Tech Tanks, Defensives hold up the Dow as Weak Data Stokes Recession Fears

6 April 2023US markets continued to wobble in Wednesday’s session after another weak employment figure and a miss on Services PMI indicated the US economy might finally start to be slowing down after a year of aggressive hiking from the Federal Reserve.

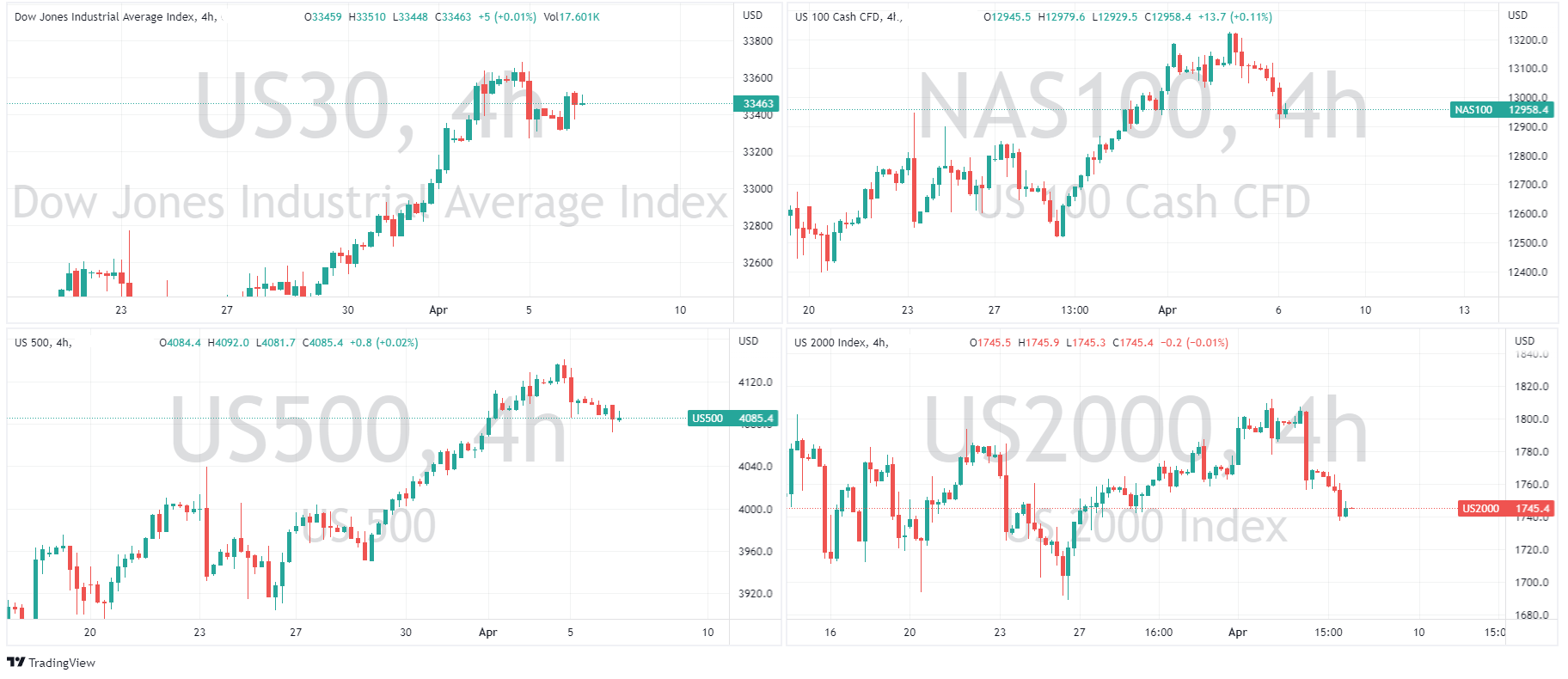

The Tech heavy and more risk sensitive Nasdaq led declines, closely followed by the Russell 2000 as regional bank stocks again took a leg down in a sign that the banking crisis is certainly not over in many investors’ minds.

The Dow Jones was the only index to finish in the green, Mostly thanks to defensive stock Johnson and Johnson (JNJ) +7.12% , UnitedHealth Group (UNH) +15.98% and Merck (MRK) +2.83% as investors continue to rotate from growth to defensive sectors.

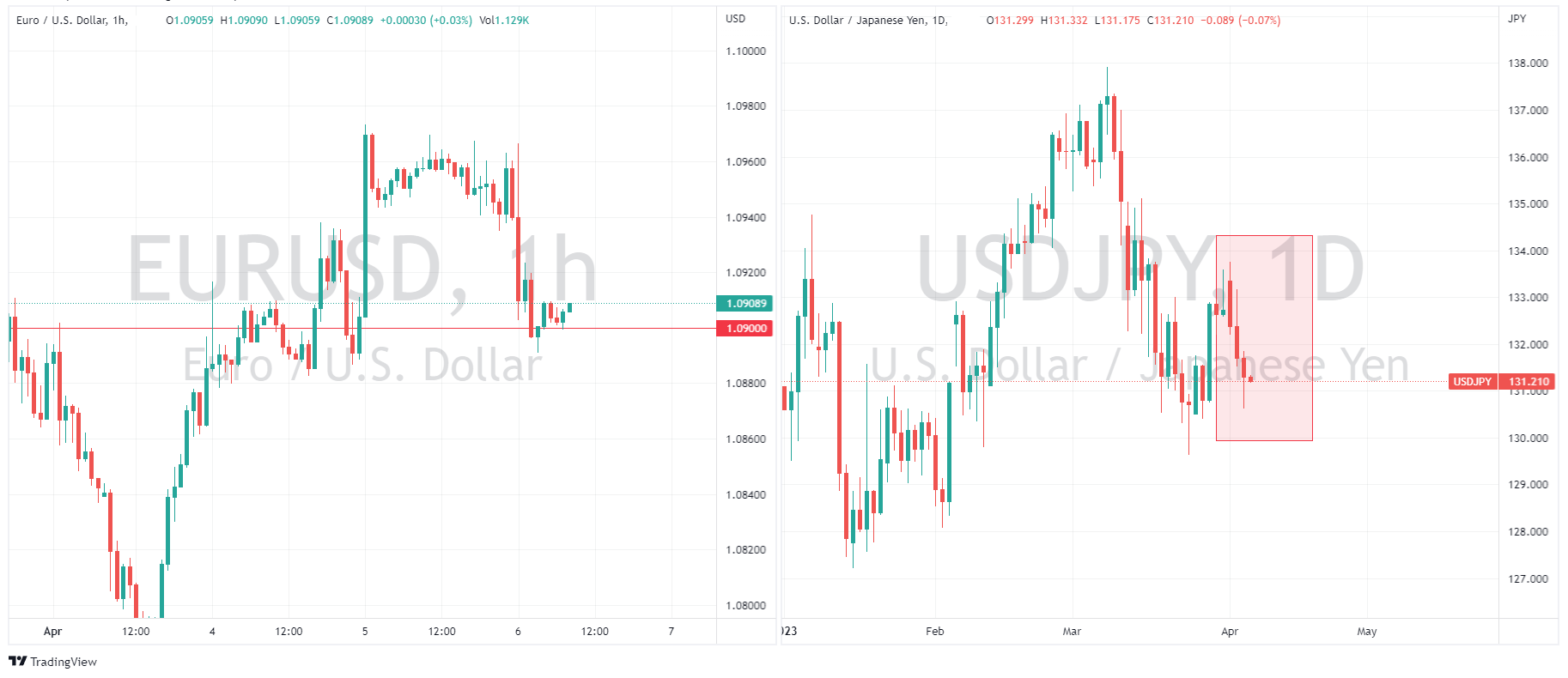

In FX markets the US Dollar was bid, benefitting from the fall in stocks as safe haven flows overrode the weak data and saw the greenback rally against most of it’s peers.

EURUSD was weaker, dipping below the psychological 1.09 level briefly to settle slightly above, this has been a level where the bulls and the bears have had a lot of push and shove so will be worth watching which way the EURUSD breaks from here to gauge its next broader move.

Safe Haven flows and moderating yield differentials again saw the Yen outperforming the USD, this saw declines in USDJPY for the third straight session, though from a chartists point of view it does look like this move is running out of steam, with successively smaller down bars on the daily chart.

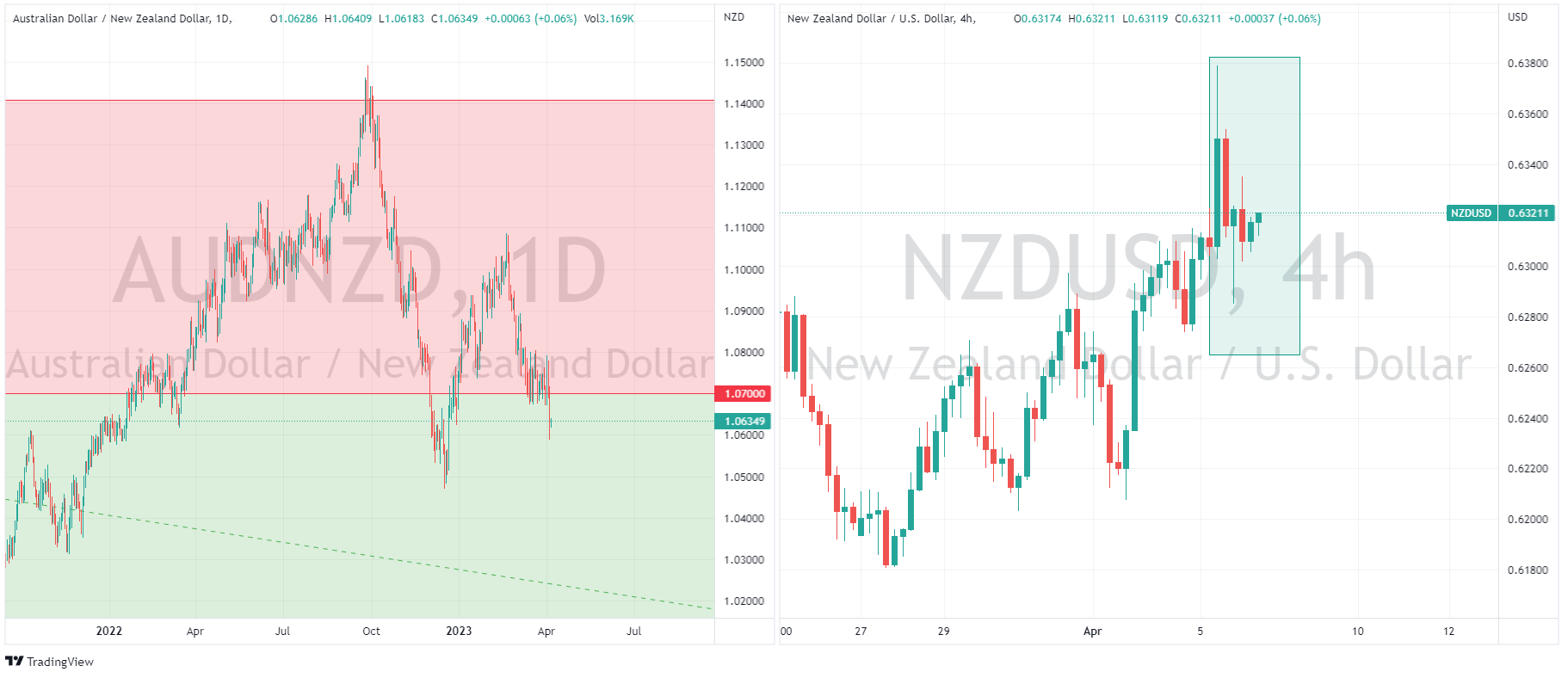

The only other currency that outperformed the USD (just!) was the Kiwi dollar after the surprise supersized 50bp hike from the RBNZ yesterday. NZDUSD gave back most of it’s gains during the session but managed to hold onto a gain. AUDNZD pushed lower for the second straight session, holding below the psychological 1.07 level as rate differentials give the Kiwi a boost.

Gold had a roller coaster of a session as the bears tested the old highs and resistance level at 2010, trying to push the price back under. The bulls held though and we could be seeing this level become support for another leg up, possibly to test the all-time highs set in March 2022.

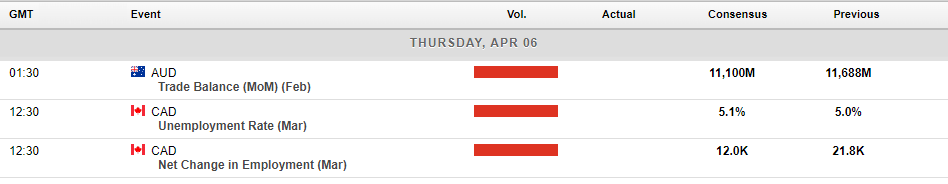

In today’s economic announcements, the pivotal Non-Farm Payroll employment figured will be released in the US.

After Tuesdays weak JOLTS report and the miss on ADP employment yesterday, this NFP will be even more closely watched than usual to gauge the strength of the US labour market and what effect that will have on future FOMC policy.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

US stocks reverse weak opening to end slightly higher in first reaction after NFP beat

US markets opened on Monday after a holiday break to the news of a resilient US labour market after a beat in the NFP figure released on Friday. Nonfarm payrolls grew by 236,000 for the month, above the 228k expected, while the unemployment rate fell to 3.5%, where a hold of 3.6% was expected. This saw rate hike expectations from the FOMC at ...

Previous Article

US stocks decline as weak JOLTS data and Dimon comments spook investors

US equities snapped a 4-day winning streak as the “bad news is good news” narrative for equities faltered in Tuesdays session. Before the cash ...