- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- WTI in Bear Mode

News & Analysis

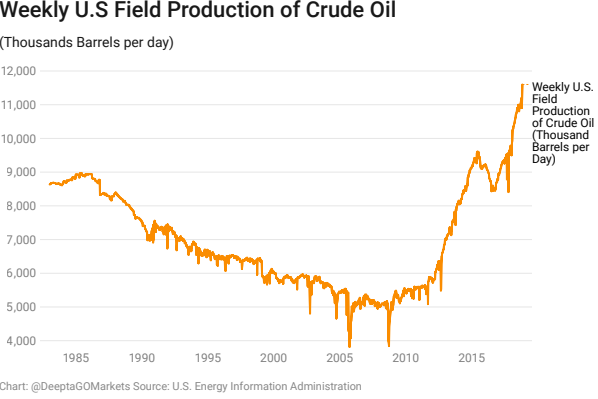

Deteriorating demand and rising global output are the main factors that sent the WTI Crude into a bear market territory. There is a shift of sentiment in the oil markets. The US sanctions have been the primary influence behind the rally in oil prices, and now that fears have eased, fundamentals took over, and economic forces- demand and supply are driving the markets.

Supply Side

The US sanctions have created fears that oil supply will take a hit and will likely drop by 30% by next year. There was also resistance from OPEC members to increase the output ceiling and boost production. These downside factors have put upward pressure on oil prices. In the last couple of weeks, sentiment soured as US crude oil reaches a new all-time high at 11.63 million bpd and is predicted to break through 12 million barrels per day by mid-2019. The US sanctions on Iran will be therefore unlikely to have a significant impact on supply.

The US decision to offer Oil Waivers to different nations also came as a surprise mitigating the effect of the Iran sanctions on the global oil supply and accelerating the slide in oil prices. It appears that the waivers were put in place to avoid a shock in the market and higher prices.

Demand Side

The concerns over global economic growth are forcing traders to reduce their projections for oil demand. Trade tensions are flashing warnings that could dent the world’s oil demand growth. A slowdown in global economic growth, consumer spending, investment flows and a rising US dollar are leading to mounting uncertainties around the demand for oil. The demand shock is boiling over slowly, and the effect will likely be felt over time.

It is too soon to know how the OPEC will react to the supply glut. Meanwhile, we will have to wait for the OPEC and its allies to discuss scenarios of cutting production again next year.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. More information on trading WTI and Brent crude oil here.The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

GO Markets Expands eFX Network with oneZero Collaboration

MELBOURNE, AUSTRALIA – 13 November 2018. Veteran derivatives provider GO Markets Pty Ltd has integrated with technology provider, oneZero Financial Systems in a bid to expand their institutional offering in LD4. Head of Trading, Tom Williams said: “The popularity of our API offering has naturally led us to expand our distribution channels and ...

November 15, 2018Read More >Previous Article

US Mid-Election & The Fed sticks to the Game Plan

The propaganda around the US mid-election dominated the markets this week. With the Democrats now in control of the House of Representatives, the...

November 9, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading