US stocks reverse weak opening to end slightly higher in first reaction after NFP beat

11 April 2023US markets opened on Monday after a holiday break to the news of a resilient US labour market after a beat in the NFP figure released on Friday.

Nonfarm payrolls grew by 236,000 for the month, above the 228k expected, while the unemployment rate fell to 3.5%, where a hold of 3.6% was expected.

This saw rate hike expectations from the FOMC at their May meeting move up to a 70% chance according to Fed Fund Futures pricing, which put equities under pressure early in the session.

The Dow Jones found support at its 100 day Moving average and pulled higher, finishing the session up around 100 points.

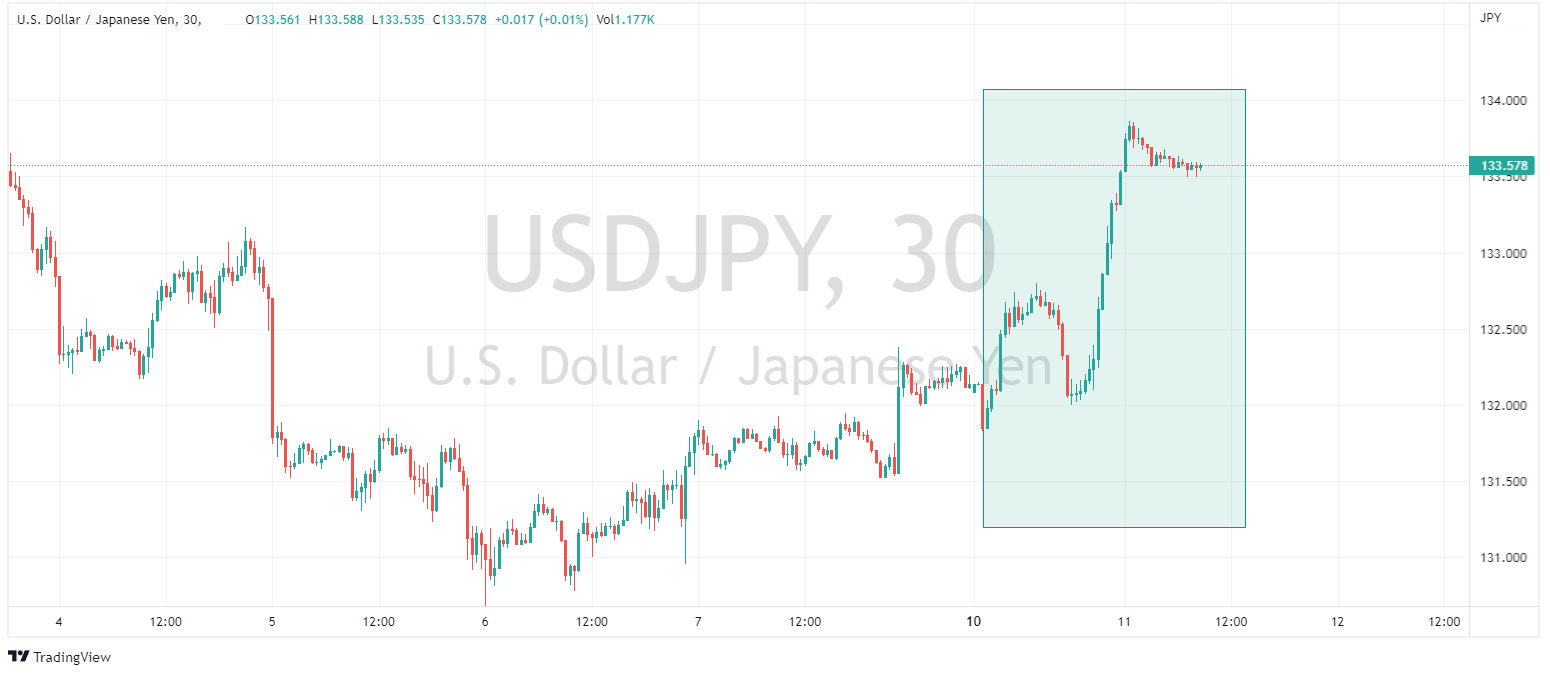

In FX the rise in rate hike expectations saw the US dollar rally against its peers with broad dollar strength across all pairs.

The Japanese Yen saw notable weakness after Friday’s jobs report, safe haven flows to the Yen were reduced and higher yield differentials also pressured the Yen. Adding to this was comments from the new BoJ governor Ueda warning against a sudden normalisation of policy, i.e. continuing with the dovish status quo, all this together saw the USDJPY surge higher, hitting one month highs intra session.

Geopolitical risks around reports of Chinese military drills around Taiwan also saw notable weakness in cyclical currencies, particularly the AUD and NZD, AUDUSD falling to 0.6625 before finding support at the late March lows, and NZDUSD dipping below 0.62 and the AUDNZD treading water at the psychological 1.07 level.

