5 influencing factors on the impact of economic data in your trading

3 July 2019There are few times when the market (irrespective of trading vehicle) is more likely to move in price quickly than on the release of some economic data. Judging potential market response can be complex as often many data points are released in quick succession but is an important component of overall risk management relating to your trading positions and account generally.

This article aims to provide you with some things to consider in your trading development and systems.

- As a trader you need to:

- Understand the basics of why markets move in response to data.

- Have an indication not only as to when data is due but its potential impact on financial instruments you may be trading, to make some judgement on risk.

- Have articulated within your trading plan how you are to manage both potential entries and open positions when sensitive economic news is due.

So, your major five factors are:

1. Data type

Obviously, not all economic data has the same level of impact. The way data is perceived in terms of importance has a general relationship to how it either:

- a. Indicates the health of a specific economy (and in some cases a global indication).

- b. Is likely to impact on central bank decision making e.g. with interest rates decisions.

To give an example, automobile sales data is unlikely to have a major impact on many trading positions and instruments except for transport related share CFDs, whereas employment data can significantly not only relate currency pairs but Index CFDs and share CFD positions.

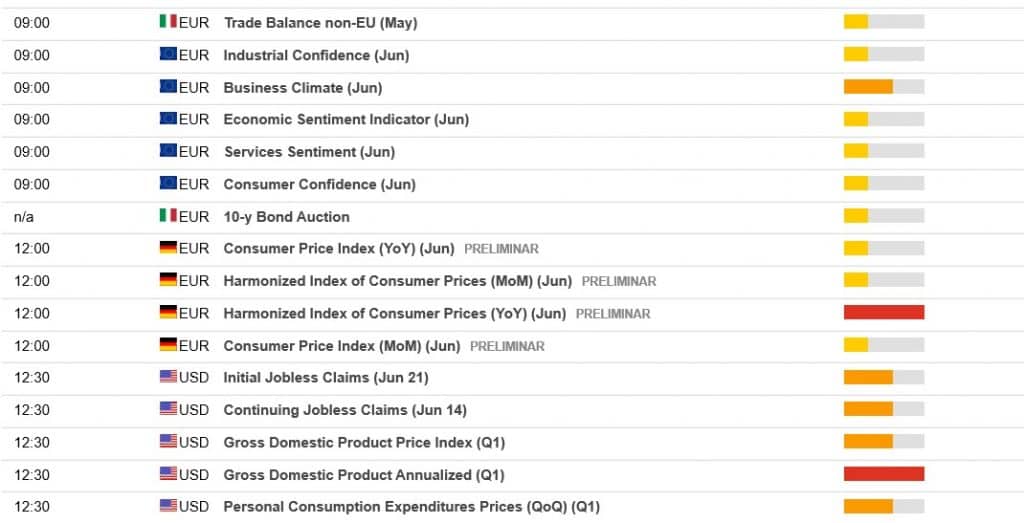

The general “impact level” is illustrated commonly on economic calendars. On the GO Markets’ economic calendar on the website this is shown as a colour coded volatility measure (see image below).

Please note that this measure relates to the potential impact on currency pairs only. For potential impact on other instruments, this should be a planned part of learning to trade.

2. Data versus instrument

You may currently trade, or plan to in the future a one or more different financial instruments on your trading account. These may include:

• Forex,

• Index CFDs

• Commodity CFDs

• Share CFDs

As well as the country of origin with an impact on relevant forex pairs, as previously referenced some data (particularly from the US, China or Eurozone) often has a broader “whole market” influence. The “whole market” extends beyond Forex and for major data news will impact on all instruments.

Your challenge is to identify what this impact and as importantly the direction of price move may be.

For example, major jobs data such as the US non-farm payrolls (monthly employment), may alter the perception of timing of any interest rate change by the US Federal Reserve. Let us use the example of a weak number that the market takes as making a rate reduction more likely.

This may weaken the USD (for Forex traders), and so be positive on other currencies with USD within any pair. Also due to the inverse relationship with some commodities and USD, there may be a rise in precious metal CFDs. The inference that a rate cut will put more money into the pocket of “Joe Public” could be bullish for oil CFDs.

Additionally, this may be positive for US equity (and subsequently other global indices) which will have a positive price impact on non-US Index CFDs.

Also, of course, if there is a positive price move in indices, related Share CFDs could generally rise with a positive price move on indices.

Your challenge therefore is to learn through observation the impact of certain data points on different instruments.

3. Overall market sensitivities

Some potential market responses are dependent on general state on local and global economic outlook. This may influence the more likely scenarios for the impending data release.

An obvious example of this would be interest rate decisions. In this case there are 3 possible options for a central i.e. to pause, raise or reduce interest rates. Although theoretically all three could be possible, it is usually a pause or EITHER of the other two not both.

To use this example further, in times when the market is uncertain about timing of rate changes, it could be “interest rate sensitive”.

As central banks utilise jobs and CPI (inflation) data as key part of their decision making, at such sensitive times, the impact of these data points may be more acute than in other times where there is no expectation of potential change in the next few months.

To give another example, if the financial markets are concerned about global economic growth then GDP, industrial production and PMI data is likely to illicit more of a response than if such concerns didn’t exist.

Although this may be sometimes difficult to gauge and so legislate for in your overall market risk assessment, keeping abreast of general financial news and market opinion often will provide a consensus view as to what scenarios are more likely.

4. How you are positioned

If you have more than one trading position open (and potentially across several different trading instruments) it is important to note that a single data point can influence positions similarly or have counter effects on different positions.

Firstly, let’s give an example of three trades you could have open…

Long AUDUSD

Short USDJPY

Long EURUSD

With a data point that may have a large general impact on USD this will have a potential 3 times risk on your account equity If you have positioned sized with a 2% per trade risk for each.

Then add to that a Long GOLD CFD (XAUUSD) perhaps.

You have added another “anti-USD” position that is likely to move in the same direction as the above.

Let’s say that the data will have a negative impact on the US equity markets also, make the assumption that the ASX often is led by what happens in the US overnight and if you have a couple of long CFD positions, these could also move against you at the same time as other open positions as described.

One last point on number of positions, there is no doubt that the more positions you have open, the more complex it is to make “whole” accounts decisions.

So, what this means for you is:

a. Set a maximum number of positions to have open at any one time.

b. Know the potential impact on all instruments you are trading at any specific data point.

c. Consider your risk level you are exposed to across all positions and plan stop/trail stop levels or potential closing of some positions accordingly.

5. Timeframe

Although it is difficult to accurately quantify and even more so when considering multiple data releases, some awareness of the longevity of a market response, including whether a trend change is likely, will be different depending on what timeframe you are trading.

Commonly, economic data release and types are likely to have more “acute” impact on shorter timeframes than longer.

If trading daily charts, with a smaller position and wider stop, there may be less implication on relative price movement and account position with an often a short-term market move which doesn’t impact long term trend.

The reverse could be the case than for example due to CPI or PMI data, if trading a 15-minute larger position with a tighter stop, where short term price and the trend may be impacted upon quickly.

Experience is a good teacher in this case as to creating general rules, and like many aspects of your trading planning and action, merits considering lower position exposure until you are at a point where creating individual “rules” for you can be established with some confidence.

In summary, as with many aspects of trading, at a beginner trading level, learning that data does have impact and having a ‘check in’ and basic plan to manage risk and opportunity is undoubtedly important as you find your “trading legs”. Even knowledge of some of the things discussed in this article will be useful in terms of increasing understanding.

As you develop some experience considering what we have covered above, is next level refinement (and we know that details often DO matter when trading) of your plan and actions you choose to take could, and arguably should, be part of your thinking going forward.

We are always here to help. Our on-going education of the ‘Inner Circle’ programme that we offer will help not only in seeing the practical implications of the content above but also give opportunities for you to ask questions and gain clarity of this and other aspects of your trading live.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

The European Union Top Jobs

The European Union Top Jobs The European Central Bank (“ECB”) President The European leaders nominated Christine Lagarde, a French lawyer and a politician serving as Managing Director and Chairwoman of the International Monetary Fund ("IMF") as the ECB President. The ECB is responsible for the monetary policy of the nineteen EU member countr...

Previous Article

Back-To-Back Interest Rate Cuts

Second Rate Cut The Reserve bank of Australia (RBA) cut interest rate by 25 basis points which marks the first back-to-back rate cut since 2012. ...