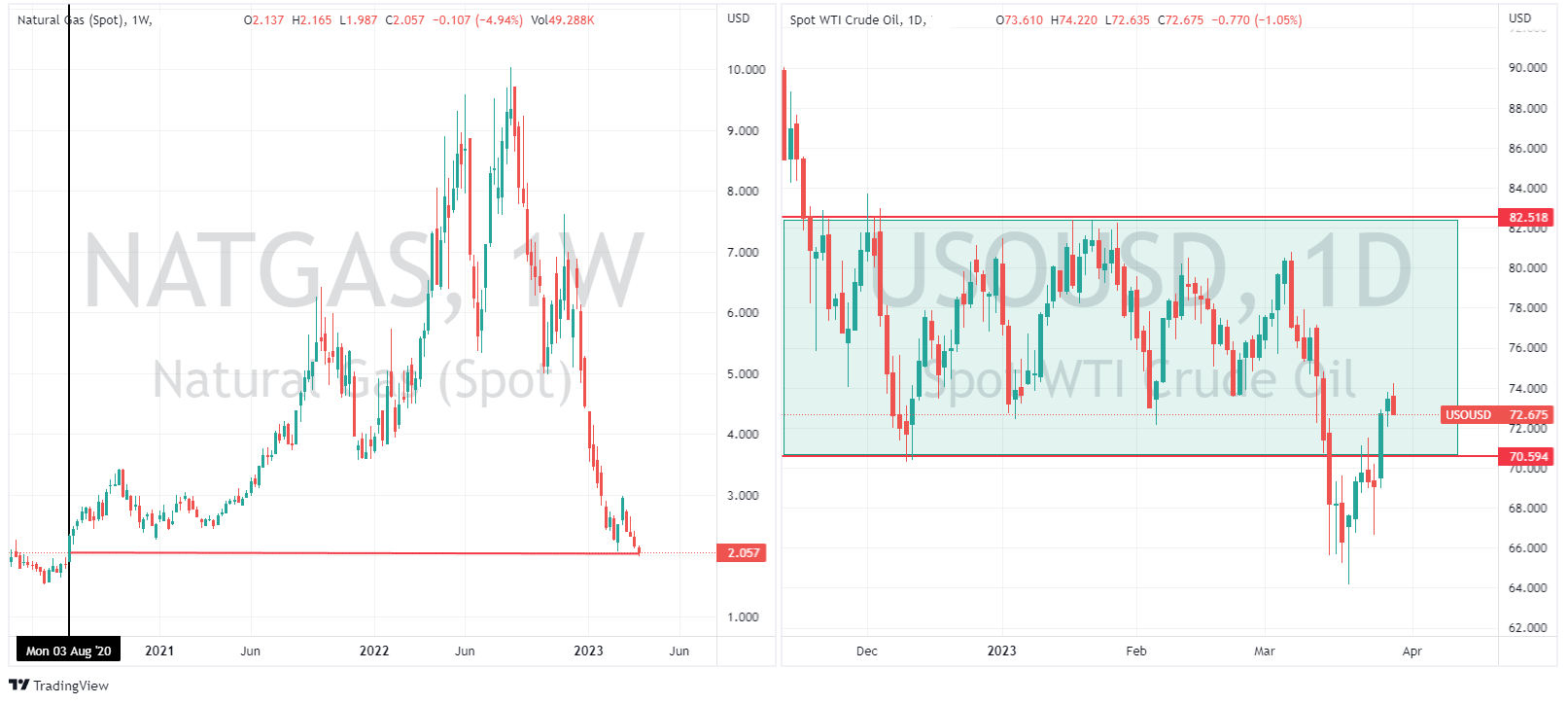

Natural gas continued it’s downtrend, hitting lows not seen since 2020 and Oil after a week-long bounce, ended lower despite a large inventory draw, dropping back to a $72 handle.

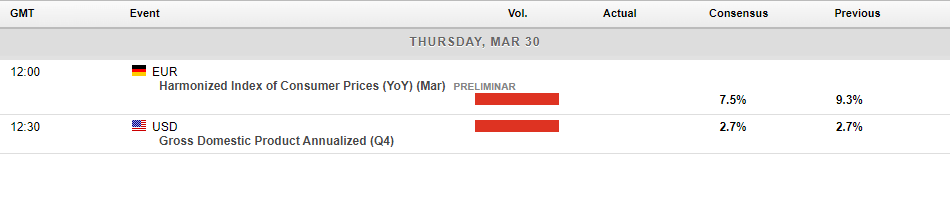

In economic announcements, later today we have the US GDP figure released, this will be an important one to gauge how resilient the US economy has been in the face of the Feds aggressive rate tightening cycle and should get the FX markets moving.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

US Stocks Rally on Economic Data and End of Quarter Flows Ahead of PCE Reading

US stocks rose again in Thursdays session on a mixture of “bad news is good news” and end of quarter flows as fund managers did some window dressing on their portfolios. The bad news was a rise in unemployment claims to 198k for the week, and a US GDP figure that came in below expectation at 2.6%. We also had a couple of Fed speakers that cause...

Previous Article

Lululemon tops estimates – the stock is rising

Lululemon athletica inc. (NASDAQ: LULU) announced Q4 and full-year earnings results on Wednesday. World’s second largest sporting goods company r...