Gold prices were under pressure from a stronger Dollar and rising yields pushing decisively below the 2000 USD an ounce level to 1990

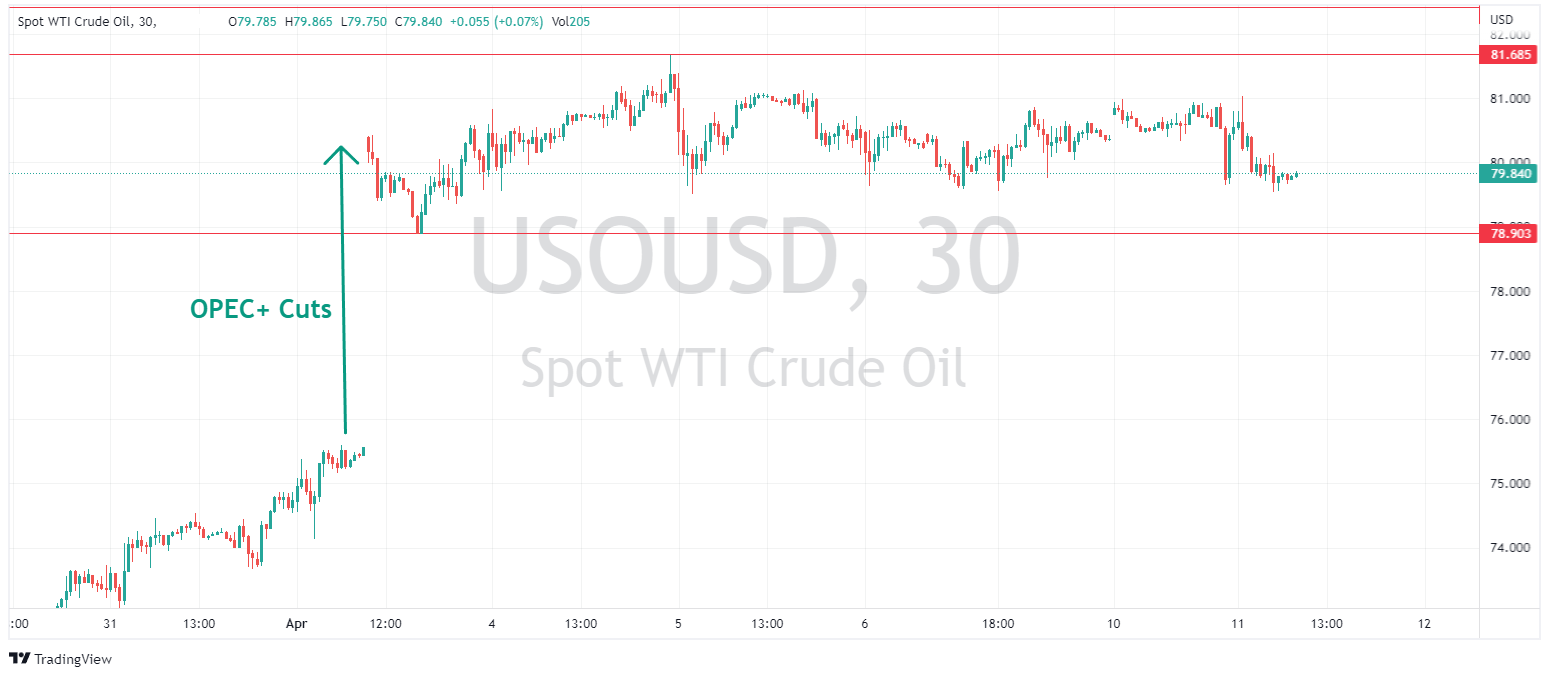

Crude Oil was down modestly , still holding its gains from the OPEC+ surprise output cut and continuing to trade in a narrow range to range trade.

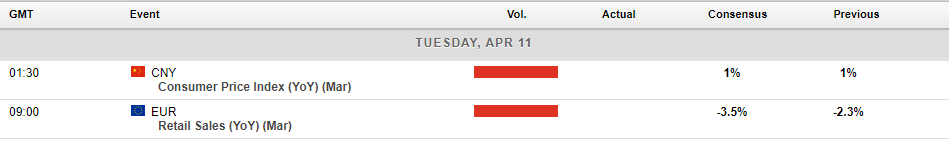

In scheduled economic announcements today, we have a fairly quiet calendar ahead of a very busy few days starting the US CPI figure tomorrow. Todays only notable figures being Chinese CPI and European retails sales, both of which are not expected to have much of an impact on the markets.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

FX analysis – USDJPY – Yield differentials pushing this pair higher

USDJPY The USDJPY is on the march higher again after a better than expected Non-Farm payroll figure on Friday saw sentiment shift hawkishly toward Fed monetary policy with Fed fund futures now pricing in a 70% chance of a 25bp hike at the FOMC May meeting, up from around a 50-50 split earlier in the week. The policy divergence in the US and J...

Previous Article

Tech Tanks, Defensives hold up the Dow as Weak Data Stokes Recession Fears

US markets continued to wobble in Wednesday’s session after another weak employment figure and a miss on Services PMI indicated the US economy might...