- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Top 5 Silver Exporters In The World

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Top 5 Silver Exporters In The World

- Official languages: Chinese and English

- Population: 7,448,900

- Gross Domestic Product: $341 billion

- Currency: Hong Kong Dollar (HKD)

- Official languages: Spanish

- Population: 123,675,325

- Gross Domestic Product: $1.1 trillion

- Currency: Mexican Peso (MXN)

- Official languages: German

- Population: 82,800,000

- Gross Domestic Product: $3.6 trillion

- Currency: Euro (EUR)

- Official languages: Standard Chinese

- Population: 1,403,500,365

- Gross Domestic Product: $12.2 trillion

- Currency: Renminbi (CNY)

- Official languages: Japanese

- Population: 126,672,000

- Gross Domestic Product: $4.8 trillion

- Currency: Japanese Yen (JPY)

News & AnalysisNews & Analysis

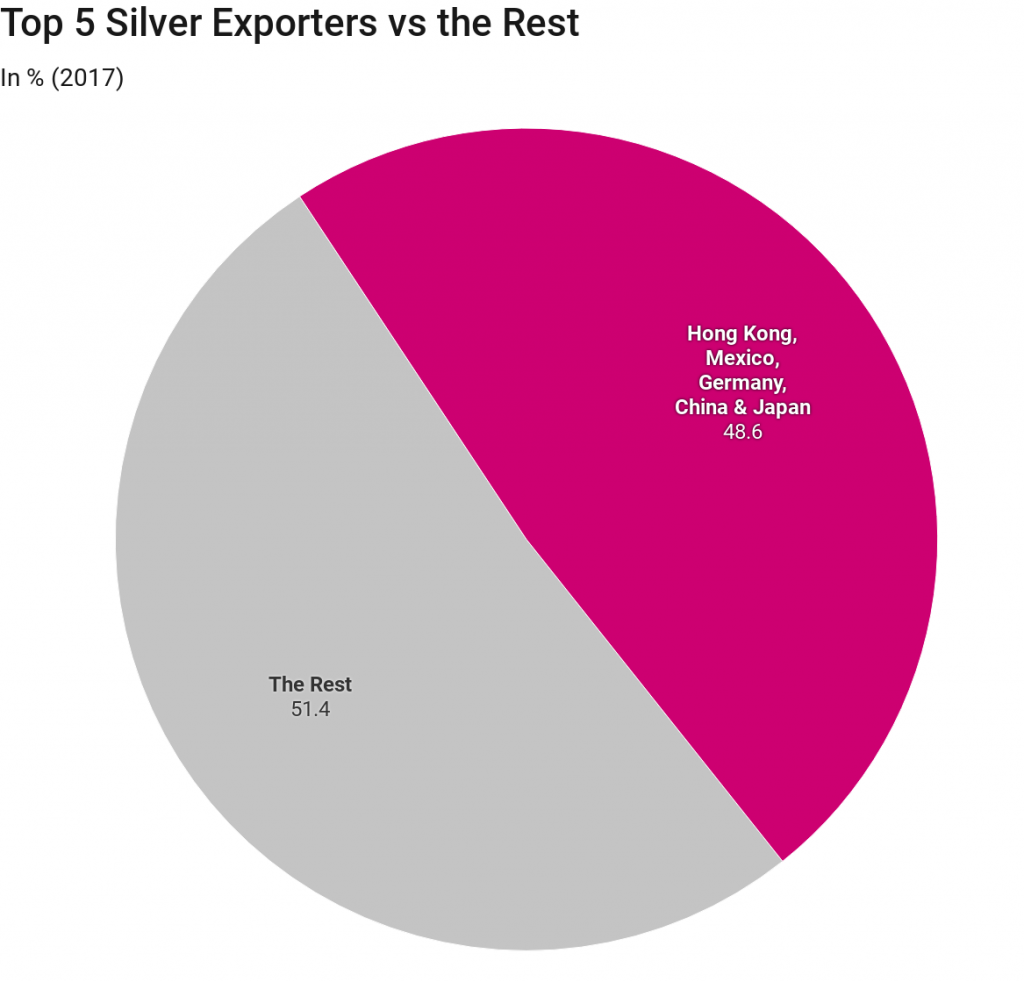

News & AnalysisNews & AnalysisIn the last article, I wrote about the top 5 gold exporters in the world. Now it is time to look at the top 5 exporters of another one of worlds precious metals – silver. Last year the total sales from global silver exports reached $19.5 billion. The top 5 exporters made up around 49% of the worldwide silver exports in 2017. So let’s take a look of the countries in the top 5.

Hong Kong

Hong Kong, officially known as Hong Kong Special Administrative Region of the People’s Republic of China is the top silver exporter of silver with exports worth $3.1 billion or 16% of the total in 2017. Hong Kong has the 33rd largest economy in the world at $341 billion and 16th per capita at $46,193. Hong Kong is the 2nd largest foreign exchange market in Asia and 4th largest in the world in 2016 with a daily average turnover of forex transaction reaching $437 billion, according to the Bank for International Settlements.

Mexico

Mexico, officially the United Mexican States is the second largest exporter of silver in the world with exports worth $2 billion in 2017, 10.2% of the world total. Mexico has the 15th largest economy in the world at $1.1 trillion and 11th concerning largest population. Mexico was worlds 13th largest exporter in 2017 with 81% of the exports going to their neighbour – the United States.

Germany

Germany is the third on the list of the largest silver exporters with a total value of $1.5 billion exported in 2017, 7.6% of the world total. Germany is the 4th largest economy in the world and most significant in Europe at $3.6 trillion. Germany’s biggest exports are motor vehicles, machinery, and pharmaceuticals.

China

China, officially the People’s Republic of China is the fourth largest exporter of silver with total exports of around $1.45 billion which is 7.4% of the world total in 2017. China is the world’s 2nd largest economy, just behind the US and is expected to overtake the North American nation in the coming years. China’s biggest exports are electrical machinery, furniture, and clothing.

Japan

With total exports of $1.43 billion in 2017, Japan is the fifth largest silver exports in the world, that’s around 7.4% of the world total. Japan has the 3rd largest economy in the world at $4.8 trillion. Japan’s most prominent exports include vehicles, machinery, and iron.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Go Markets MT4, Google, Datawrapper

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

Yield Curves: What Are They And How Can We Use Them?

Undoubtedly anybody who dabbles or takes an interest in the financial markets will have come across the term yield curves. Perhaps stumbled on during research or overhearing Bloomberg TV hammer home various aspects of yield curve movements. Either way, yield curves are embedded in the fabric of financial analysis and are considered a fundamental ...

October 19, 2018Read More >Previous Article

Top 5 Gold Exporters In The World

Last year the total sales of gold exports reached $310 billion mark. The top 5 countries made up a large portion of the total gold exports l...

October 12, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading