- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Economic Updates

- An Election Rate Cut?

- The housing sector remains a concern with a steeper fall in building approvals

- Weak Wage growth persists

- Retail Sales is sluggish

- Global Growth is slowing

News & Analysis

Among the few interest rate decisions this week, the Reserve Bank of Australia stands out. The Federal election 2019 is fast approaching and analysts are debating whether a rate cut before the election is justified or not.

The Rate Cut Debate

The Australian economy is facing real challenges but the rate cut debate ahead of the election exuberated as inflation for the first quarter dropped to zero. In other words, there was no change in consumer prices during the first three months of 2019.

The last time inflation dropped to such levels was back in 2016 whereby the RBA responded with a rate cut. Australia is facing a softening economy and the weak CPI figures are evidence of a struggling economy and may push a reticent RBA to cut interest rate:

However, the timing of the rate cut in an election month can be controversial as after three years of inactivity regarding interest rates, the RBA may send signals to the markets that may impact the federal election. At this stage, analysts are predicting a close call for a rate cut this Tuesday. However, irrespective of whether the RBA will alter interest rates this week, monetary policy statement would most certainly be dovish reflecting the current weakness in the Australian economy.

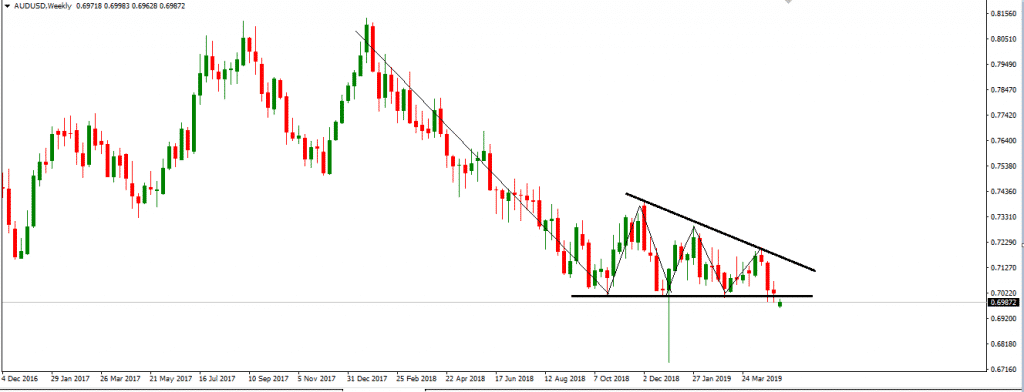

The AUDUSD pair has resumed its trading in a downtrend line and is poised to remain on the defensive. Alongside the RBA’s interest rate decision and the monetary policy this week, tariffs threats by President Donald Trump are adding additional downward pressure on the pair.

The pair traded in a bearish channel throughout nearly the whole of 2018. Aside from the flash crash in January, the AUDUSD pair managed to hold above the 0.70 level from January to early April 2019, even though sellers dominated the price action.

AUDUSD (Weekly Chart)

Source: GO MT4The sell-off triggered this Monday by tariffs threats has the potential to persist as both the fundamental and technical side are supporting the downside.

The rate decision will be announced at 07:30 (Platform time)

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Another New Indicator? – 4 Questions to Judge If It Is the Right Time for You

Invariably, the motivation to look at adding another technical indicator is a belief that your trading results, and the system that creates these, could be improved. As traders, we are bombarded with information relating to the use of technical indicators to guide decision making in our entry and exit decisions. Such information can be “persuasi...

May 7, 2019Read More >Previous Article

US Jobs Report

The Buraeu of Labor Statistics have released the latest jobs report for April. Let’s take a look at the latest numbers. The total non-farm payrol...

May 3, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading